Polish farmers block highway at border crossing with Germany

Israeli battery tech startup Addionics to build $400 million U.S. plant

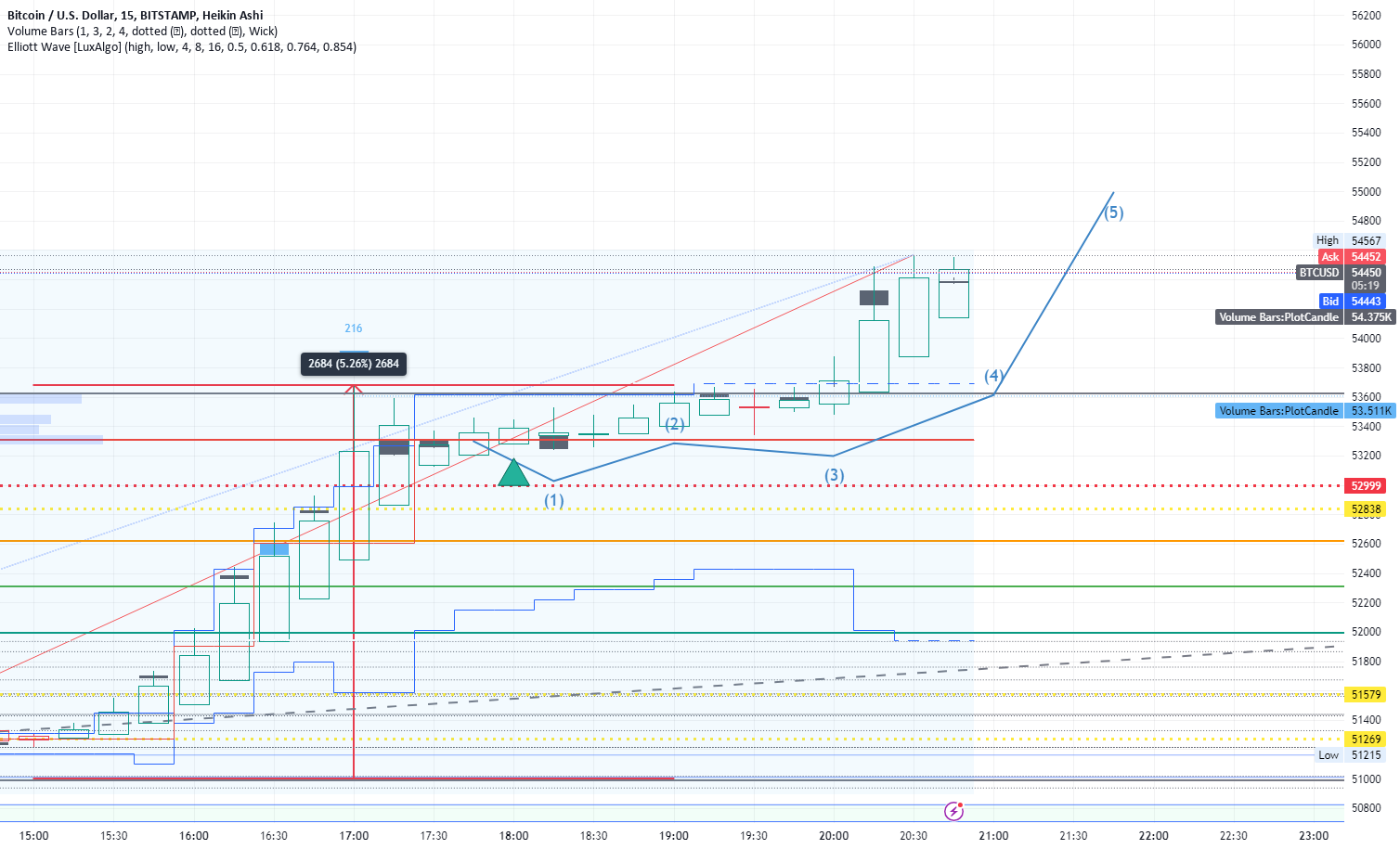

The cryptocurrency market is buzzing with anticipation as Bitcoin (BTC) continues its upward trajectory. With BTC currently standing at $54,400, the prospect of surpassing the $55,000 mark is becoming more

Oil prices edge lower; inflation data deluge due

AUD/USD is coming off a string of eight consecutive days of gains but appears to have found resistance at a key longer-term level now that Chinese markets have eased

US new home sales miss expectations in January

Sterling has enjoyed a run higher thanks in part to some better news from its home economy. There’s not much on this week’s slate, which will leave the Dollar in

Farmers protest across Europe, press ministers to act

LLY shown on a daily chart has doubled in the past year with the introduction of new FDA approved drugs into the market. It has but out a series of

With spears and shields, India's Nihang Sikh warriors join farmers' protest