Pakistan December CPI up 29.7% y/y - statistics bureau

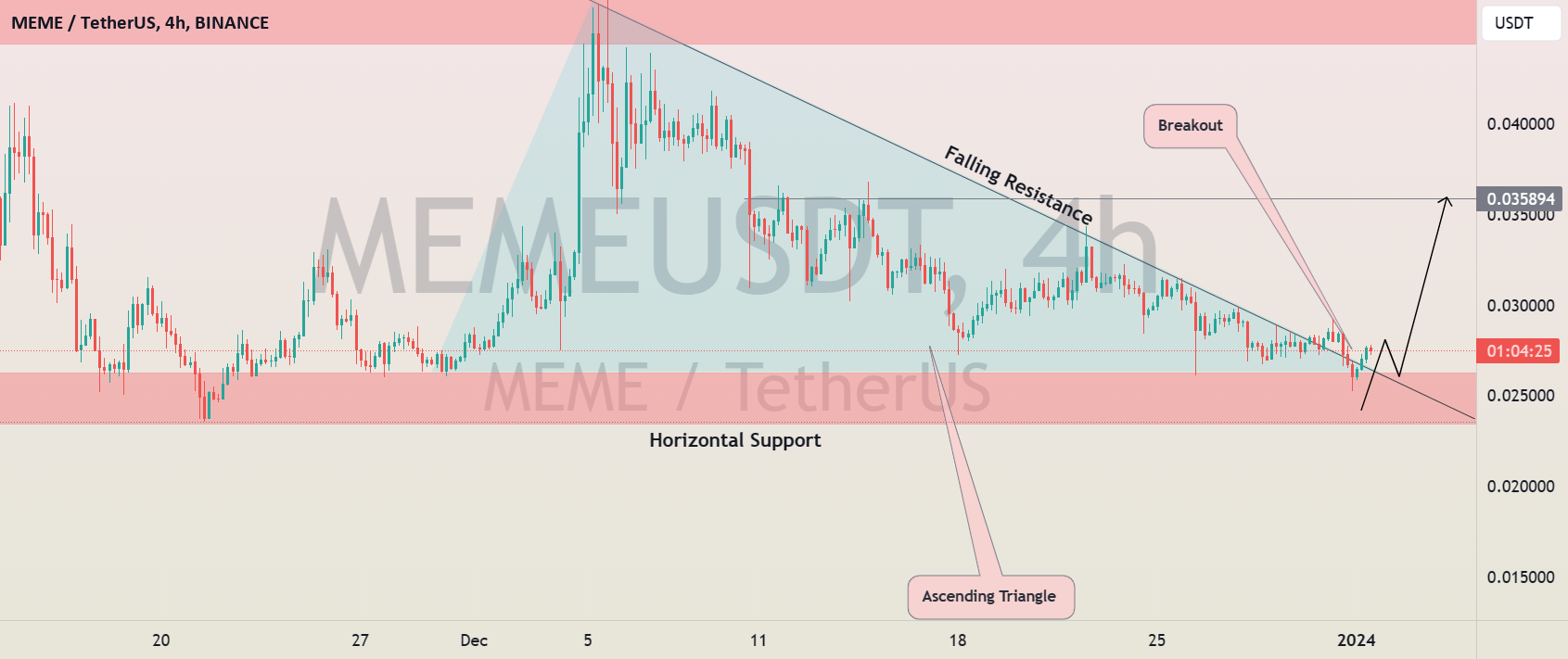

The price of MEME cryptocurrency has found a stable level of support after consistently decreasing along a downward trendline. However, once it reached a particular level, the market bounced back

The technical picture is a little hard to read for the S&P 500 heading into the first quarter of 2024, with immediate resistance resting near the record high around the

The Fed’s unexpected dovish pivot is a clear signal that officials want to shift policy in time to engineer a soft landing; in other words, they are prioritizing growth over

Oil prices hit their highest level of 2023 in September but have declined very sharply since, with shaky economic data keeping markets fretting about the demand outlook.

South Korea Dec exports up for third month but at slower pace

The British pound enters 2024 on a relatively strong footing against the USD after markets reacted ‘dovishly’ to the Federal Reserve’s more accommodative messaging in the last FOMC announcement.

China's new home prices up in Dec for 4th straight month - survey

If FINNIFTY if Sustain above 21508 to 21530 then 21593 to 21608 then 21663 to 21680 then 21732 to 21740 then 21802 to 21829 if FINNIFTY if Sustain Below 21461

Contracts to buy US existing homes flat as mortgage payments soften