The crypto market had another bumpy week, which ended with a positive sentiment. The week started by the stronger push of BTC toward the downside, where the coin was testing

The US inflation data for September was published during the previous week. Inflation on a monthly basis was higher by 0,2%, a bit hotter from market estimate of 0,1%. Inflation

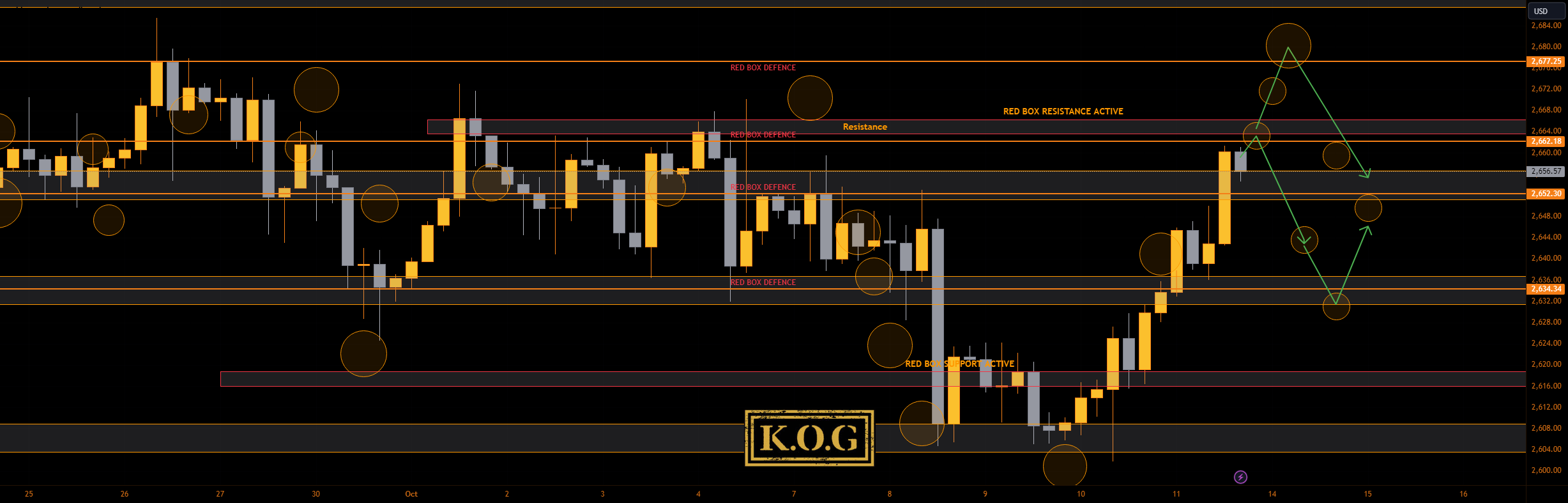

THE KOG REPORT:In last week’s KOG Report we said we would be looking for price to push up and look for a reaction above, this came earlier than expected but

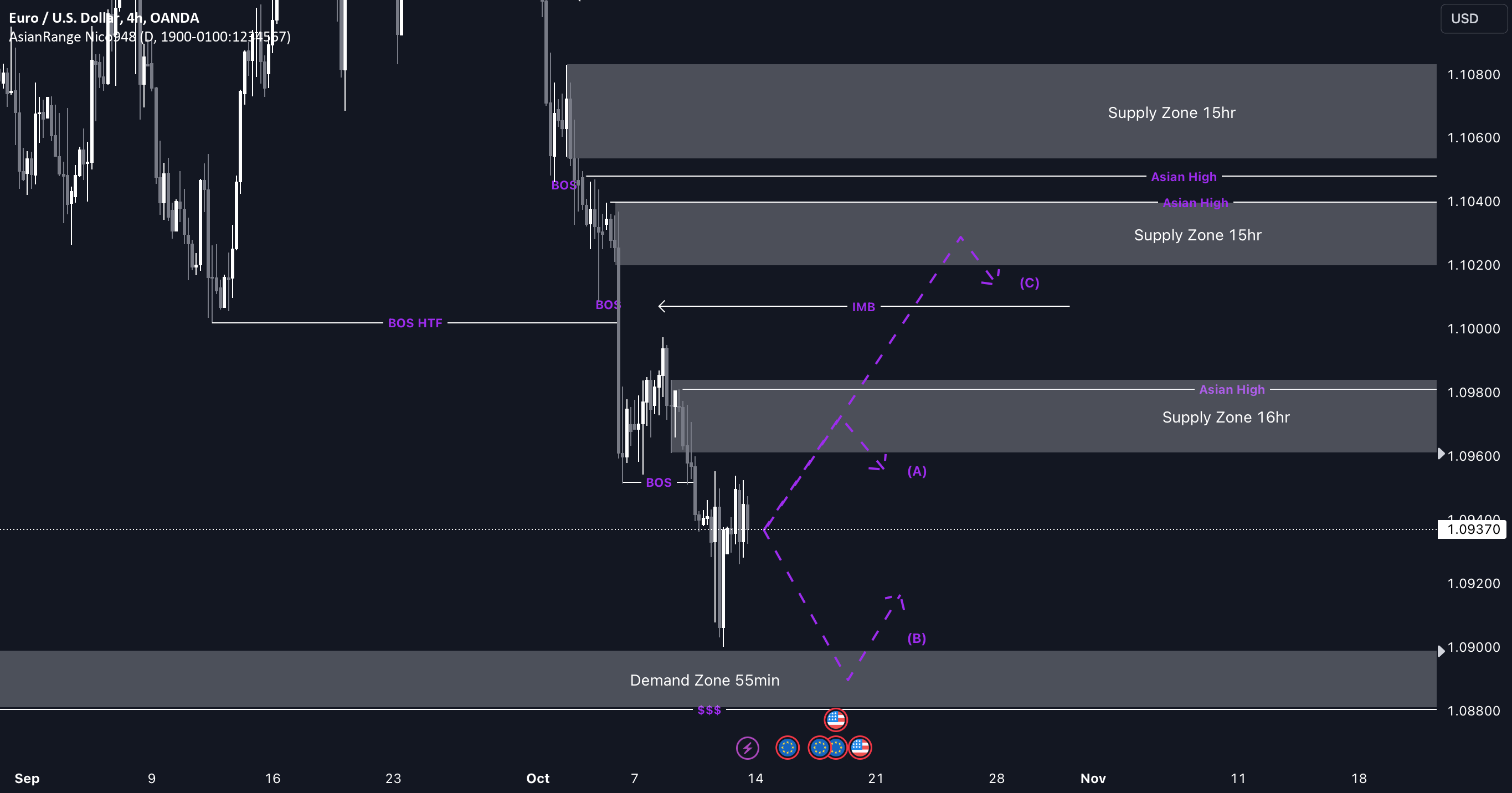

The US inflation figures were the ones that the markets were awaiting to see during the previous week, in order to position accordingly. As the inflation was much in line

The inflation data were the ones that the market was watching closely during the previous week. The September inflation came just a bit higher from the market estimate. While core

Analysis of YM1!.This count sees price in wave ((5)) of (v), with wave (v) starting at October 2022 low.From 5 August 2024 low, count in red is less bullish, count

Hello, traders.If you "Follow", you can always get new information quickly.Please click "Boost" as well.Have a nice day today.-------------------------------------Since this is a chart for trading, there is nothing to analyze.However,

This week’s EUR/USD (EU) outlook is quite similar to my GU analysis, with the market continuing its bearish trend. I’ll be waiting for price to retrace back to the 16-hour

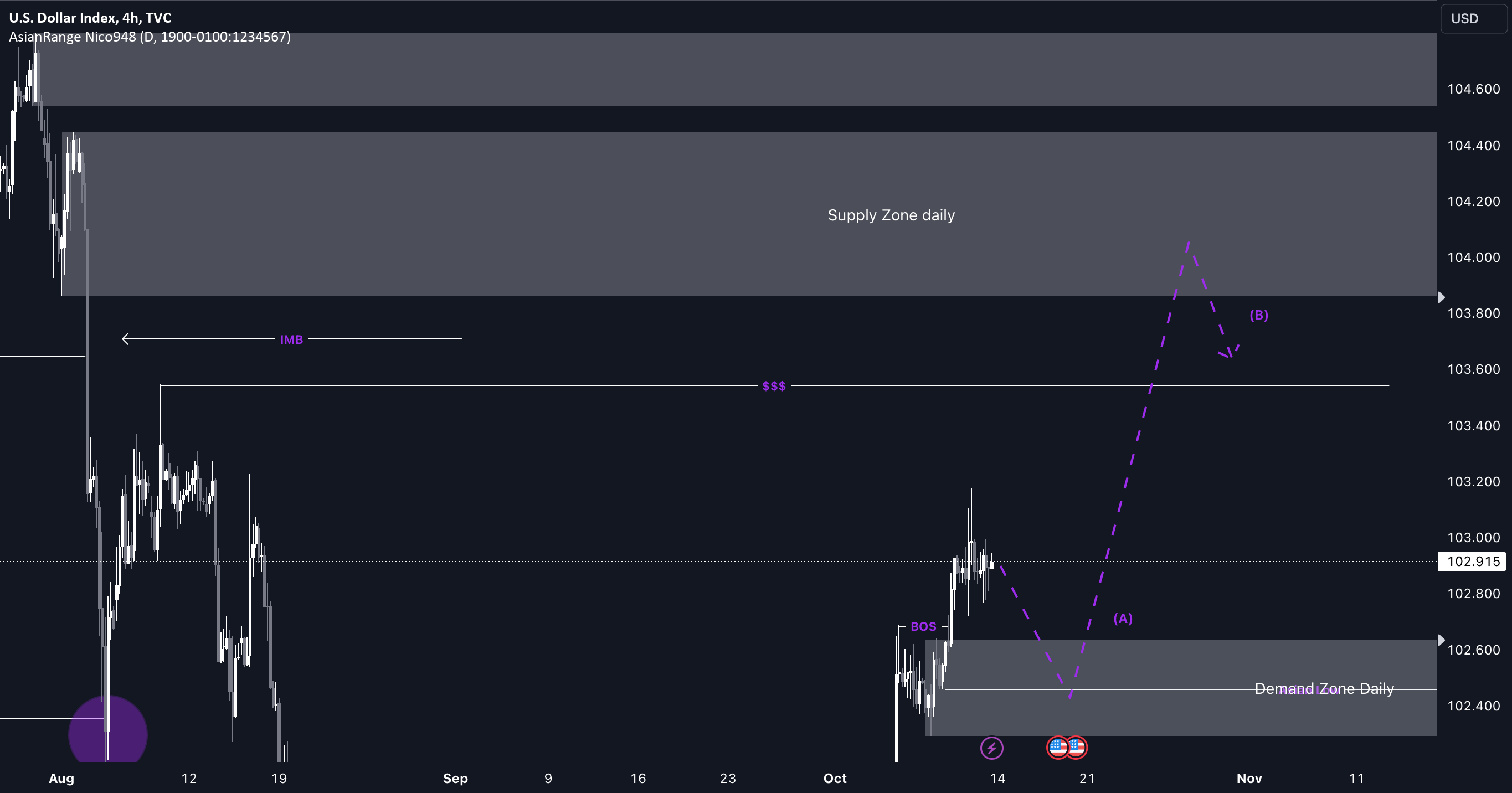

Once price mitigates and retests the daily demand zone I’ve marked out, I’ll be looking for the dollar (DXY) to trigger another bullish move within this point of interest (POI),

BTCUSD- Time to Sell!If we look at the chart, we can see how the price traded within the resistance area, but then reversed and fell to the support level, breaking