Gold (XAU/USD) – Latest Sentiment Analysis

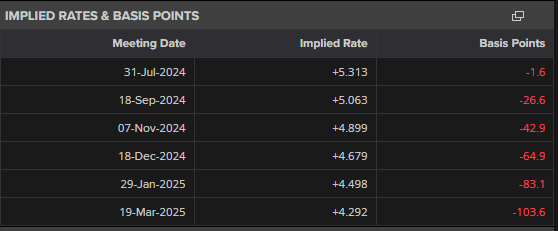

- US rate cut fully priced in on September 18.

- Gold’s multi-month range now in danger.

Recommended by Nick Cawley

Get Your Free Gold Forecast

The price of gold continues to push higher and is set to test the May 20th all-time high of $2,450/oz. Renewed speculation that the Federal Reserve will cut rates by 25 basis points in mid-September is helping the latest move higher. Financial markets are now pricing in a total of 65 basis points of US rate cuts this year, leaving a third move lower a 50/50 call.

Data using Reuters Eikon

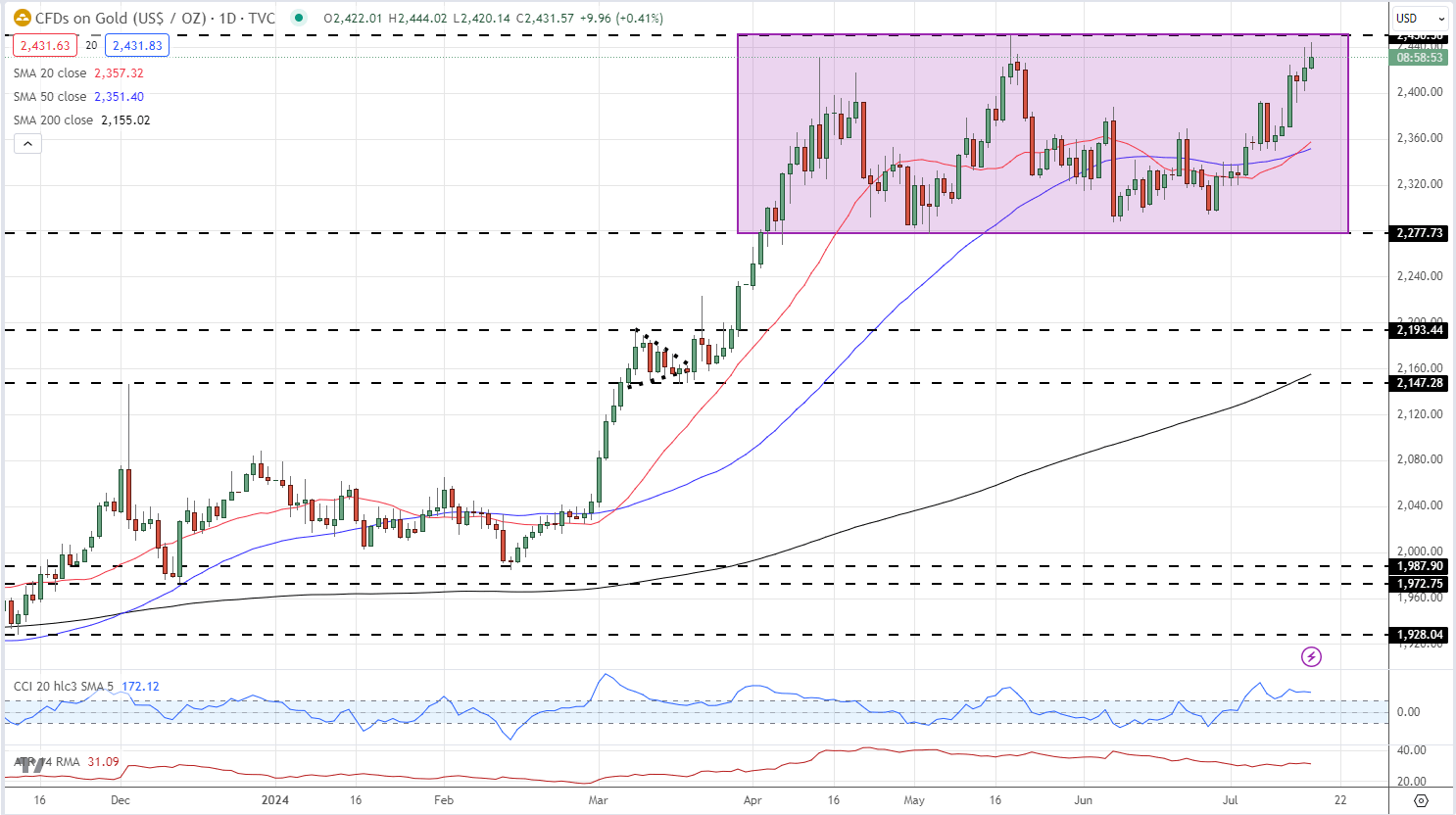

The daily chart shows gold nearing the top of its recent multi-month range with the move supported by the 20- and 50-day simple moving averages. The CCI indicator suggests that gold is overbought, so a short period of consolidation may be seen before fresh highs are made.

Gold Daily Price Chart

Chart via TradingView

Retail trader data shows 49.86% of traders are net-long with the ratio of traders short to long at 1.01 to 1.The number of traders net-long is 1.69% lower than yesterday and 12.94% lower from last week, while the number of traders net-short is 5.27% higher than yesterday and 16.85% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Gold prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Gold-bullish contrarian trading bias.

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | -5% | 8% | 1% |

| Weekly | -14% | 19% | 1% |

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or contact the author via Twitter @nickcawley1.