British Pound Forecast: Bearish

- GBP/USD is close to five-week highs

- Better UK economic data have helped, as have Fed rate-cut bets

- Watch Wednesday’s consumer price data closely

- Discover the power of crowd mentality. Download our free sentiment guide to decipher how shifts in GBP/USD’s positioning can act as key indicators for upcoming price movements.

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | -7% | -2% | -4% |

| Weekly | -4% | -12% | -9% |

The British Pound heads into a new trading week with plenty of vigor. Despite giving back some recent gains, it remains close to five-week highs against the United States Dollar.

Admittedly much of this impressive pep is down to general Dollar weakness. Expectations have crystallized that rates will head lower Stateside after the Federal Reserve meets in September.

There are some home-grown, United Kingdom factors behind it, too, though. Economic growth has sprung a pleasant surprise, suggesting that the country is out of a recession that has in any case been much shorter and shallower than the norm. Moreover, some clear resilience in UK wage growth has left markets a little less certain that the Bank of England will be able to cut its own interest rates in the next couple of months. Higher wages tend to feed through into headline inflation.

With this in mind, the week’s main scheduled trading cue on the GBP side of GBP/USD will be official UK Consumer Price Index data.

April figures are due to be released on Wednesday. The March headline rate of 3.2% was the lowest since 2021 and part of the clear deceleration trend seen since late 2022. A continuation of that trend will likely see Sterling fall back, as rate-cut expectations come forward again. Upside shocks will only mean further gains.

The rest of the week’s playing field will be dominated by US releases. There are plenty of superstar speakers, including Fed Chair Jerome Powell (on Sunday, unusually) and Treasury Secretary Janet Yellen. There’s some top-line data too, including durable goods orders and the University of Michigan’s time-tested look at consumer confidence.

If the week ends with interest-rate differential forecasts unchanged, then it could be another strong one for Sterling. However, on the basis that the UK trend toward weaker inflation continues, it’s a bearish forecast this week, if not necessarily a very bearish one.

GBP/USD Technical Analysis

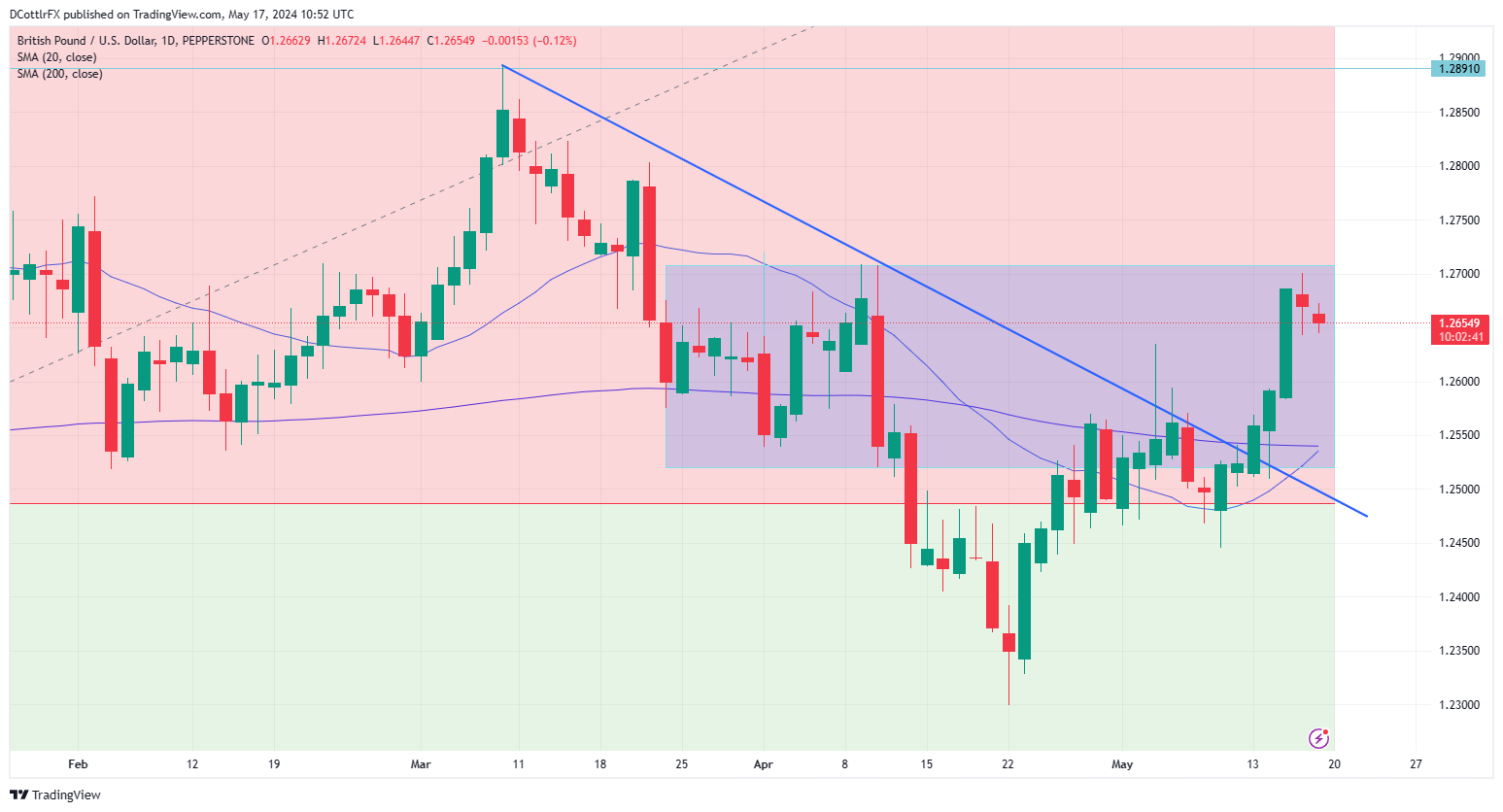

GBP/USD Daily Chart Compiled Using TradingView

GBP/USD’s surge has taken it above its 20- and 200-day moving averages, and well above the previous downtrend line from the peaks of March 8.

The pair is now back in the broad trading band last seen between March 21 and April 12, between 1.25913 and 1.27078.

Sterling bulls will have to work hard to consolidate their position above psychological support at 1.2600 as there’s little obvious nearby strong support above that at present. Retracement support at 1.24871 looks very solid though, as does support in the mid 1.25 region from earlier this month.

The latter looks likely to be tested soon if the market fails to consolidate closer to current levels.

IG’s own sentiment data finds traders unsurprisingly bearish about the Pound, but not overwhelmingly so, with 56% coming to the market from the short side. Likewise the Relative Strength Index finds Sterling overbought, but to a quite modest extent so far given recent gains.

If you’re puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls that can lead to costly errors.

Recommended by David Cottle

Traits of Successful Traders

–By David Cottle for DailyFX