Recommended by IG

Improve your trading with IG Client Sentiment Data

Wall Street looks set to deliver its fifth consecutive week of gains, pushing ahead with another round of stellar gains overnight (DJIA +1.26%; S&P 500 +1.22%; Nasdaq +1.15%). Considering that the Fed is still data-dependent, market participants have not been buying into the Fed’s hawkish guidance, with the Fed funds futures continuing to price for one last 25 basis-point hike in July and rate cuts as early as next year. This serves as a pushback against the Fed’s guidance of 50 basis-point hike by the end of 2023 and a ‘couple years out’ in rate cuts, which may be perceived to lack commitment with the aim to avoid complacency.

Overnight economic data saw US retail sales turned in a positive surprise (0.3% month-on-month versus -0.1% expected) as a reflection of resilient consumer demand. While previous concerns were that stronger consumer demand may feed into inflation, the broader trend of easing pricing pressures has somewhat put inflation risks in the backseat for now, with the narrative shifted towards whether a soft landing can be delivered. Along with jobless claims’ numbers indicating further progress in cooling the overheated US labour market, sentiments managed to resume its risk-on mode following the data release.

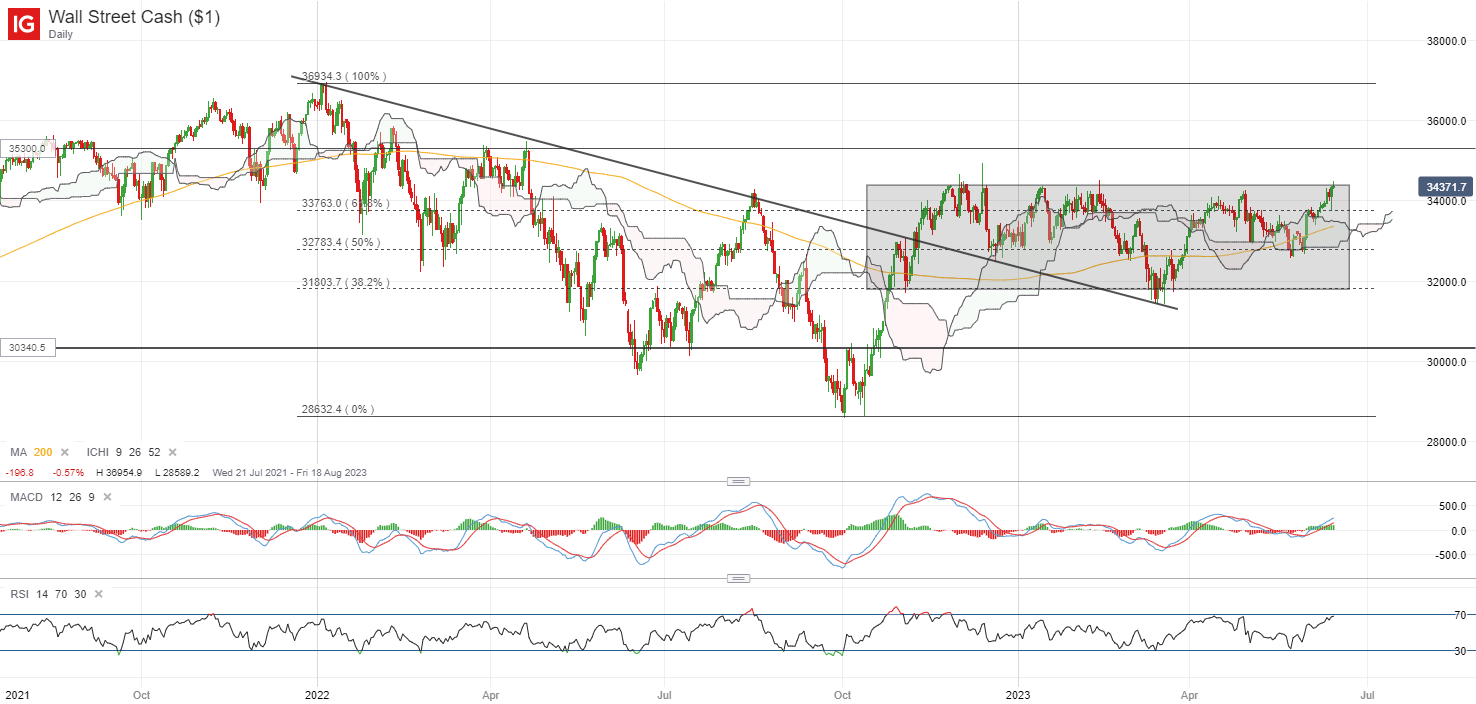

The DJIA is back to retest the upper range of its consolidation pattern at around the 34,400 level, where the index has failed to overcome on at least five occasions since October last year, reinforcing the level as a crucial resistance. A break of the upper range may pave the way to retest the 35,300 level next. The overall upward trend remains, with its moving average convergence/divergence (MACD) heading above the zero line as a sign of building upward momentum. In the event of a retracement, immediate support may be at the 33,800 level (Fed-meeting bounce).

Source: IG charts

Asia Open

Asian stocks look set for a mixed open, with Nikkei -0.66%, ASX +0.54% and KOSPI +0.32% at the time of writing. The Nikkei has diverged from the positive handover in Wall Street, seemingly a sign of some near-term exhaustion as technicals trend in overbought territory. With follow-up rate cuts coming from China yesterday, the Hang Seng Index is hovering just below its 20,000 psychological level in today’s session. Overcoming this level may further support bulls in control for now.

Economic data saw Singapore’s non-oil domestic exports (NODX) contracting for the eighth straight months (-14.7% versus -1.3% consensus), with the significant underperformance reflecting greater risks to global demand conditions. A low-for-longer growth outlook for Singapore seems to be the takeaway, validating the cut in 2023 growth forecast to 1.4% (previous 1.9%) from a MAS survey this week.

Ahead, the Bank of Japan (BoJ) meeting will be in focus. Speculations for a quicker policy shift from the BoJ have not been receiving much validation by policymakers thus far, with a dovish rhetoric from BoJ Governor Kazuo Ueda last week anchoring expectations for a no-change in policy rate for at least the next three policy meetings.

Market participants will be looking for any response to the continued pull-ahead in Japan’s “core core” inflation (4.1% in April) but while a higher inflation picture may be acknowledged, an uneven recovery in Japan and still-subdued wage growth of 1% may still provide some reasoning for the central bank to justify its ‘transitory inflation’ view.

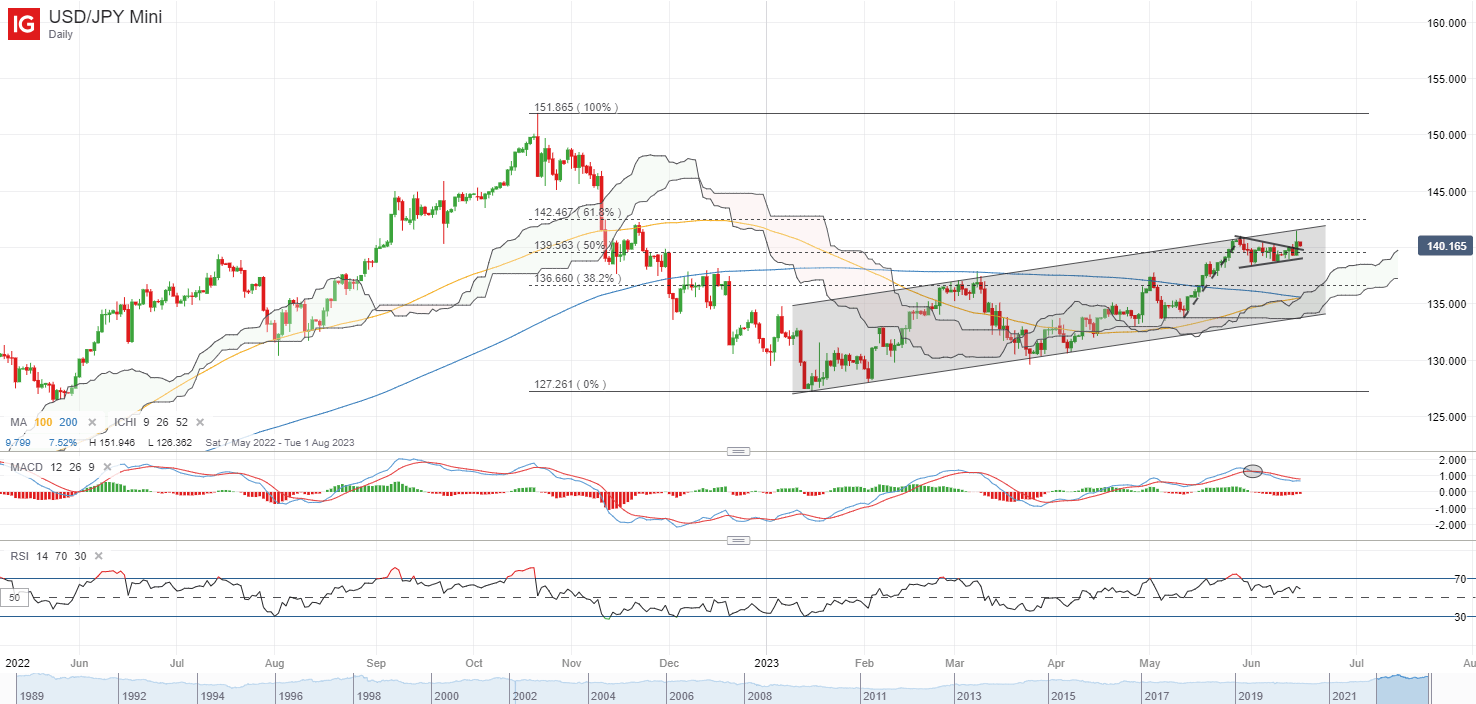

The USD/JPY has been trading within an ascending channel pattern since the start of the year, with a retest of the upper channel trendline overnight met with some resistance on a lacklustre US dollar. The lower highs on RSI may point to some near-term exhaustion, with further downside to leave immediate support at the 138.50 level on watch, followed by the 136.70 level. That said, the overall trend remains upward bias, with the formation of higher highs and higher lows, along with a firm sit above its 100-day and 200-day moving averages (MA). Any failure to hold above its key 200-day MA line may be an indication of a trend reversal ahead.

Source: IG charts

On the watchlist: Trend for EUR/USD tilted to the upside following the ECB meeting

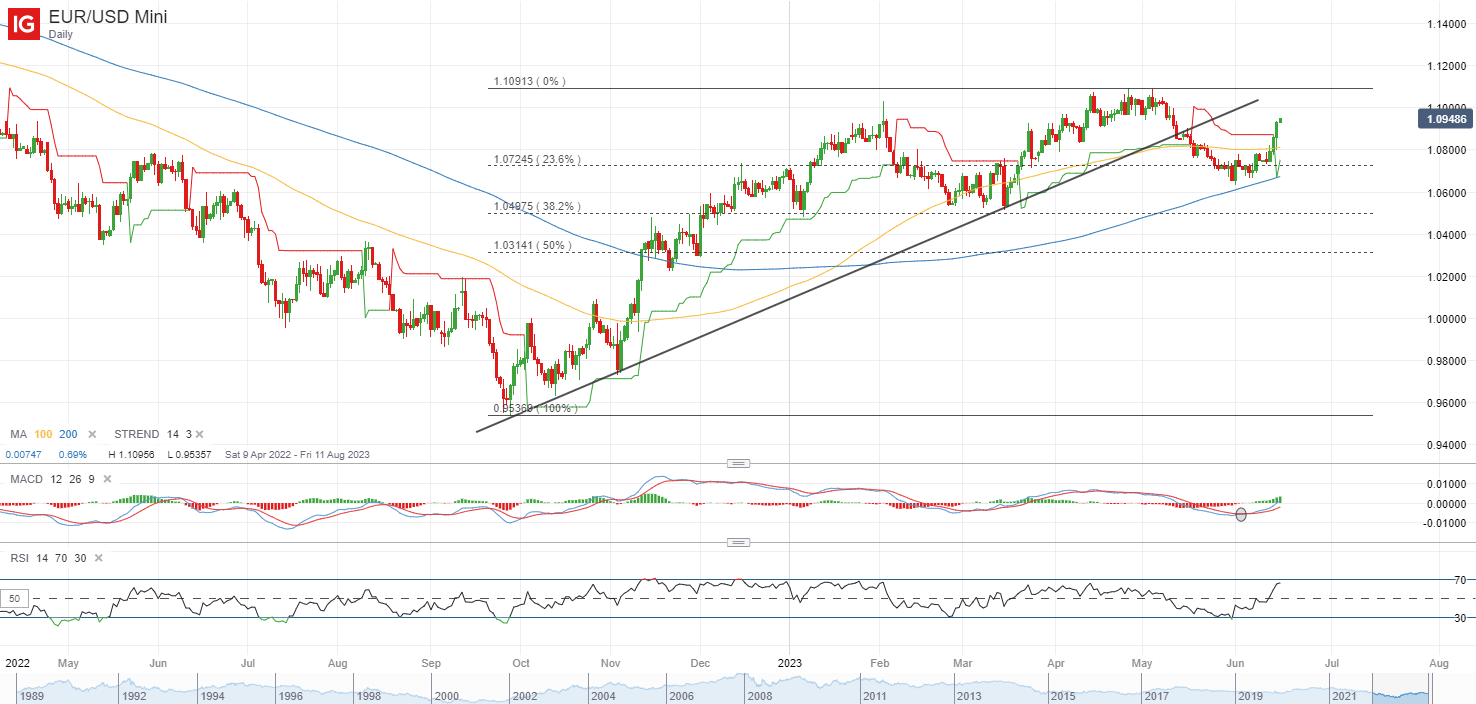

The conclusion of both the FOMC and ECB meeting this week has allowed the EUR/USD to reclaim its 100-day MA, as the US dollar failed to sustain its recent gains while the ECB pushed on with a hawkish guidance at its latest meeting. Policy divergence remains the key driving force.

Following a 25 basis-point move yesterday, an upward revision in inflation forecast from the ECB points to stickier pricing pressures and that more needs to be done. Validation was further sought from the ECB President Christine Lagarde, who anchored expectations for another hike in July and pushed back against any impending policy pause in its hiking cycle.

A switch in the Supertrend indicator from red to green indicated that the trend for EUR/USD has tilted to the upside. The RSI has also headed back above the key 50 level, reflecting buyers taking control after a 4% retracement in May this year. With the formation of a new higher low, the pair may set its sight on its May 2023 high at the 1.109 level, with any move above the level pointing to a new higher high and reinforces the overall upward trend.

Source: IG charts

Thursday: DJIA +1.26%; S&P 500 +1.22%; Nasdaq +1.15%, DAX -0.13%, FTSE +0.34%.