08:30am Trade (1 HR) EURUSD:Buy 1.08514 tp 1.08564Sell 1.08464 tp 1.08409 GBPUSD:Buy 1.26821 tp 1.26900Sell 1.26729 tp 1.26657 USDJPY:Buy 150.571 tp 150.680Sell 150.416 tp 150.286 USDCAD:Buy 1.35988 tp 1.36092Sell 1.35854

Parallel lines are lines in the same plane that go in the same direction and never intersect. When a third line, called a transversal, crosses these parallel lines, it creates

Canada concerned about critical metals market manipulation, minister says

The tech-heavy index started the week around Friday’s close but trading appears muted in a week of ‘high importance’ US data including Powell’s testimony and NFP

US home prices to grind higher as cheap mortgage holders stay put: Reuters poll

Good evening and i hope you are well. Quote from last week: Bulls got their major trend reversal and i conclude the bear trend from the 2023-12 over. I drew

Chile wants 3 or 4 new lithium projects running in 2026, finance minister says

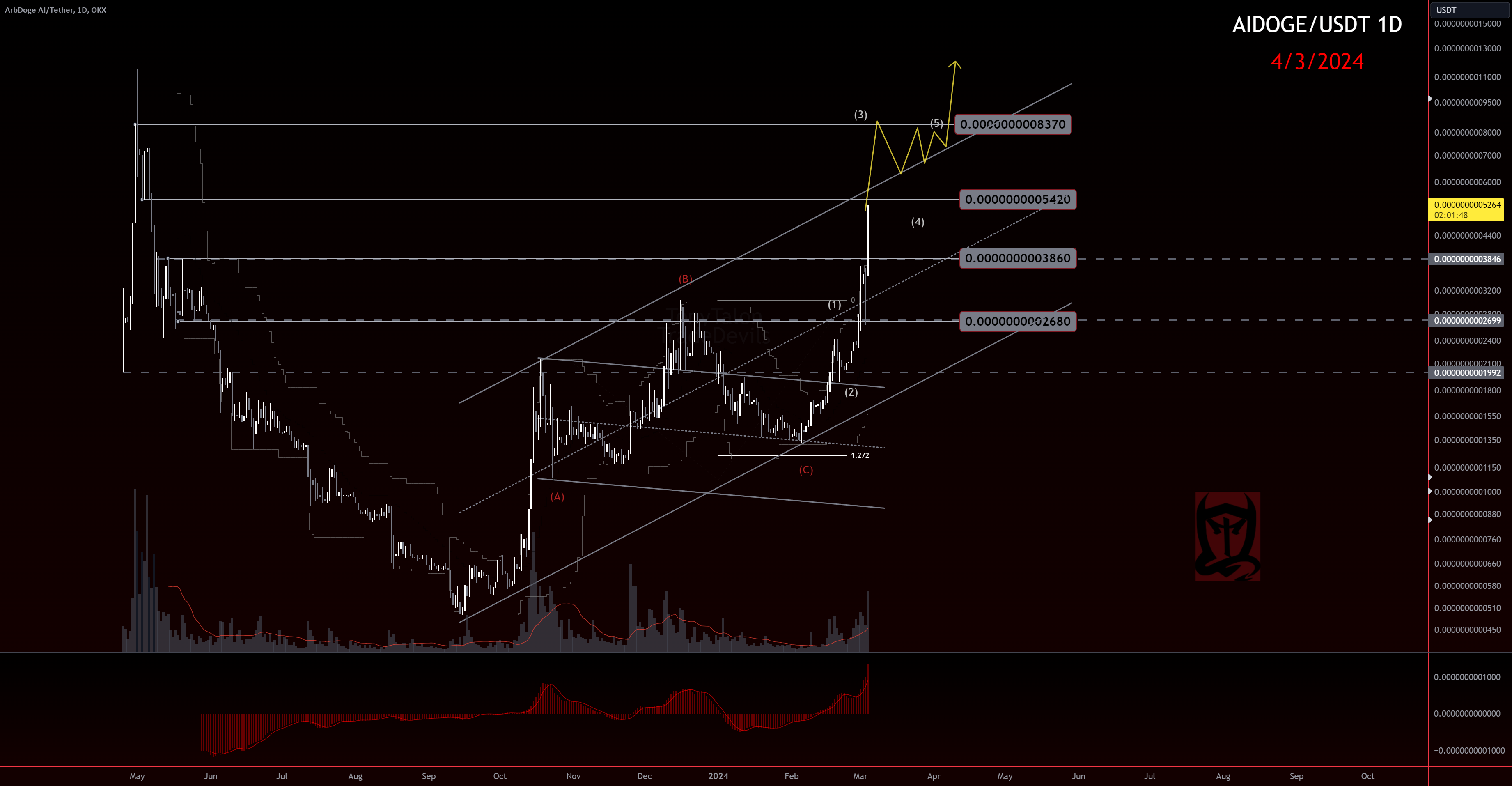

If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment! Well I got in, but the waves are not super

OPEC+ producers extend oil output cuts to second quarter

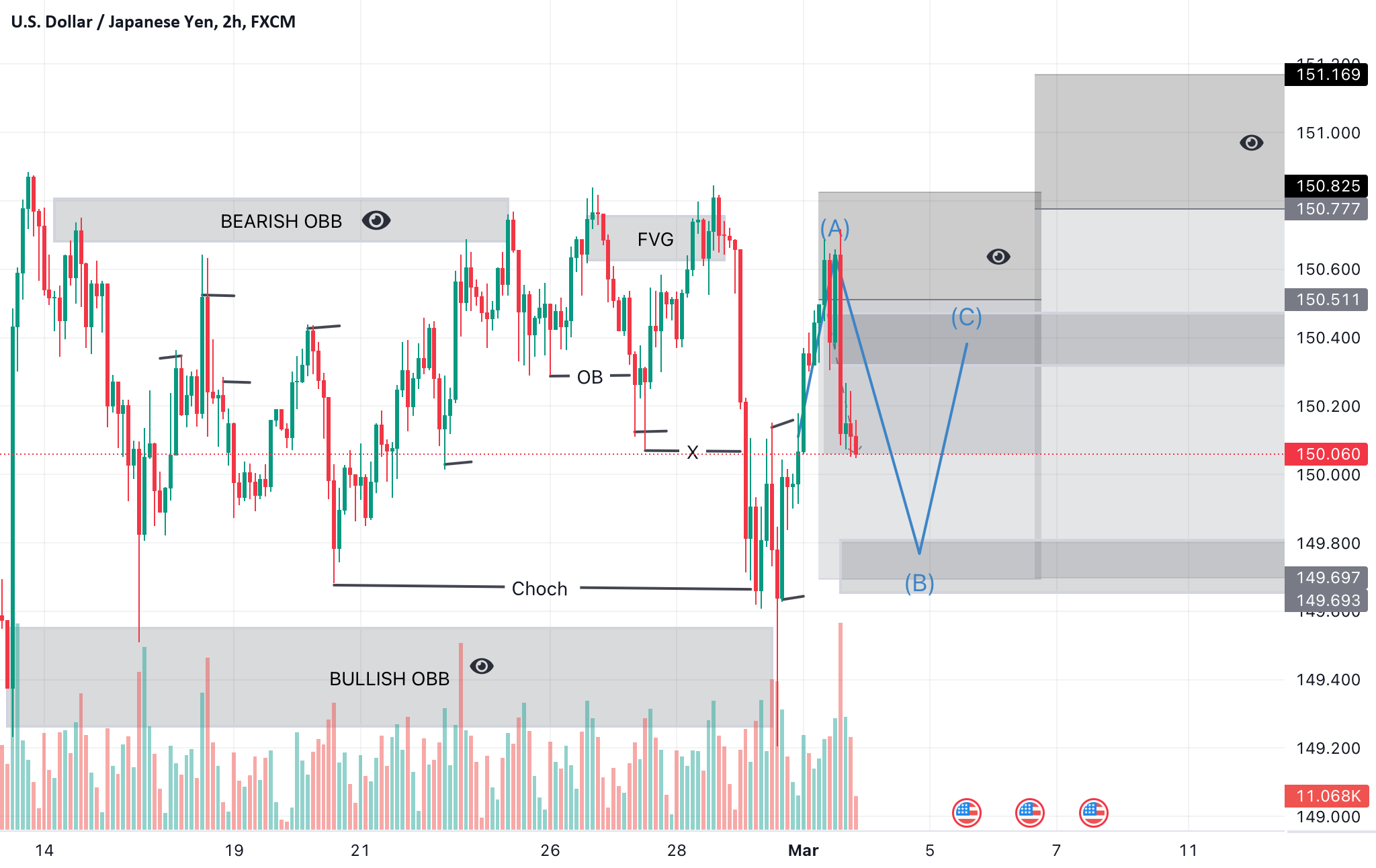

Hey there USDJPY has been extended on Friday From 150.700 to recovery and has gone downside for previous orders and go down continue We now seems of Fibonacci retrace from