British Pound Weekly Forecast: Lack of Local Cues Could See Drift Lower

British Pound Forecast: Bearish

- GBP/USD has been supported by expectation beating UK inflation, and some stronger economic data

- However the UK economic slate is pretty bare this week

- Momentum is likely to come form the USD side

- Learn the ins and outs of trading GBP/USD, or ‘Cable’ below:

Recommended by David Cottle

How to Trade GBP/USD

Sterling has edged higher against the United States Dollar in the past few days, but now faces a trading week very short of scheduled domestic trading cues. That needn’t be especially bad news for Sterling bulls, but the market could be vulnerable to drift which may see it head lower, especially if the US numbers hold up and dim rate-cut hopes there.

The United Kingdom’s currency seems to have largely shrugged off news of the snap general election called for July 4. The vote seems all-but certain to hand power to the Labour Party, after fourteen years of Conservative government. However, room for fiscal maneuver is held to be limited whoever governs. The new government’s level of desire to test this may well see the Pound pay more attention to politics down the track, but for now they’re very much in the background.

Instead, the Pound finds support in inflation’s surprise resilience and signs from the most recent Purchasing Managers Index data that the UK’s momentum out of recession is holding up. Major banks like HSBC, JP Morgan and Goldman Sachs, now think the Bank of England won’t be cutting rates until August, with a June move effectively off the table.

Still, the Dollar has been given something of a tailwind, too by the release of minutes from the Federal Reserve’s May monetary policy meeting. These contained discussion of still-higher interest rates should inflation not come to heel. In some respects, this is merely a statement of the obvious. After all the Fed has a specific inflation-busting mandate. If inflation were to rise again, it would clearly need to take action.

To be sure markets still think that the next US interest-rate move, when it comes, will be a cut. But even discussion of theoretically higher rates is enough to see the Dollar gain.

The coming week will see the release of a second official look at US Gross Domestic Product for the first three months of this year, and the closely watched inflation indexes from the Personal Income and Expenditure series, known to be a favorite at the Fed.

So, given the lack of UK data, and the markets’ lack of conviction as to when US rates will fall, it’s a bearish call for the Pound this week.

GBPUSD Technical Analysis

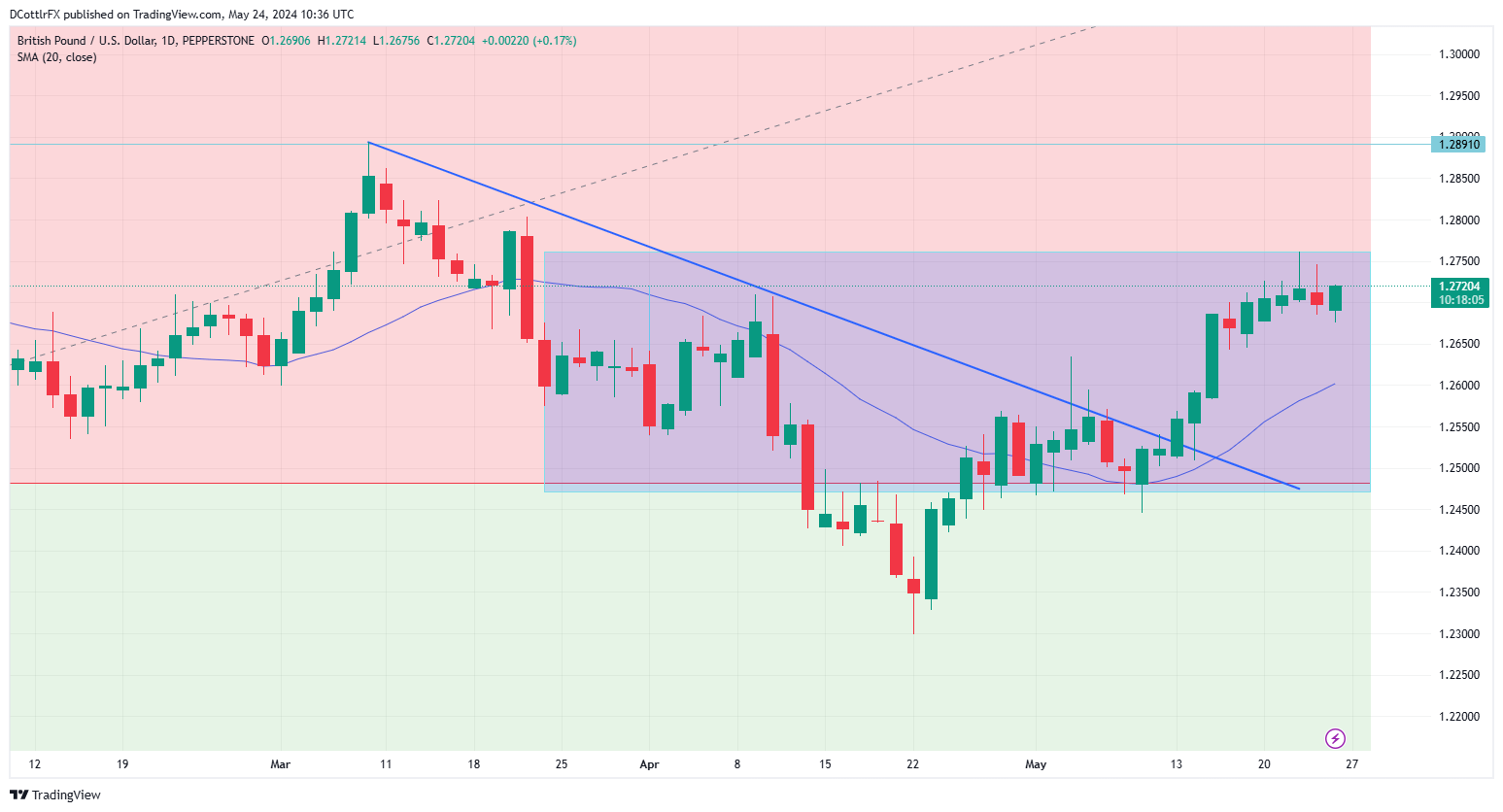

GBP/USD Weekly Chart Compiled Using TradingView

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | -33% | 18% | -4% |

| Weekly | -23% | 5% | -5% |

The Pound broke above its downtrend line from the peaks of early March in the middle of May and has climbed consistently since.

GBP/USD appears to be confined within a broad range whose lower bound can be seen at retracement support of 1.24819. Admittedly the pair slipped below this level at the end of April, but it was traded back into very quickly after that fall.

That level seems likely to hold this week, barring some major Dollar-boosting shock.

The $1.28 level still eludes sterling bulls on the upside, although if they can top it this coming week and stay above it, then the picture might turn more clearly bullish. However, an obvious failure at this level might suggest that the market is topping out and mean further, deeper falls are coming. The market is closing back in on its 20-day moving average, which now offers support around $1.2605.

–By David Cottle for DailyFX