AUD/CAD faces mounting downside pressure, as both technical and fundamental signals align against bullish sentiment. Large speculators appear increasingly disinterested in driving meaningful upside, as reflected in lackluster price action

UK100 is falling towards the pivot and could bounce to the 1st resistance which is a pullback resistance.Pivot: 8,199.441st Support: 8,071.061st Resistance: 8,404.02Risk Warning:Trading Forex and CFDs carries a high

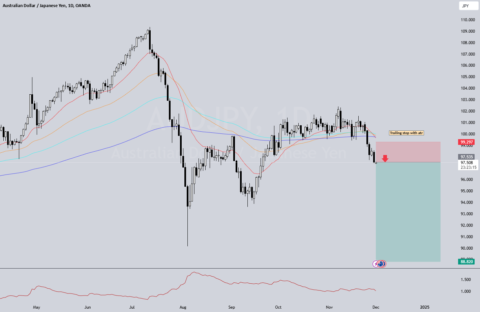

AUD/JPY presents a compelling case for downside potential as large speculators increasingly position short, according to COT data. This shift in institutional sentiment contrasts with the prevailing retail bullish bias,

The Bitcoin (BTC/USD) is rising towards the pivot which and could drop to the 23.6% Fibonacci support.Pivot: 3,883.631st Support: 3,452.301st Resistance: 4,092.48Risk Warning:Trading Forex and CFDs carries a high level

Go With Coin ANd SMile You who dare hide by the sidelines are the same who are hide in both fair and now "GOOD" season. An "Alt"erNet reality where your

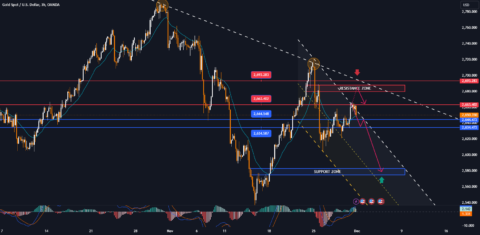

Key Levels to Watch:1️⃣ Demand Zone: $2,645–$2,650 (previous support or unmitigated order block).2️⃣ Supply Zone: $2,662–$2,665 (recent resistance or breaker block).Scenarios to Consider:1️⃣ Bullish ContinuationIf the price holds above $2,650

2 days agoThe U.S. and Japan closed on the upper shadow line in the monthly level - OB area for 2 consecutive weeks. This week, the big negative line broke

With the Magic Linear Regression Channel [MW] by mwrightinc, we built a channel on the daily chart that shows that NVDA looks like it may be beginning a bounce from

XAUUSD rose, boosted by the weakening of the USD and safe-haven demand due to concerns about persistent geopolitical tensions. Despite recovering in the final trading session of the week, gold

Yesterday i was working on my trading strategies from a risk management standpoint.i plan to scale upon some of the asset classes I have chosenbut I will not encourage you