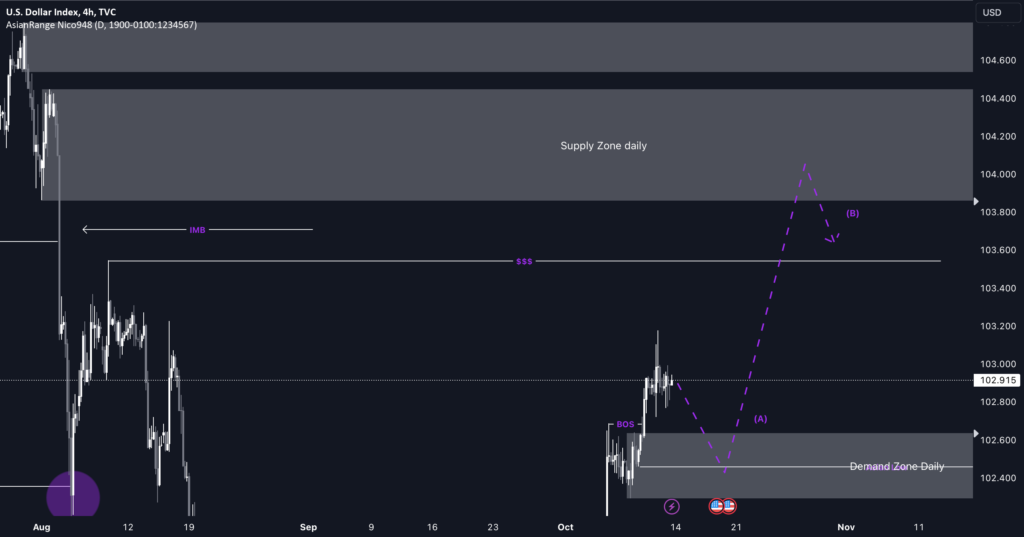

Once price mitigates and retests the daily demand zone I’ve marked out, I’ll be looking for the dollar (DXY) to trigger another bullish move within this point of interest (POI), potentially leading to a rally that could take out another all-time high (ATH).

Upon reaching this daily demand, I’ll focus on finding a lower time frame entry. As price pushes up, taking out the liquidity and filling the imbalance, I’ll be watching for potential short-term sell opportunities from the daily supply zone, which looks like a high-quality area.

Confluences for DXY Bullish Move:

Recent Bullish Momentum: Price has been strongly bullish.

Break of Structure (BOS): A clear BOS to the upside, leaving behind a demand zone.

Liquidity and Imbalance: Liquidity targets and imbalance above, providing room for a rally.

High-Quality Daily Demand: The daily demand zone is strong and has a good potential for a bullish push.

P.S. I wouldn’t be surprised if the daily supply also holds and causes a deep retracement, but we’ll see how the market reacts.

Have a great trading week guys!