Downtrend started since April 2021 until now, and those EP wrong should be hardly to recovery. What now? >> Price below Hull MA >> Need to break the short-term downtrend

US single-family housing starts fall in January; permits rise

Considering that the price is approaching the bottom range of its ascending pattern and the demand range of 1.345 units, if the range of 1.350 units is broken upwards and

US consumer sentiment steady in February

Hello dear traders In the dusk currency, the price can experience a price correction after a significant drop in the 1-hour period The next destination can be the consumption of

Factbox-What a second Trump presidency could mean for US energy policy

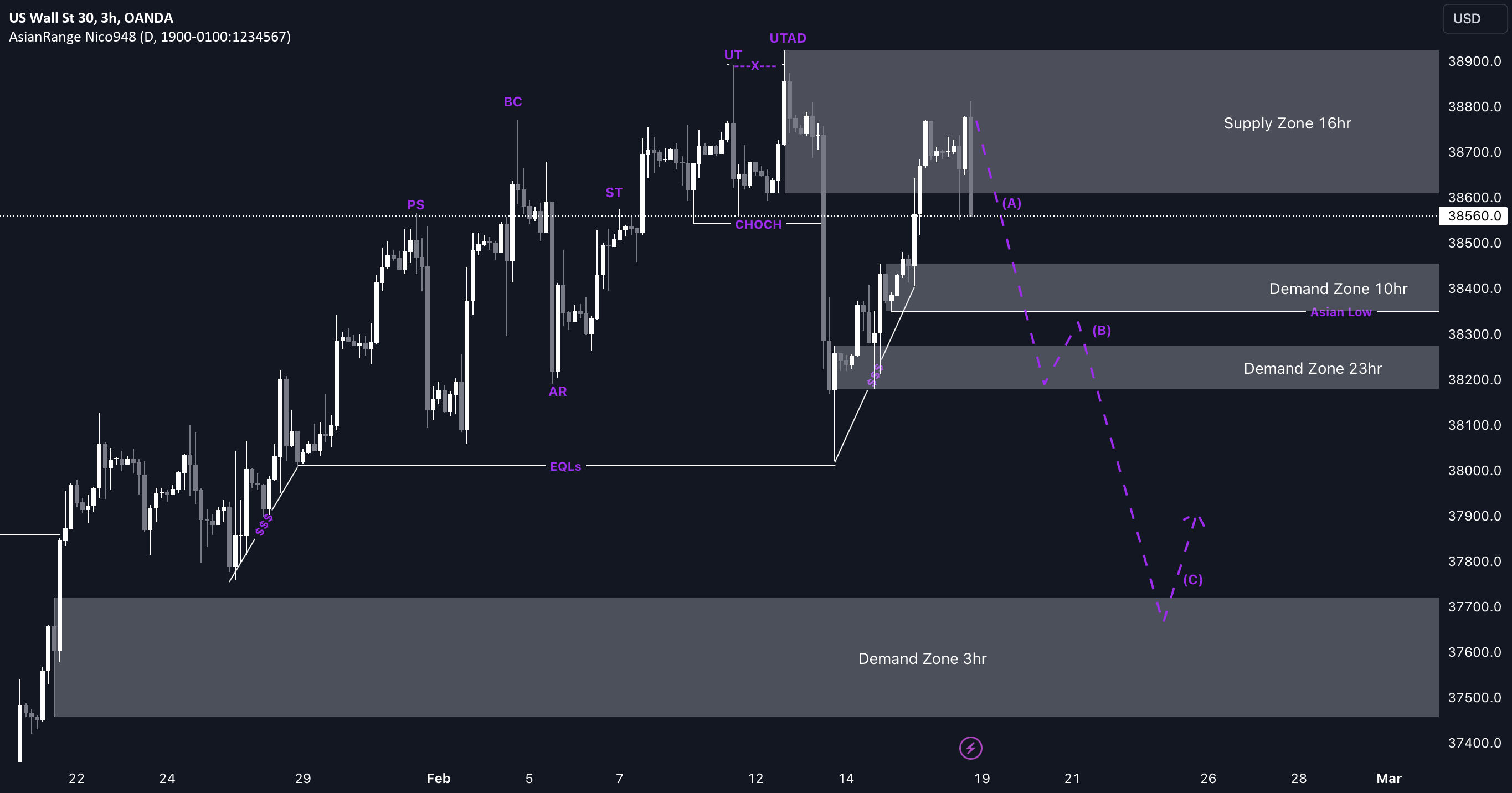

Last week, the US30 exhibited significant potential for a more favourable market environment, offering several promising trading opportunities. Following the completion of a Wyckoff distribution on a higher time frame,

Analysis-US refinery M&A stalls as buyers shun aging assets, uncertain future

#USDCAD FX:USDCAD ️ Date: 18 February, 2024 ⏰ Time frame: Weekly Given in the chart – ️ Blue Color (Long Term Trend line) = Strong Uptrend Weekly, H4 ️ Red

Wars and elections complicate deal-making ahead of Abu Dhabi meeting - WTO chief