GBP/USD and EUR/GBP Analysis and Charts

For all market-moving economic data and events, see the DailyFX Calendar

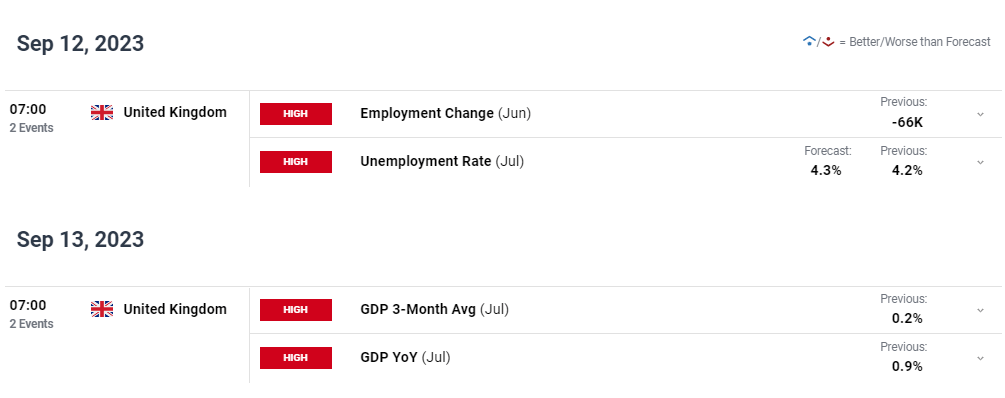

Sterling traders will need to be at their desks early next Tuesday and Wednesday as the latest UK jobs report and growth numbers are released at 07:00 UK. The UK unemployment rate is seen ticking up by one-tenth of a percent to 4.3% in July, a level last seen one year ago. The unemployment rate has picked up steadily since April this year as more people look to re-enter the workplace, and this should cap wage pressure in the months ahead.

On Wednesday the latest UK growth figures will be keenly followed by the Bank of England to see if the lagged effect of 14 months of interest rate hikes is hampering the UK economy. A below consensus reading could well see the Bank of England holding interest rates steady at the next MPC meeting later this month.

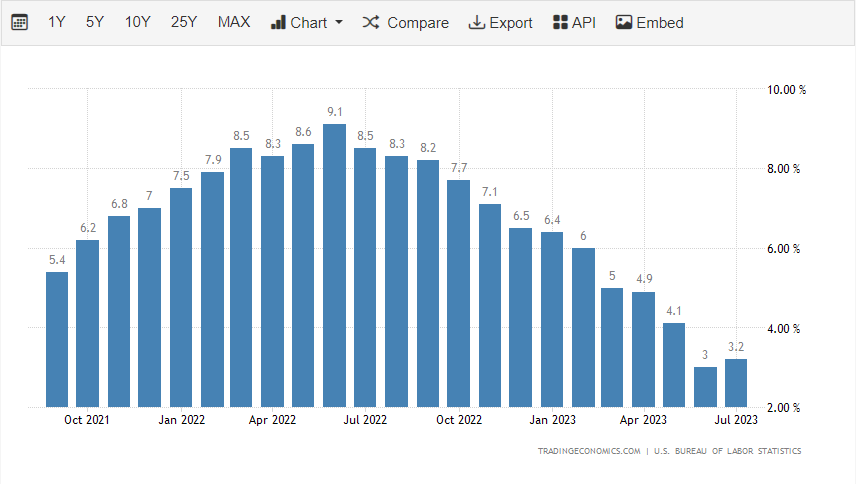

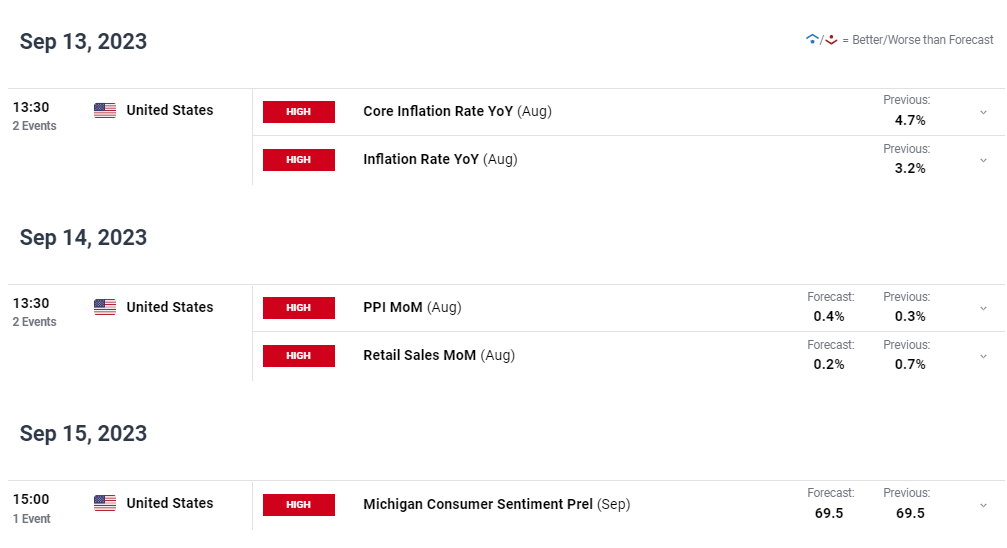

In the US, inflation has taken a back seat to jobs data in the last couple of weeks, but Wednesday’s data should change that. After falling steadily since June last year, annual inflation picked up again in July, and a further move higher will increase calls from the more hawkish members of the FOMC to raise interest rates in November.

US Annual Inflation

Recommended by Nick Cawley

Traits of Successful Traders

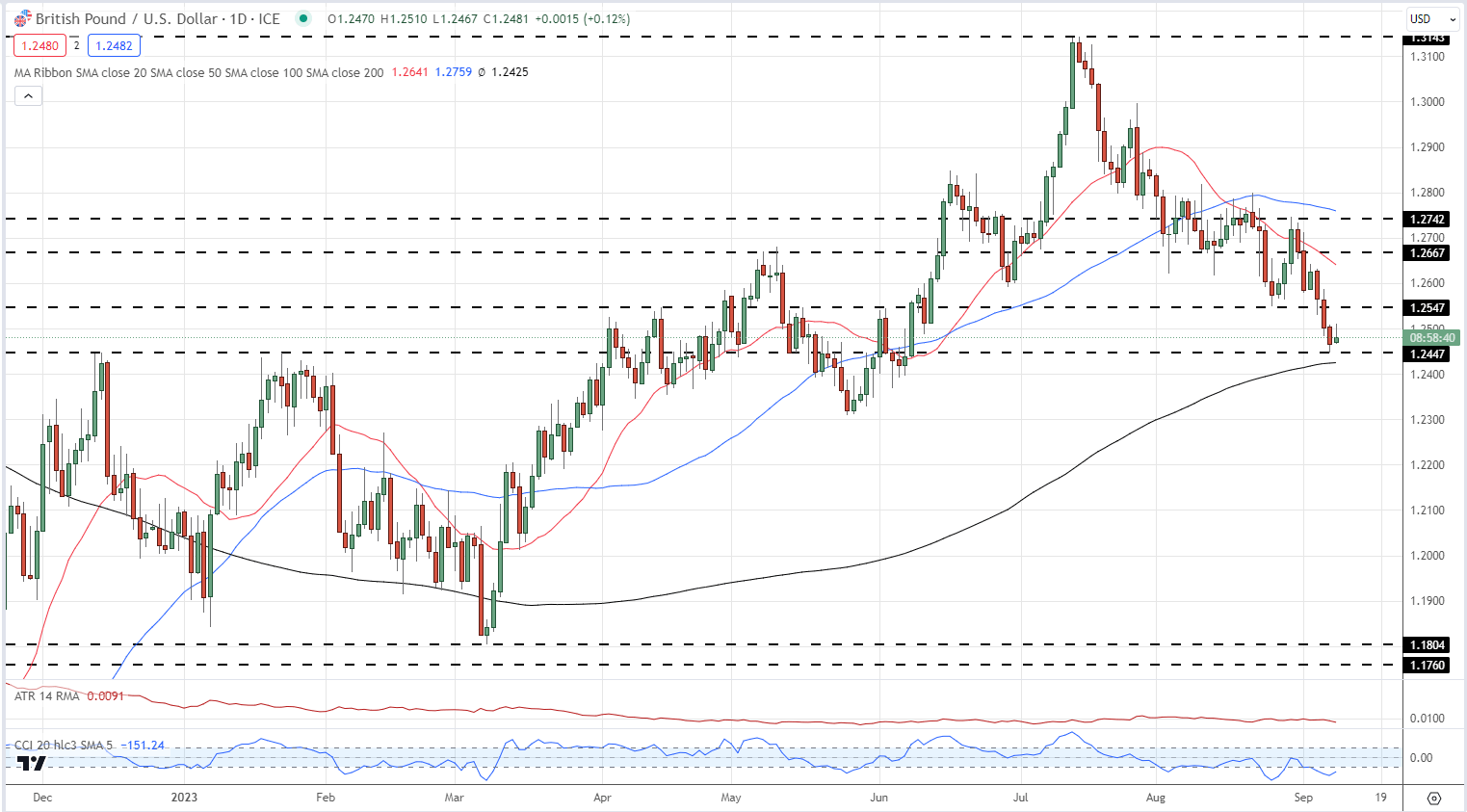

With the potential of market moving data out for both sides of GBP/USD, volatility should at least pick up in cable next week. The pair touched a multi-week low on Thursday, driven by a strong US dollar complex. This horizontal support at 1.2447 is also guarded by the 200-day simple average, currently at 1.2425. Cable has not traded below this longer-dated ma since a brief move in early March. Initial resistance is seen around 1.2550 ahead of the 20-day sma at 1.2641.

Recommended by Nick Cawley

How to Trade GBP/USD

GBP/USD Daily Price Chart September 8, 2023

See How GBP/USD Traders are Positioned

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | 0% | -1% | -1% |

| Weekly | 8% | -11% | 2% |

Looking at the Euro Area, next week sees the latest ECB monetary policy decision with the market currently split between leaving rates unchanged or a further 25 basis point rate hike. Recent data shows the Euro Zone economy near flat lining with Germany, once the driving engine of European growth, struggling. The risk of tightening policy too far is now one of, if not the most important factors for the ECB to discuss when they meet next Thursday.

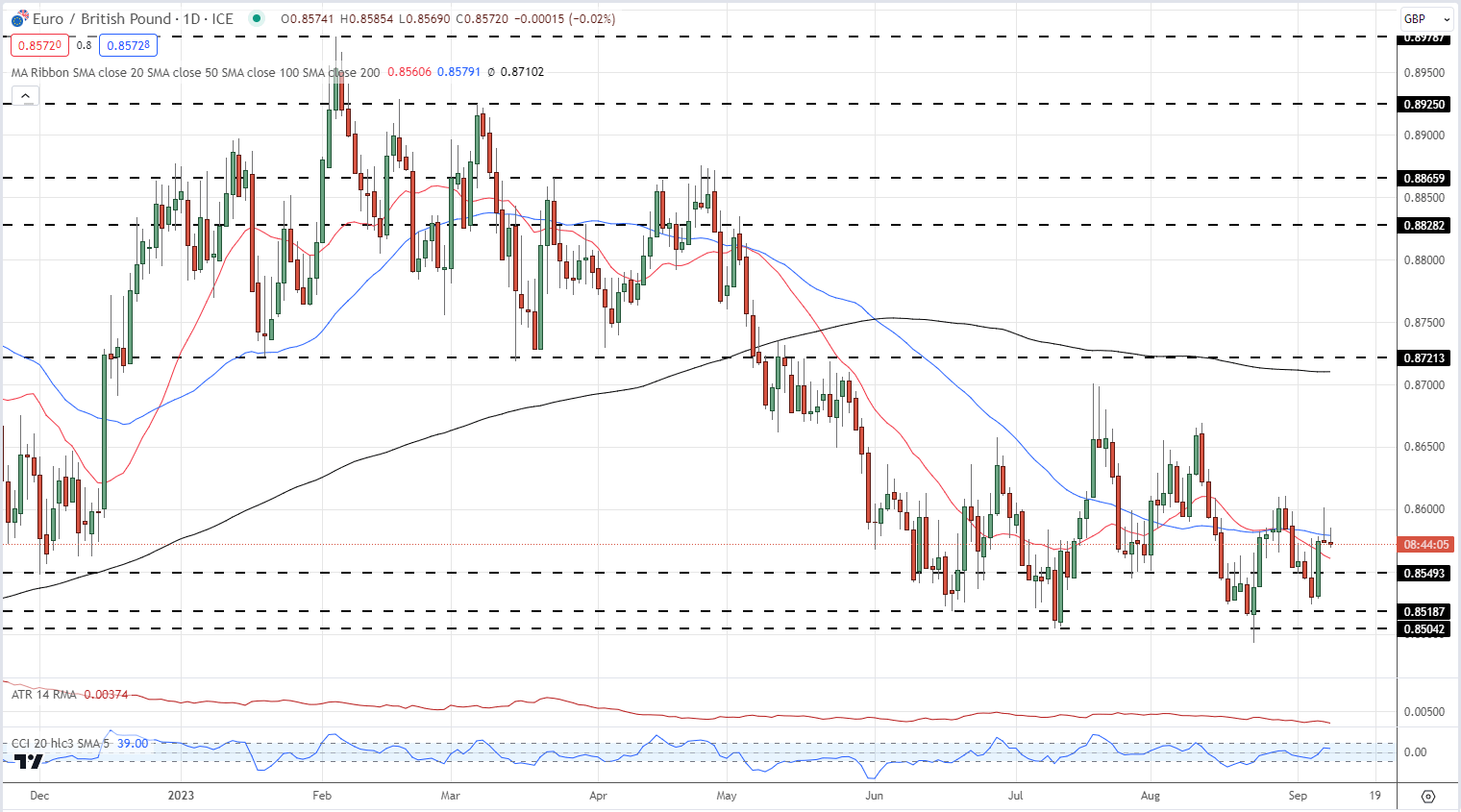

We have spoken at length about how EUR/GBP has been range trading over the past weeks, and this remains the case. Support around 0.8500 has held comfortably so far, bar one intraday spike lower, while an old level of support turned resistance at 0.8720 has held. The daily chart does show a recent series of lower highs from mid-July and this continues to press down on EUR/GBP. It may be time to tighten this range and move resistance down to 0.8700.

EUR/GBP Daily Price Chart – September 8, 2023

Charts using TradingView

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.