Bitcoin Prices, Charts, and Analysis:

- Bitcoin turns a blind eye to SVB failure and Credit Suisse woes.

- A confirmed break of resistance will open the way to $32k in the longer term.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Risk markets have been roiled in the past few days, first by the shuttering of two US banks, Silicon Valley Bank and Signature, and then by fears that Credit Suisse may also be wound up as its share price continues to plunge to new all-time lows. In the past, any strong risk-off move has seen Bitcoin turn lower, but not this time. The cryptocurrency space as a whole has moved higher over the last week, driven by a growing view that a failing bank system reinforces the view that a peer-to-peer digital currency is in part immune to traditional banking woes.

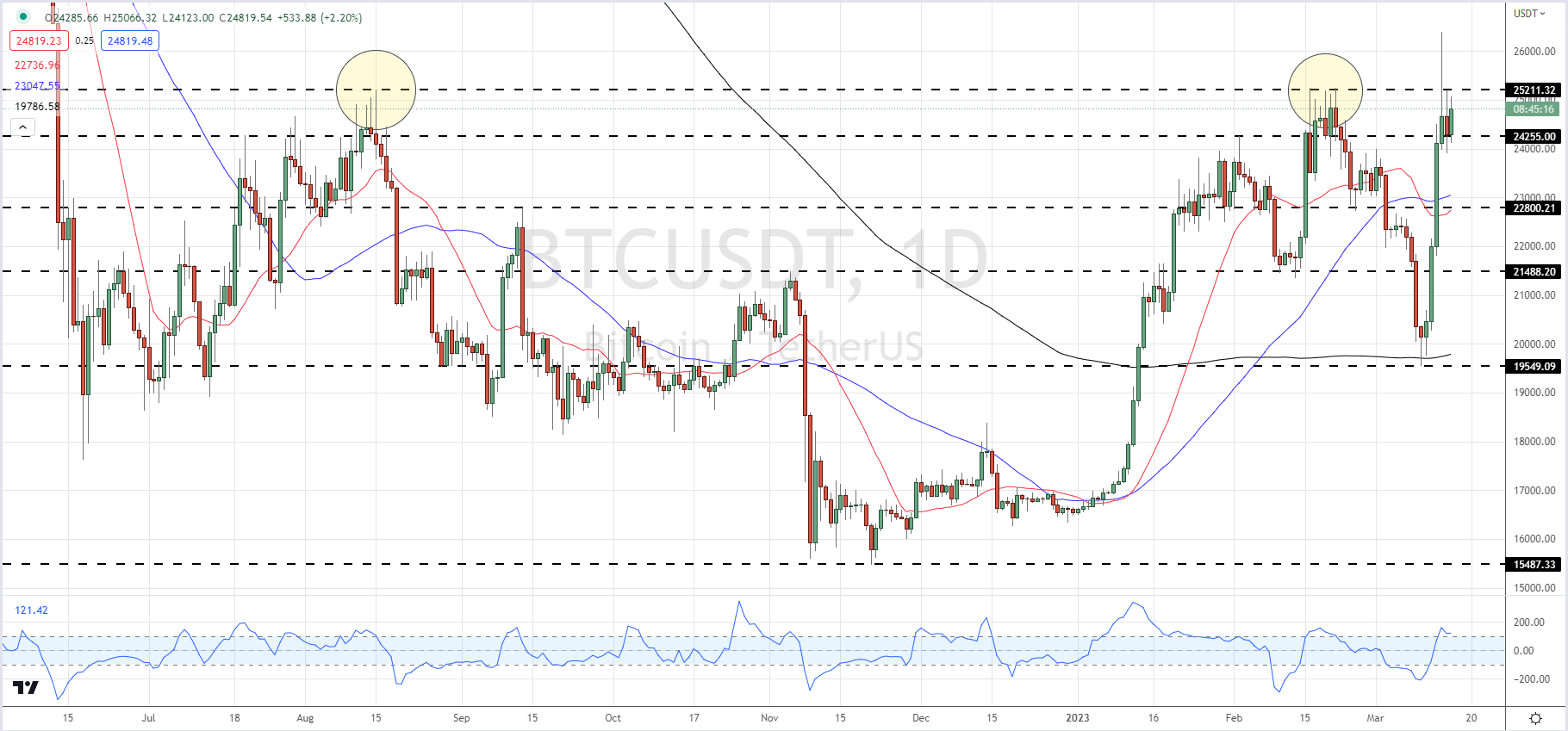

The current market resilience can also be traced back to the FTX/Alameda meltdown in mid-November. Bitcoin hit a low of $15,487 a couple of days later, but since then BTC has pushed further ahead and despite the late-February sell-off, it is now within a few percent of making a fresh multi-month high. It seems Bitcoin, and the cryptocurrency space as a whole is becoming increasingly resilient to both defi and tradfi shocks.

Cryptocurrency Meltdown Pauses After FTX and Alameda Implosion

Bitcoin is now pressing against a level of resistance around $25.2k that has not been broken convincingly for months. While Tuesday’s rally took BTC to an intra-day peak of just under $26.4k, it closed around $24.6k. For BTC to make fresh gains, and the path to an eventual target of $32k looks possible, it needs to close and open above this resistance to confirm the move. All three moving averages are supportive, with the 200-dma providing strong support during last week’s sell-off, while the CCI indicator shows BTC trading in overbought territory. A few more days of consolidation and then a fresh push higher may be on the cards.

Bitcoin (BTC/USD) Daily Price Chart – March 16, 2023

Chart via TradingView

What is your view on Bitcoin – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.