US30 Technical Analysis Report

December 16, 2024

Current Market Overview

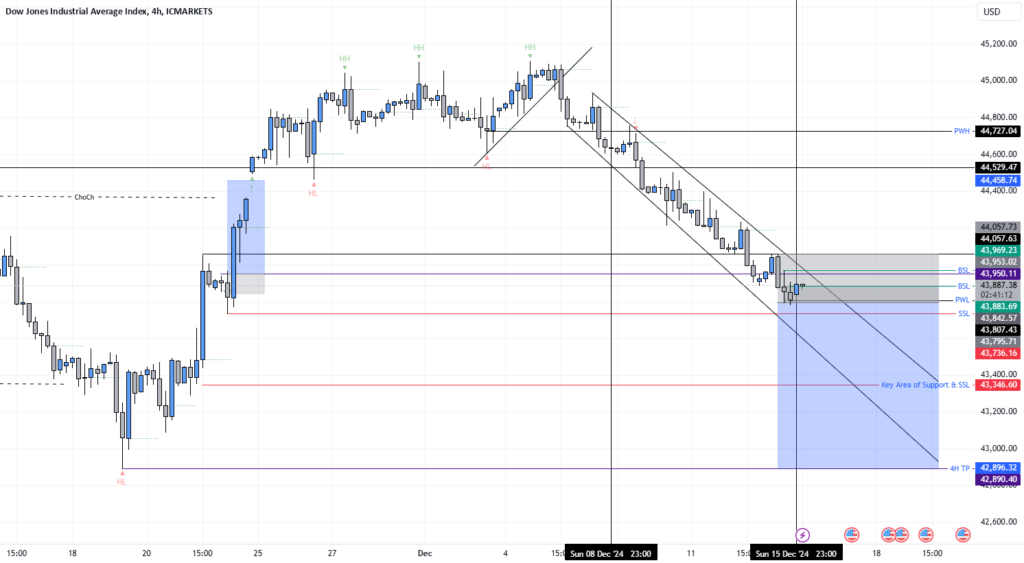

The US30 (Dow Jones Industrial Average) is currently displaying a significant bearish bias, with multiple timeframe analysis supporting a continuation of the downward momentum. Current price: 43,886

Technical Analysis by Timeframe

Daily Timeframe (HTF)

- Confirmed bearish market structure break at 44,392 (December 10, 2024)

- Overall Higher Timeframe trend remains bearish

- This break serves as a key reference point for the current bearish momentum

4-Hour Timeframe (H4)

- Clear downtrend pattern formation

- Current price action showing retracement to sweep buy/sell liquidity zones

- Price action respecting the downward trendline range

- Suggested entry level identified at 43,809

1-Hour Timeframe (H1)

- Key resistance level identified at 44,058

- Potential for temporary trend interruption if this level is breached

- Currently operating within Asian session range boundaries

Key Trading Levels

- Entry Target: 43,809

- Take Profit 1 (TP1): 43,345

- Extended Target (TP2): 42,890 (conditional on market alignment)

- Key Resistance: 44,058

- Previous Structure Break: 44,392

Volume Analysis

Current phase: Asian session (characterized by lower volume)

Critical observation period: New York session open

Anticipating increased volume and potential trend confirmation during NY hours

Risk Management Considerations

- Primary trend remains bearish

- Watch for potential temporary reversals at 44,058

- Monitor NY session volume for trade confirmation

- Consider partial position closure at TP1 (43,345)

Trading Session Context

- Currently in Asian trading hours

- Key decision point expected at NY session open

- Volume expected to increase significantly during NY hours, providing better trade execution opportunities

Trade Strategy Summary

The overall strategy aligns with the bearish bias across multiple timeframes. Entry opportunities are being monitored at 43,809, with a structured approach to take profit levels. The New York session will be crucial for volume confirmation of the anticipated moves.

Note: This analysis is provided for educational purposes only and does not constitute financial advice. All traders should conduct their own research and risk assessment before entering any positions.