Australian Dollar, US Dollar, AUD, US, China Data – Talking Points:

- The Chinese economy less than forecast in the second quarter.

- Industrial output rose more than expected last month, while retail sales continued to softern.

- What does this mean for AUD/USD?

Discover what kind of forex trader you are

The Australian dollar held the day’s losses against the US dollar after the Chinese economy grew less than expected in the second quarter.

The Chinese economy grew 6.3% on-year in the April-June quarter, Vs 7.3% expected and 4.5% in the previous quarter. Industrial production grew 4.4% on-year in June, Vs 2.7% expected and 3.5% in May. Retail sales grew 3.1% on-year in June, Vs 3.2% expected and 12.7% in May. Fixed asset investment grew 3.8% on-year in the January-June period Vs 3.5% expected.

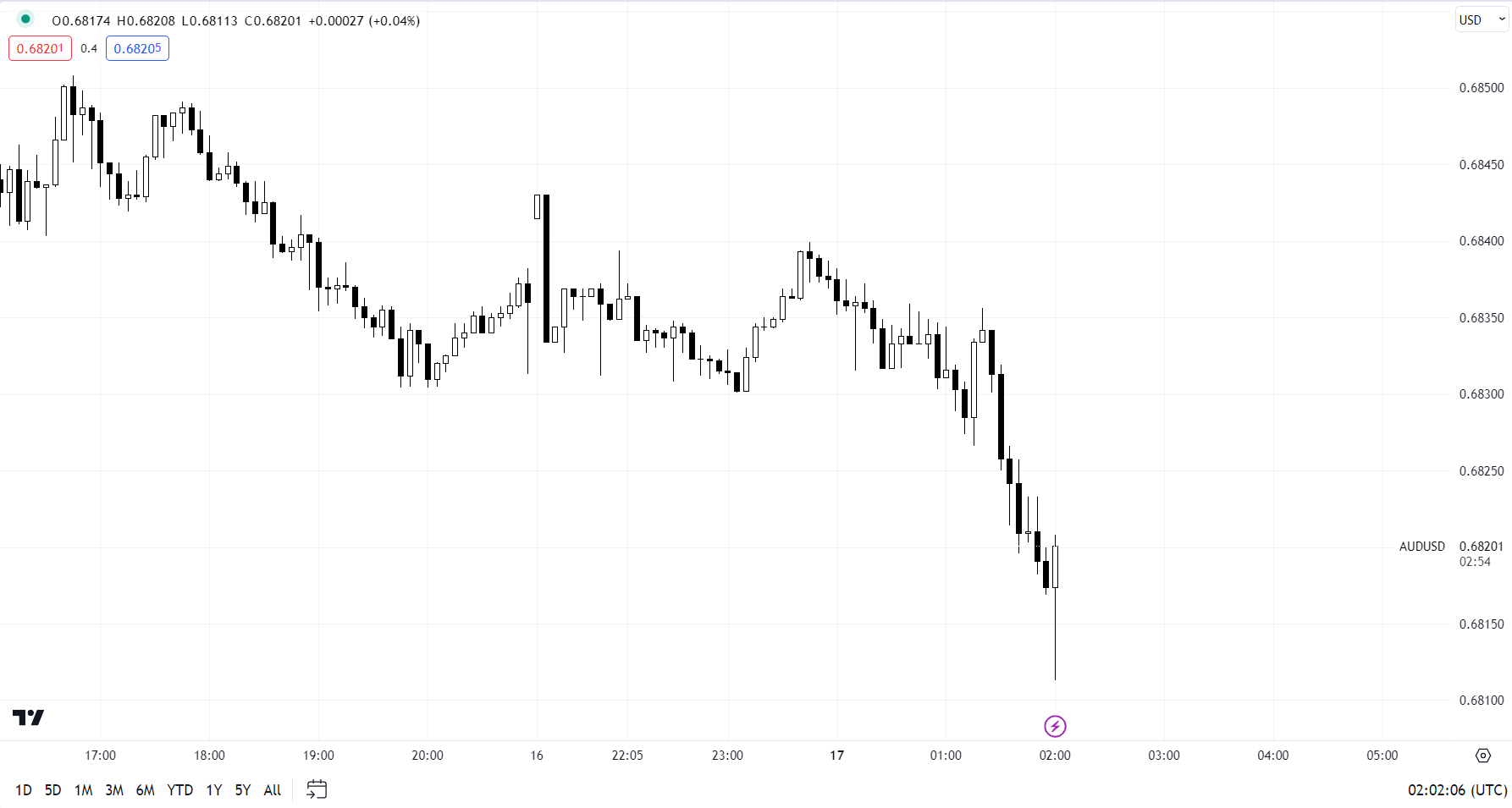

AUD/USD 5-minute Chart

Chart Created by Manish Jaradi Using TradingView

In recent months, China’s macro data have underwhelmed, as reflected in the China Economic Surprise Index, which is languishing around levels before the economic reopening earlier this year. Beijing has announced a series of measures in recent weeks to cushion some of the downside risks to the economy, including cuts in key lending benchmarks, targeted measures toward new-energy vehicles, the property sector, and the booming generative artificial intelligence sector, and signaled the end of the years-long crackdown on the technology sector.

Analysts have already started to upgrade the outlook on Chinese equities on expectations of more stimulus measures from the government, attractive valuations, and easing financial conditions. China is Australia’s largest two-way trading partner in goods and services. Any improvement in China’s growth outlook bodes well for AUD prospects. Key focus is now on the Politburo meeting in late July and potential additional stimulus measures, especially infrastructure, and the real estate sector.

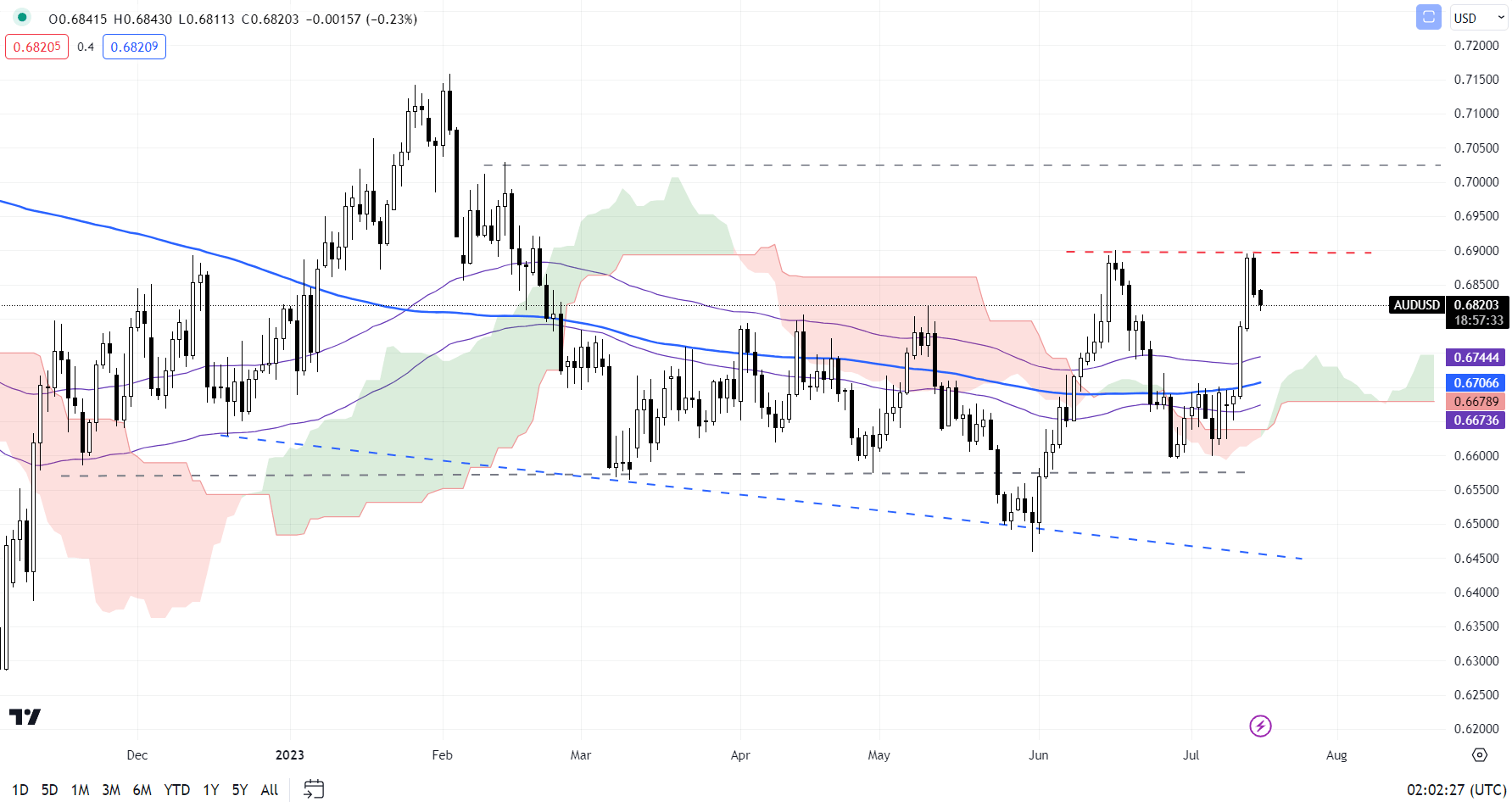

AUD/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

Aside from China, AUD/USD has been supported amid growing expectations that the US Federal Reserve is nearing the end of its tightening cycle on softening US inflation. Rate futures are showing a 96% chance of one last 25 basis point hike at the July 25-26 meeting, according to the CME FedWatch tool.

On technical charts, the medium-term downward pressure in AUD/USD appears to be abating after earlier this month rebounded from near 0.6600. It is now testing resistance at the mid-June high of 0.6900. Any break above could open the door initially toward the mid-February high of 0.7030.On the downside, there is quite strong support around 0.6785.

Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish