GBP/USD Prices, Charts, and Analysis

- UK 2yr-10yr Gilt yield curve inverts further.

- UK economic calendar is thin.

- Cable may test prior levels of support.

Recommended by Nick Cawley

How to Trade GBP/USD

The Bank of England hiked rates by a more than expected 50 basis points this week as the central bank doubled down in its fight against inflation. While a larger-than-expected rate increase had been talked about, the market was still surprised by the BoE’s aggression and subsequent hawkish talk. Inflation in the UK was meant to be on a steep downward path by the middle of the year, but this hasn’t happened and price pressures remain persistently high. Financial markets are now pricing in another 100 basis points of rate increases this year to take the Bank Rate to 6%.

In normal circumstances, the Pound would find itself propped up by higher rates as the currency becomes more attractive against its peers. This is not the case as the talk now turns to the housing market and an impending recession. Two- and five-year fixed mortgage rates have steepened sharply since the BoE began raising rates over a year ago and repayment costs are soaring. With rates expected to go even higher in the coming months, consumer spending will be crimped sharply, and this will hit the UK economy.

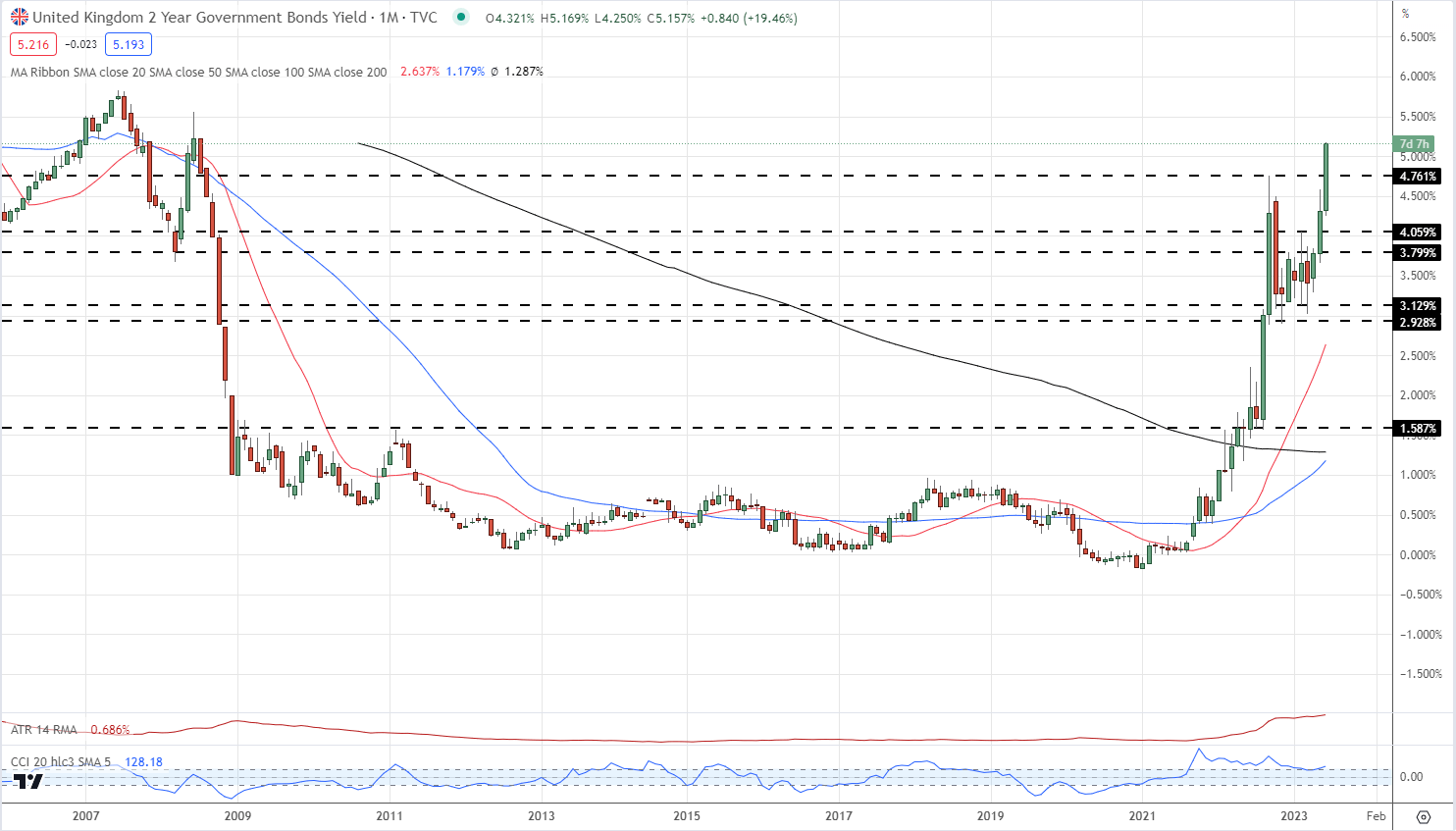

A look at UK gilt yields highlights the current problems and points to a recession. The closely watched US 2-10 year yield curve is now inverted by 85 basis points, while the 1yr-10yr is inverted by over 100 basis points. Inverted yield curves are a strong recessionary signal.

Two-Year UK Borrowing Costs Are at a 15-Year High

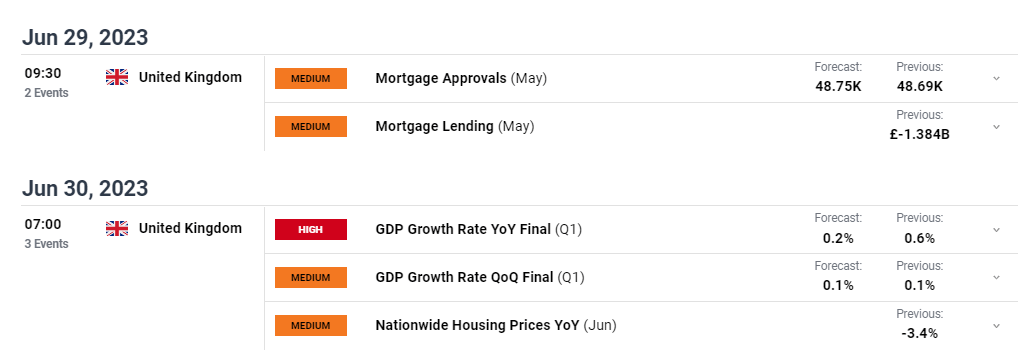

The domestic economic calendar next week contains two data releases of note. The latest look at mortgage approvals will show how the housing market is coping with higher rates, while the final look at UK Q1 GDP is expected to show the economy eking out minimal growth in the first quarter.

For all market-moving events and data releases see the real-time DailyFX Calendar

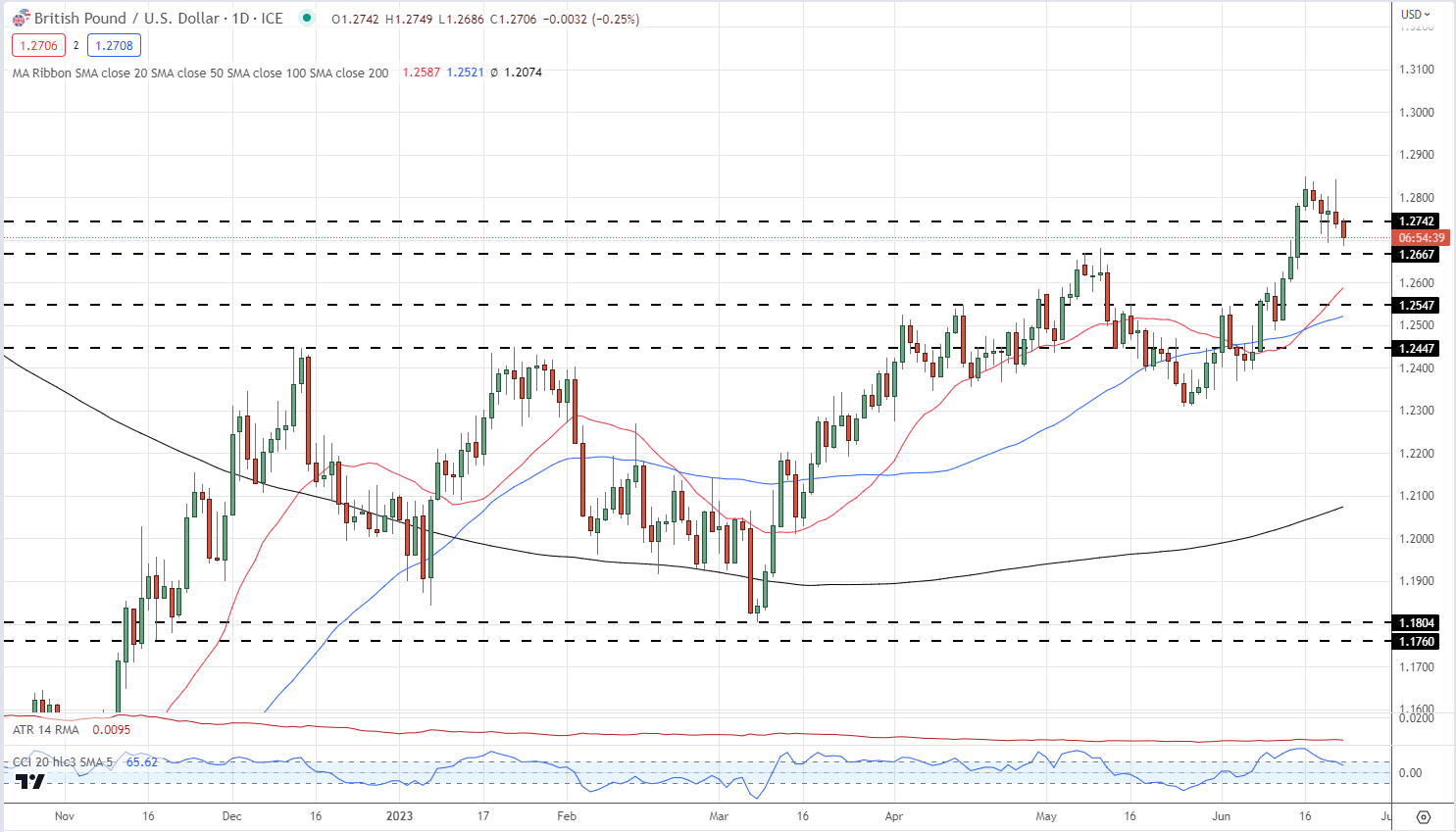

Cable (GBP/USD) is drifting back to 1.2700 after posting a 1.2842 high post-BoE announcement. The 1.2667 level is the next line of short-term support ahead of the 20-dma at 1.2587.

GBP/USD Daily Price Chart – June 23, 2023

Chart via TradingView

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | -20% | 8% | -5% |

| Weekly | -6% | -5% | -5% |

Retail Traders are Short GBP/USD

Retail trader data show 41.08% of traders are net-long with the ratio of traders short to long at 1.43 to 1.The number of traders net-long is 0.82% higher than yesterday and 28.77% higher than last week, while the number of traders net-short is 3.22% lower than yesterday and 14.09% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse lower despite the fact traders remain net-short.

What is your view on the GBP/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.