ICICI Bank is a large private sector bank in India offering a diversified portfolio of financial products and services to retail, SME and corporate customers. The Bank has an extensive

08:50am Trade (1 HR) EURUSD:Buy 1.08221 tp 1.08319Sell 1.08093 tp 1.07998 GBPUSD:Buy 1.25956 tp 1.26120Sell 1.25797 tp 1.25629 USDJPY:Buy 146.496 tp 146.644Sell 146.344 tp 146.184 USDCAD:Buy 1.36018 tp 1.36127Sell 1.35907

DLTR has earnings in 3-4 trading days. On the 30 minute chart it has been sideways and maybe a little down for this past week which is par for the

Recommended by Daniel Dubrovsky Get Your Free USD Forecast The US Dollar outperformed its major counterparts this past week, with the DXY Dollar Index gaining over 0.8 percent. In fact,

US DOLLAR FORECAST:USD FORECAST: NEUTRALUS CPI Data Largely Offset by Hawkish Fed Rhetoric.FOMC Minutes Unlikely to Provide Any Further Clarity, with the Hawkish Rhetoric Set to Continue. Markets Continue to

Trading Idea 1) Find a FIBO slingshot 2) Check FIBO 61.80% level 3) Entry Point > 10.8/61.80% Chart time frame : B A) 15 min(1W-3M) B) 1 hr(3M-6M) C) 4

May have trouble making interest payments on debt Declining trend in earnings per share Analysts anticipate sales decline in the current year Stock price movements are quite volatile Stock has

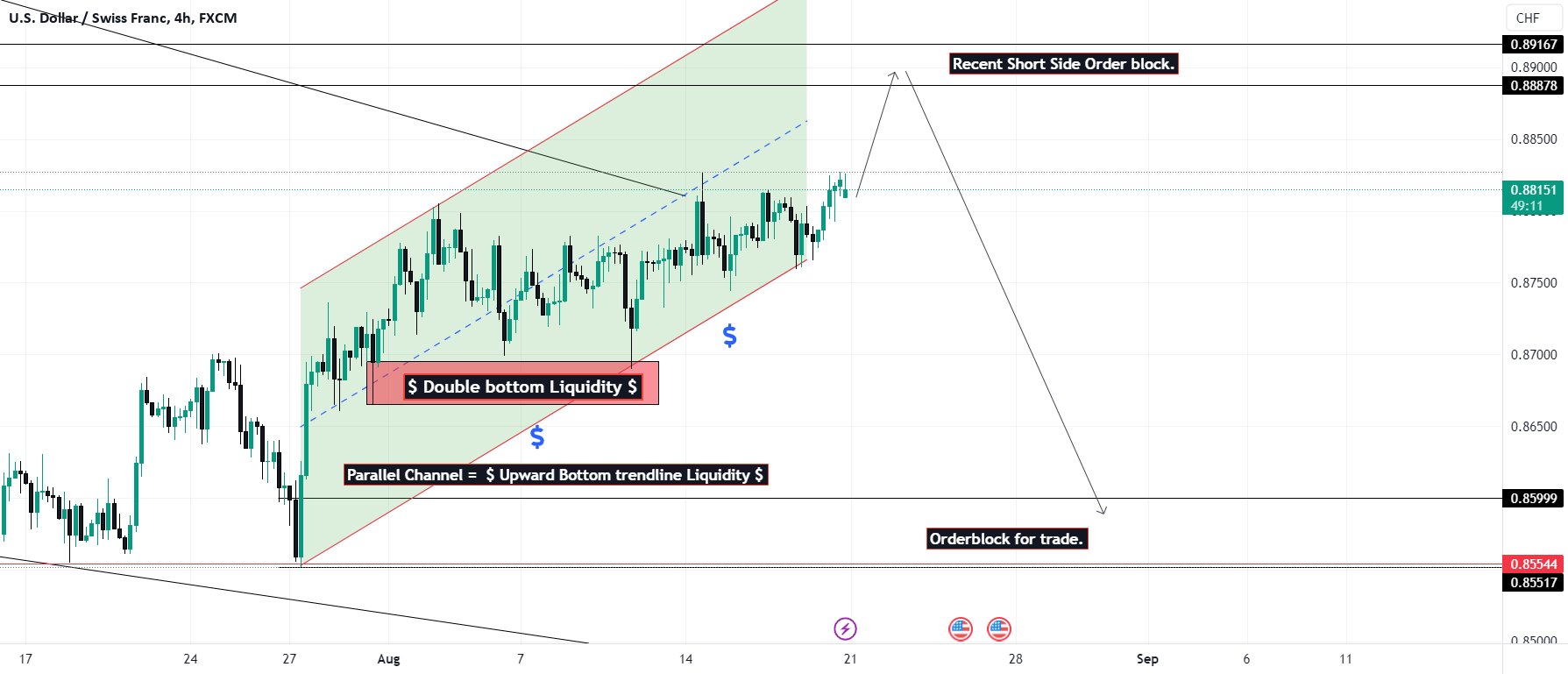

Educational Analysis says USDCHF trade set up according to my technical. This is not an entry signal. I have no concerns with your profit and loss from this analysis. Why

EUR/USD and EUR/GBP Forecast - Prices, Charts, and Analysis Recommended by Nick Cawley How to Trade EUR/USD The Euro remains on the back foot after Wednesday’s anemic PMIs showed the

This pair is currently locked within a long-term range on the Monthly charts, spanning from 0.82 to 0.92. Our current path is leading us downwards, inching closer to the lower