Australian Dollar Forecast: Neutral

- The Australian Dollar had a whippy week with a solid rally before retreating

- The US Dollar sell off and recovery was a key feature as bond spreads kicked in

- With US CPI out of the way, AU CPI moves into view. Will it boost AUD/USD?

Recommended by Daniel McCarthy

Get Your Free AUD Forecast

The Australian Dollar scaled to a seven-week high last week before collapsing. The US Dollar faced renewed selling pressure after benign CPI and PPI figures in the US before recovering into the weekend.

CPI was 5.0% year-on-year to the end of March instead of the 5.1% forecast and PPI came in at 2.7% for the same period rather than the 3.0% anticipated.

While a 25 basis point hike is expected at the Federal Open Market Committee (FOMC) meeting in early May, the softening price pressures have led to hopes that the tightening cycle might be near its conclusion.

Equity, commodity and currency markets appear to have seen it that way, but Treasury yields are yet to get on board with the concept it appears. US Government bond yields eventually nudged higher.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

However, Australian Commonwealth Government bonds (ACGB) did move higher last week after another strong labour market report. The unemployment rate was 3.5% in March against estimates of 3.6% and 3.5% previously. 53.0k Australian jobs were added in the month, beating the 20k forecast and 64.6k previously.

The nominal yield on the 10-year ACGB is around 23 bps higher over last week while the Australian 10-year breakeven rate also recovered.

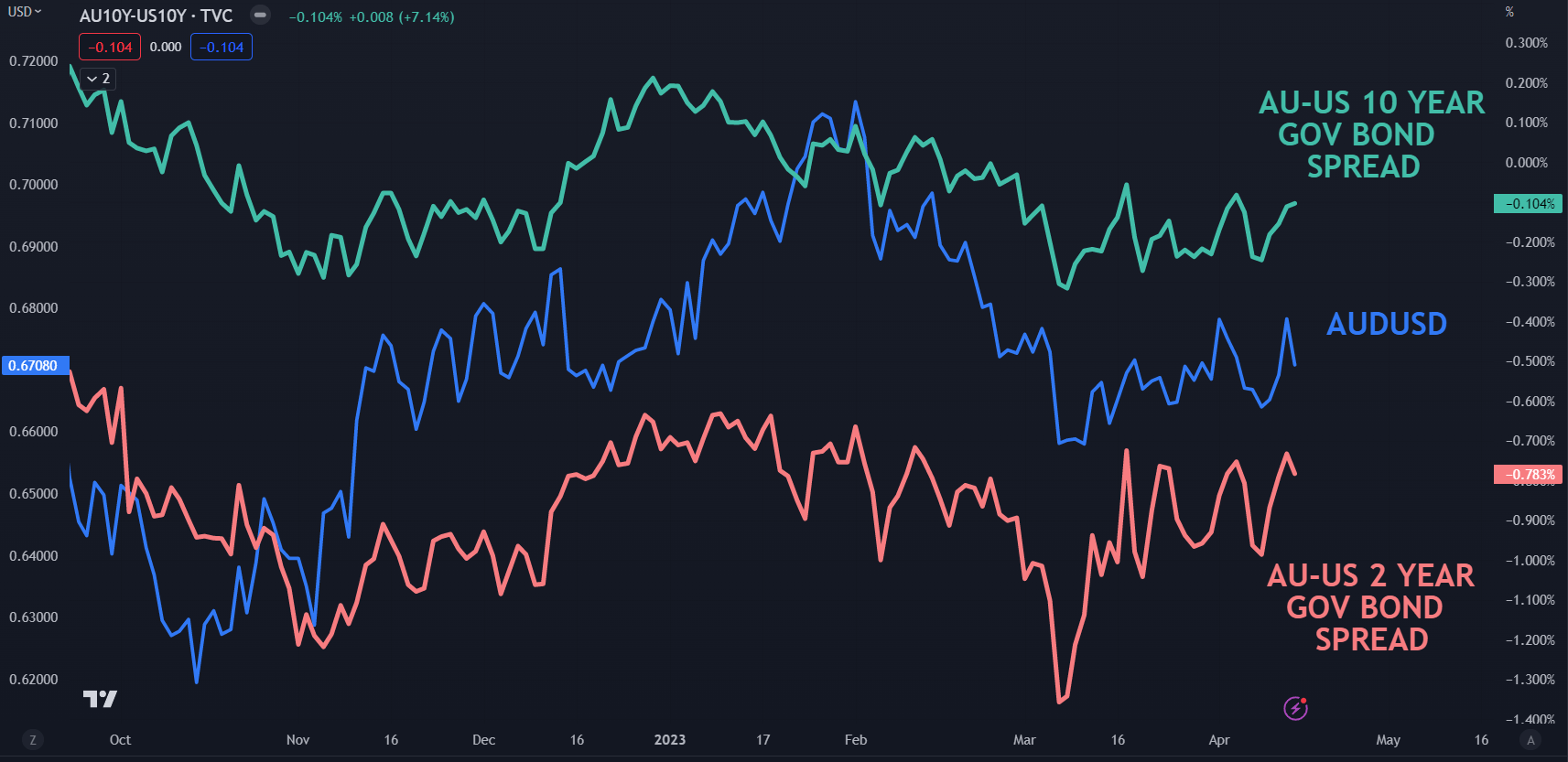

The spread between US and Australian government bonds moved in favour of the Aussie Dollar although this appears to be coincident rather than causal with the greenback generally sinking across the board. Nonetheless, AUD/USD did a bit better than other currency pairs overall.

The upcoming week will see the RBA meeting minutes released for its March gathering. Given the commentary from the bank since then, it seems unlikely that there will be any surprises in the notes.

From a domestic perspective, the next impact event for AUD will be the quarterly CPI on Wednesday 26th April. A soft reading there will give the RBA breathing room to pause on any future hikes, but a reacceleration of price pressures may see a pivot back to a more hawkish attitude.

In the meantime, the trajectory of the US Dollar seems likely to continue to permeate AUD/USD moves.

AUD/USD AGAINST AU – US 3- AND 10-YEAR GOVERNMENT BOND SPREADS

AUD/USD TECHNICAL ANALYSIS

AUD/USD briefly popped above the 0.6547 – 0.6793 range that it had been in for 7-weeks last Thursday, but it was unable to follow through. False breaks have been a feature of many asset markets of late.

The Aussie managed to chop through a couple of previous peaks but a series of daily Simple Moving Averages (SMA) were unable to be overcome.

Looking closer at the daily SMAs, the longer-term 55-, 100-, 200- and 260-day SMAs are above the price and have negative gradients.

The shorter-term 10-, 21- and 34-day SMAs are below or near the current price and have a mostly positive slope. All of these SMAs appear to be converging.

A clean break the 260-day SMA (currently 0.6813) might see bullish momentum unfold while a snap below the 34-day SMA (currently 0.6686) could see bearish momentum evolve.

Until one of these SMAs is broken, the Aussie might be in a range trading setup.

Recommended by Daniel McCarthy

How to Trade AUD/USD

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter