Australian Dollar, AUD/USD, US Dollar, RBA, BoC, Fed, BoJ, ECB – Talking Points

- The Australian Dollar remains range locked after the US Dollar bounced around

- The Bank of Canada rate hike has raised questions about the Fed doing the same

- Rates markets are not expecting a Fed hike, but they also didn’t see an RBA or BoC lift

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The Australian Dollar shrugged off a miss on trade balance data as markets reassess the interest rate outlook after the Bank of Canada (BoC) followed the RBA and put the hawks among the doves.

Both central banks have raised their respective cash rates by 25 basis points this week and now attention has turned toward the Federal Reserve, the European Central Bank and the Bank of Japan monetary policy meetings next week.

The RBA and BoC rate rises were mostly not anticipated by the market, and this has raised the spectre of next week’s meetings holding some surprises.

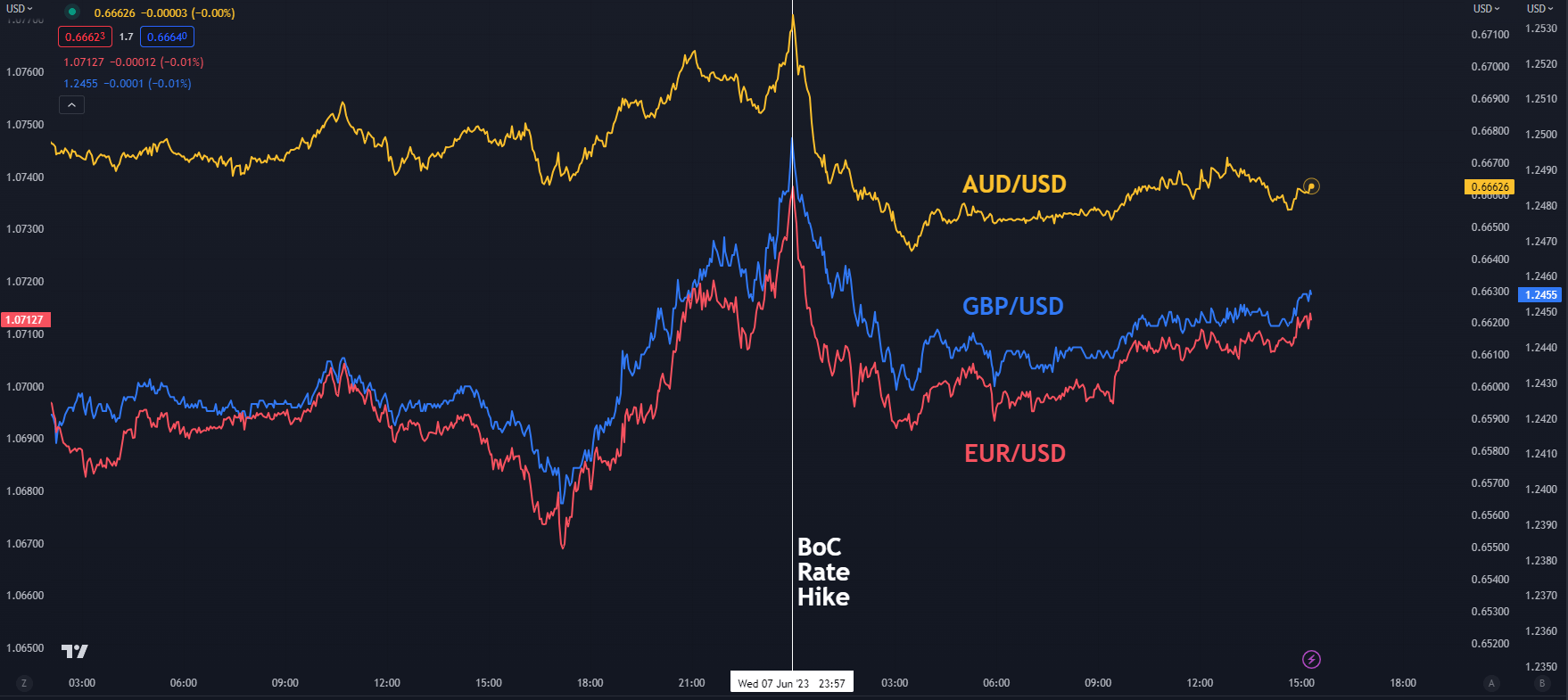

Interestingly, the US dollar was bought across the board when the BoC made its decision. This might highlight the risk within financial markets whereby a ‘skip’ on rate hikes from the Fed at their June 14th gathering might not be set in stone.

The hawkish tilt appears to have undermined equities with the Nasdaq leading the way lower on its close. The Nikkei 225 has also seen more profit-taking today as it drifted off over 1%.

Elsewhere, the Reserve Bank of India (RBI) left its cash rate unchanged today at 6.5%. USD/INR is steady near 82.50.

Australia’s trade balance came in at AUD 11.158 billion for the month of April rather than the AUD 13.64 billion anticipated. With AUD/USD below 70 cents, the domestic economy there seems likely to remain hot despite the RBA hike on Tuesday.

Recommended by Daniel McCarthy

How to Trade AUD/USD

Like many asset classes, crude oil is caught in the range, although it is a bit softer to start Thursday. The WTI futures contract is under US$ 72.50 bbl while the Brent contract is a touch above US$ 77 bbl.

Gold is testing a long-range ascending trend line support level near US$ 1,960 and Treasury yields are stable after spiking higher in the back end of the curve in the North American session.

Looking ahead, after Eurozone GDP data, the US will see jobless claims figures.

The full economic calendar can be viewed here.

AUDUSD, EUR/USD AND GBP/USD CHART OVER THE BoC RATE HIKE

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter