Headline CPI dropped massively as energy and food prices see large declines. UK government achieves its target of halving inflation ahead of next week’s Autumn Statement

Oil prices retreat on US inventory build, global demand woes

AUD prices have held onto yesterday’s gains with some positive Chinese data as well as high wage growth locally.

South African retail sales rise 0.9% year on year in September

The symbol seems to be in a pivotal moment, where the price level was steadily climbing while the DO indicated a down-term trend. A possible ending may be reached by

US producer prices unexpectedly fall in October

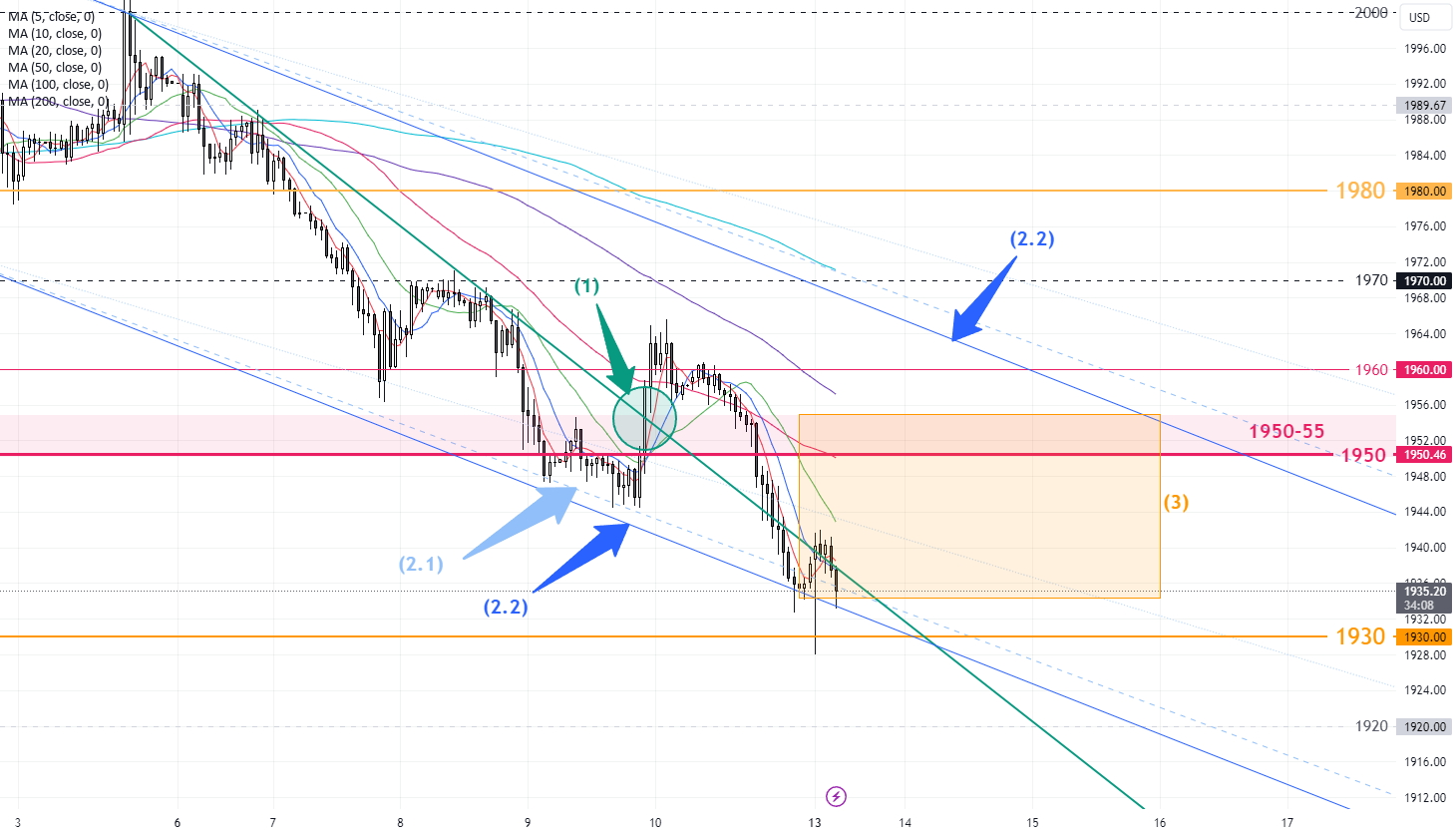

S-T rebound approaching, target around 1950. Gold made a new weekly low before the weekend, completing the downward cycle mentioned in our previous analysis. The price cleared the S-T resistance(1)

Oil prices slip on US crude build, China demand worries

9:00am Trade (1 HR) EURUSD:Buy 1.08454 tp 1.08641Sell 1.08291 tp 1.08104 GBPUSD:Buy 1.23962 tp 1.24169Sell 1.23742 tp 1.23514 USDJPY:Buy 151.445 tp 151.635Sell 151.285 tp 151.105 USDCAD:Buy 1.37082 tp 1.37233Sell 1.36977

Outlook on FTSE 100, DAX 40 and S&P 500 following weaker-than-expected US and UK inflation.