In the fast-paced world of trading, everyone’s looking for that edge—the strategy that gives you a clear view of where the market is heading and helps you make smarter decisions.

Many traders rely on tried-and-true methods like moving average crossovers within the same timeframe, such as the 50-day and 200-day moving averages.

However, there’s a more nuanced technique you can leverage: combining different timeframes but covering the same period to measure market momentum with even greater precision.

Let’s break down why this works so effectively, how you can use this technique, and why integrating it with my F!72 10MA Multi-TimeFrame Indicator will supercharge your trading performance.

Why Use Different Timeframes for the Same Period? 🤔

Most traders focus on moving averages in a single timeframe, but there’s a lot to gain by thinking outside the box.

The idea here is use a weekly EMA8 and a daily EMA56 or SMA56 is that both cover the same number of days (56 days in total), but they react differently to price movements. Here’s why this can be powerful:

EMA8 Weekly: Since this is a short-term weekly exponential moving average, it smooths out some of the volatility by giving more weight to recent price action. It offers a medium-term view of the market, reacting to the most recent movements while still considering a reasonable time window of 8 weeks (or 56 days).

EMA56 Daily: This gives you a more responsive daily view of the same 56-day period. The daily chart reacts more quickly to price changes, especially in a volatile market, allowing you to catch short-term fluctuations while maintaining the broader context.

SMA56 Daily:

Being a simple moving average, it smooths out price data even further, making it less sensitive to day-to-day noise. This provides a stable reference point to compare against more dynamic averages like the EMA8 and EMA56.

How It All Comes Together: Understanding the Market’s True Momentum

The magic happens when you compare these different moving averages:

EMA8 (weekly) vs. EMA56 (daily):

If the EMA8 weekly is trending above the EMA56 daily, it’s a sign of consistent upward momentum across both short-term and medium-term perspectives. However, if the EMA8 crosses below the EMA56, it suggests that the market is starting to lose strength, potentially signaling a reversal or correction.

EMA8 (weekly) vs. SMA56 (daily):

Comparing the exponential weekly average to the simple daily average helps you identify sustained trends. The SMA is slower to react, so if the EMA8 weekly is trending above the SMA56 daily, it indicates recent upward pressure. But if the EMA8 drops below the SMA56, it might be a signal that the recent price action isn’t strong enough to sustain the uptrend.

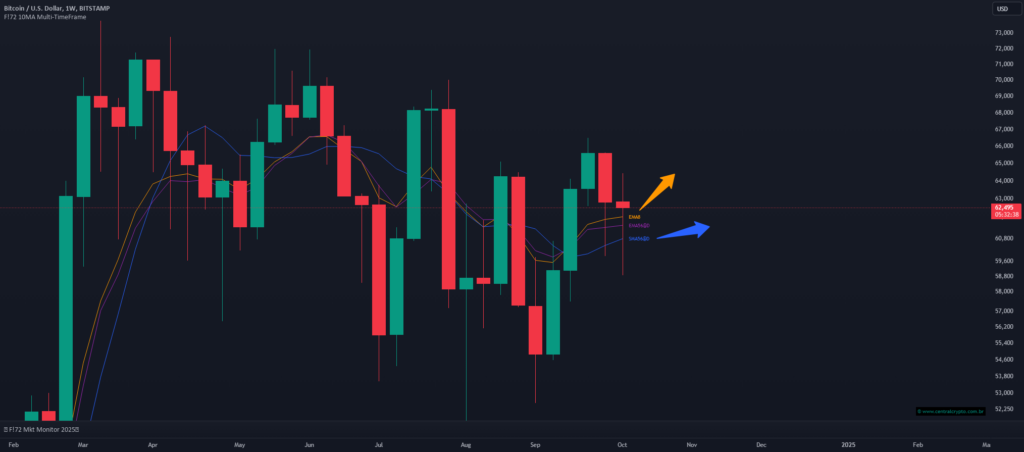

Real-World Example

Let’s say you’re analyzing Bitcoin, and you notice the following:

The EMA8 weekly is moving slightly below the EMA56 daily, indicating potential weakness in the broader trend.

At the same time, the EMA8 weekly is still above the SMA56 daily, meaning that while there is some short-term volatility, the longer-term bullish trend might still have legs.

This subtle interplay between the moving averages can provide valuable insights. Instead of waiting for a massive correction or reversal, you’re able to fine-tune your entries and exits based on these small shifts in momentum. Timing becomes everything, and this method helps you stay ahead of the curve.

Boost Your Analysis with the F!72 10MA Multi-TimeFrame Indicator 🧠

To make this technique easier and more accessible, I highly recommend integrating my F!72 10MA Multi-TimeFrame Indicator. Here’s why it will change your game:

Multi-Timeframe Analysis:

You can overlay multiple timeframes directly onto your chart, so you don’t have to switch back and forth between charts to compare trends.

Customizable Periods:

Adjust the moving average settings (like EMA8, EMA56, and SMA56) directly within the indicator, tailoring it to fit your unique strategy.

Clearer Trends:

The indicator helps you visualize crossovers and divergences in real-time, giving you a clearer picture of whether momentum is shifting up or down.

Multiple Applications:

Whether you’re day trading, swing trading, or managing long-term investments, this tool adapts to any trading style and enhances the effectiveness of multi-timeframe analysis.

A New Way to See the Market

The strategy of comparing EMA8 weekly with EMA56 daily and SMA56 daily gives traders a powerful new lens through which to understand the true strength of trends. While most strategies rely on same-timeframe crossovers, this method takes it a step further by integrating different resolutions of the same period, allowing you to see subtle shifts in momentum before the broader market notices them.

Ready to elevate your trading? Combine this unique technique with the F!72 10MA Multi-TimeFrame Indicator for better entries, smarter exits, and an edge over the competition. Let the markets know who’s boss!

Try it out here: F!72 10MA Multi-TimeFrame Indicator

Happy trading, and may your charts be ever in your favor!