British Pound Latest – GBP/USD and EUR/GBP Analysis and Charts

- Solid UK growth driven by all three main sectors.

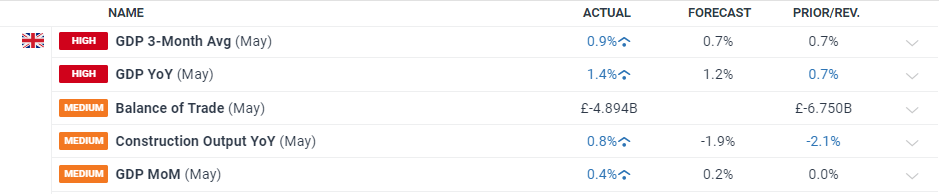

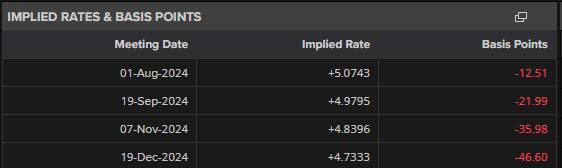

- UK rate cut expectations trimmed by 3-4 basis points.

The latest monthly UK GDP data surprised to the upside earlier today with all three sectors – services (+0.3%), production (+0.2%), and construction (+1.9%) – expanding.

According to the Office for National Statistics (ONS),

‘Real gross domestic product (GDP) is estimated to have grown by 0.9% in the three months to May 2024, compared with the three months to February 2024. This is the strongest three-monthly growth since January 2022. Services output was the main contributor, with a growth of 1.1% in this period, while production output showed no growth and construction fell by 0.7%. Monthly real GDP is estimated to have grown by 0.4% in May 2024, after showing no growth in April 2024 (unrevised from our last publication).’

ONS – GDP Monthly Estimate – May 2024

Today’s strong GDP data trimmed UK rate cut expectations by 3-4 basis points but market pricing still shows just under 47 basis points of rate cuts this year with the September 19th meeting heavily favored for the first 25 basis point move.

Recommended by Nick Cawley

Get Your Free GBP Forecast

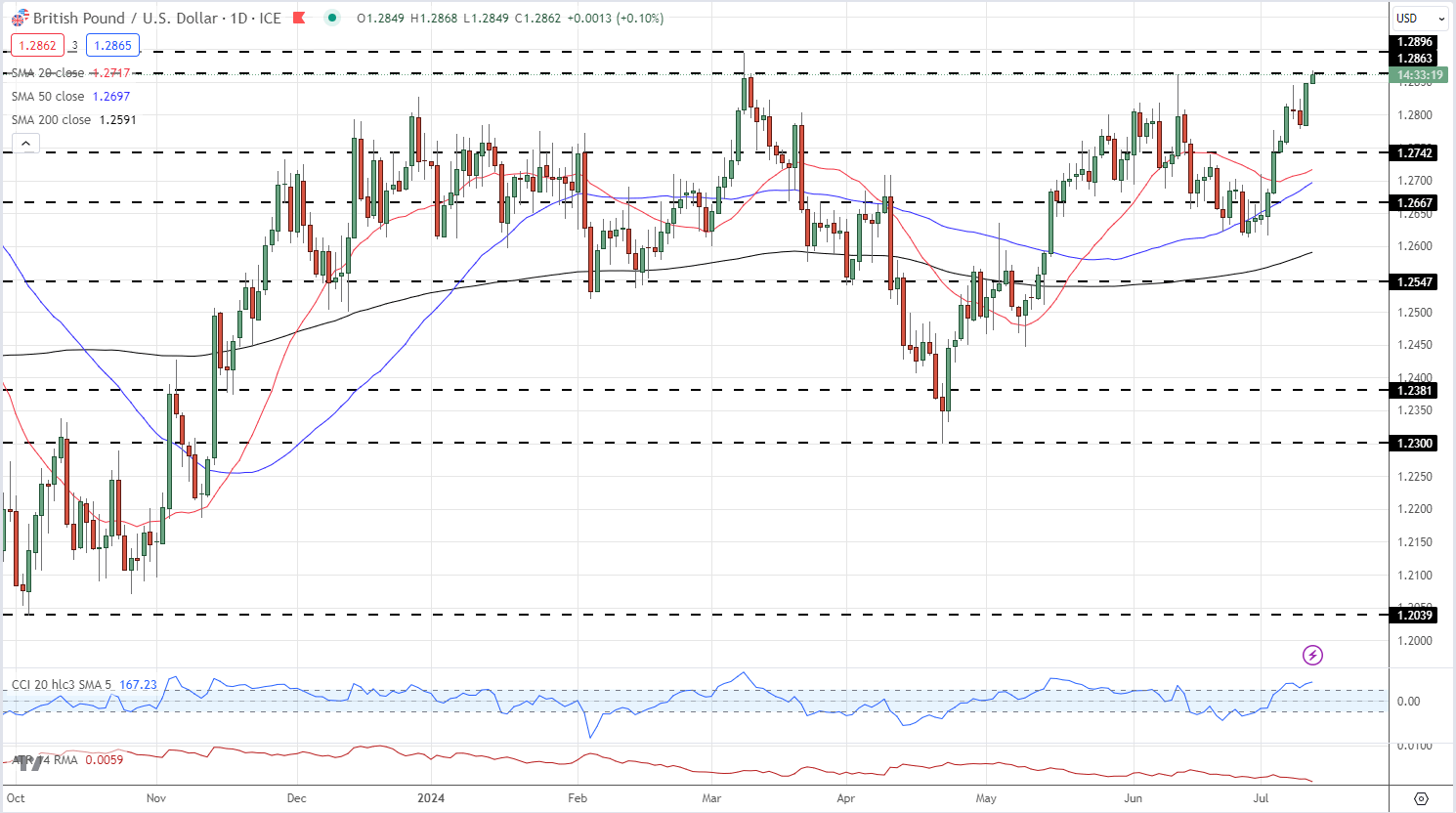

GBP/USD posted a multi-week high of 1.2668 after the release, and now eyes the early March high of 1.2896.

GBP/USD Daily Chart

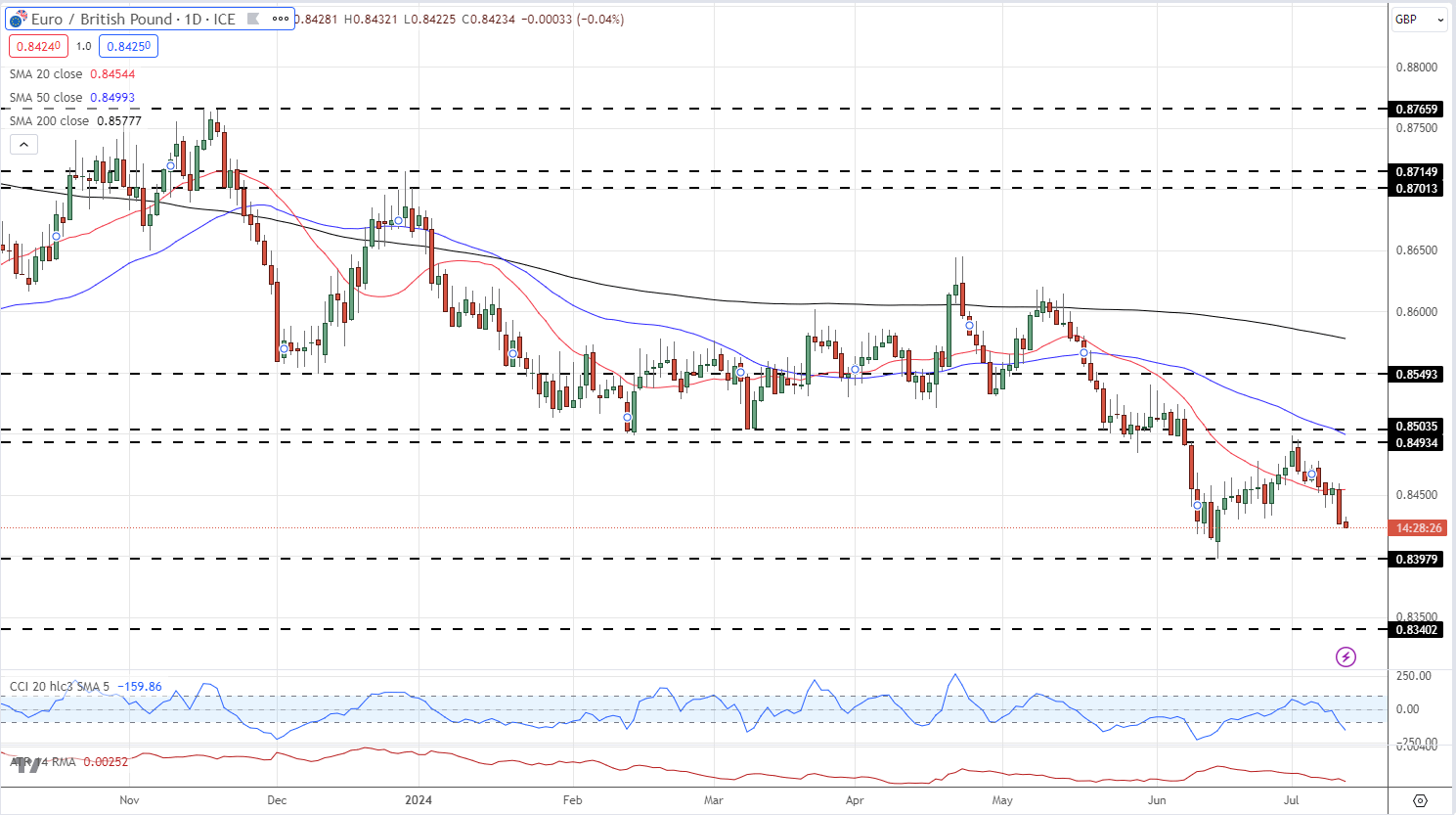

EUR/GBP continues its recent move lower and is set to test the June 14 low at 0.8397. A break below here would see EUR/GBP back at levels last seen in August 2022 and would leave 0.8340 vulnerable.

EUR/GBP Daily Chart

All charts using TradingView

IG Retail trader data shows 69.80% of traders are net-long with the ratio of traders long to short at 2.31 to 1.The number of traders net-long is 8.11% higher than yesterday and 11.58% higher than last week, while the number of traders net-short is 12.50% lower than yesterday and 9.26% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBPprices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/GBP-bearish contrarian trading bias.

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | 3% | 7% | 4% |

| Weekly | 26% | -34% | 4% |

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or contact the author via Twitter @nickcawley1.