EURGBP is currently in a downtrend on the higher time frames, so I am looking for sells. The Fibonacci has been drawn on an imbalance on the 15min TF and

China's Dec new yuan loans seen higher, hitting record in 2023: Reuters poll

The December U.S. inflation report, due for release on Thursday, is poised to provide clarity on the Fed's monetary policy outlook, helping guide the near-term trajectory of both gold prices

German industrial output drops unexpectedly in November

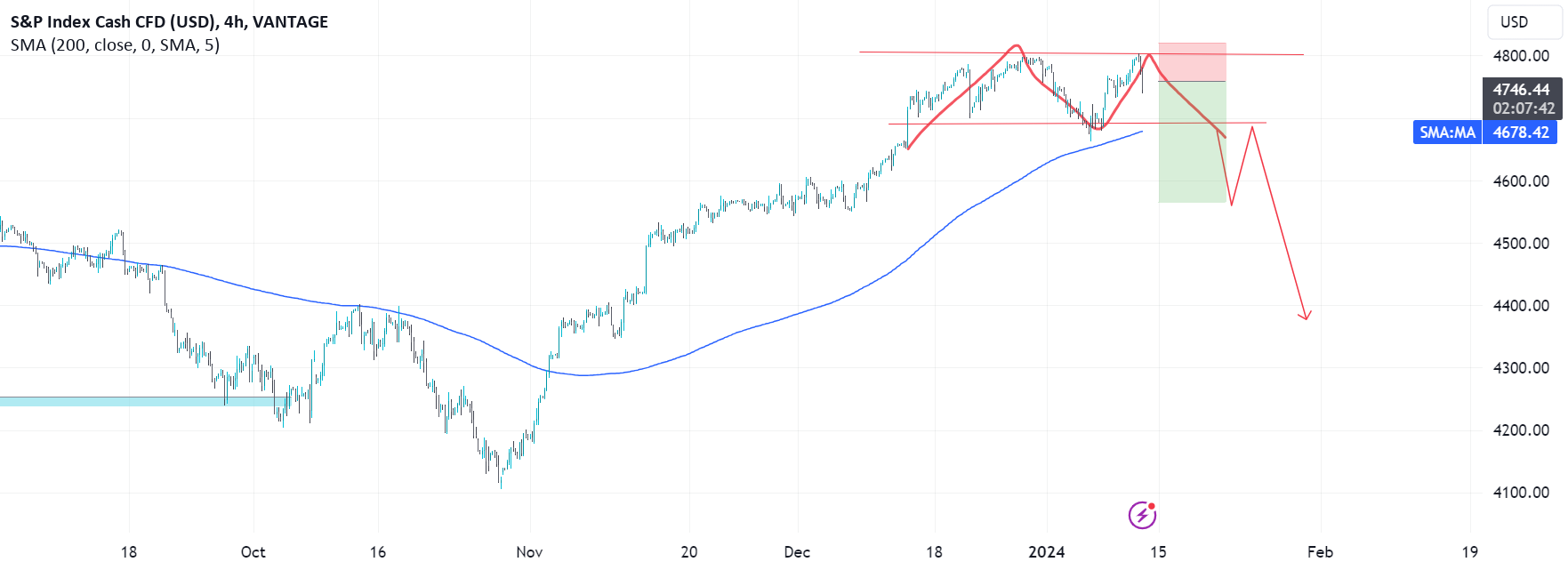

While higher inflation should be an indicator of a booming stock market since the consumers are spending more and the companies make more profit, this time the case is different.

India Dec inflation likely picked up to 5.87% on rising food costs - Reuters poll

Dear FRIEND, I hope you're doing well and that the new year has started on a good note for you. I wish you success in your business endeavors and a

Yellen says strong demand from Americans to boost cost of clean energy tax credits

With little of note on the economic calendar today, the US dollar is in a holding pattern ahead of Thursday’s US inflation report. USD-pairs remain listless ahead of the data.

Winter storm along US East Coast leaves behind power outages, flooding