US business activity moderates in February - S&P Global survey

Fed officials continued to signal a preference to remain patient on the topic of rate cuts as the US economy, consumer and labour market maintain their resilience

Angry French farmers storm into agriculture fair in Paris

The last few sessions have seen data showing the UK in recession, and some more hopeful signs that it might already be coming out. There’s less to look forward to

US existing home sales rise to five-month high in January

CME_MINI:NQH2024 - PR High: 17710.00 - PR Low: 17675.50 - NZ Spread: 77.25 Significant calendar events 08:30 | Initial Jobless Claims 09:45 | S&P Global US Manufacturing PMI - S&P

Analysis-Trans Mountain expansion may not give long-term price relief to Canada's booming oil output

ECB governing council members reiterated a lack of urgency to cut interest rates despite improved wage growth data. Lack of bullish euro drivers suggest vulnerability

Canada December retail sales up 0.9%, seen falling in January

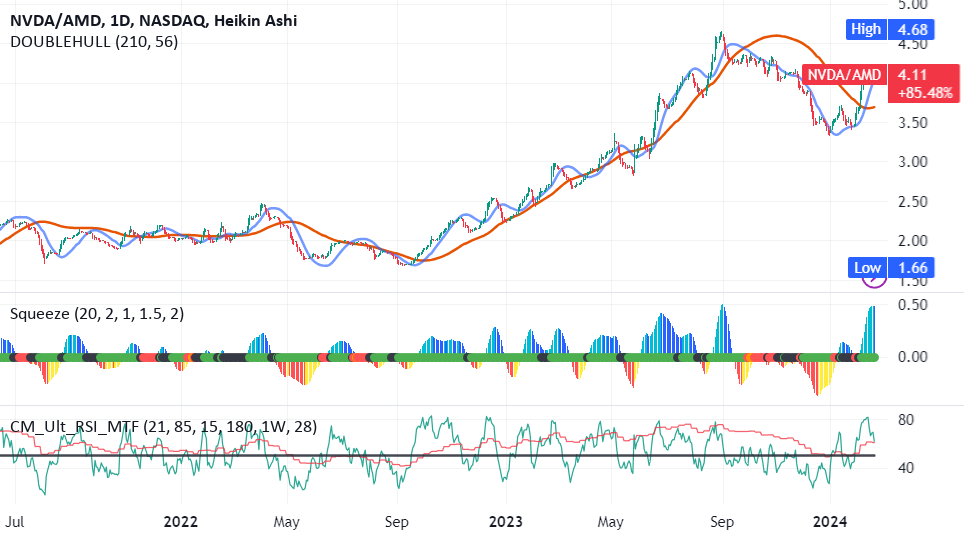

Here on a daily chart I have the ratio of shares of NVDA to AMD and so the market caps proportions. From September 2022 and for a year NVDA rose