EUR/USD and GBP/USD Rallies Fuelled by Ongoing US Dollar WeaknessEUR/USD and GBP/USD LatestThe US dollar is sliding lower as US rate cuts nearEUR/USD and GBP/USD post multi-month highs Recommended by

SPY trade idea 5:1 ratioShort = 565Stop = 570Profit = 540(SPY) S&P 500 index rapidly dropped in a week, then bounced in a V shape recovery for 2 weeks, now

Current Price: 190.400Outlook: BearishReasons:- The pair has broken below the key support level of 191.000, indicating a potential downtrend.- The Relative Strength Index (RSI) is below 50, suggesting bearish momentum.-

IOUSDT.P is currently trading at $1.723, and the technical indicators suggest a bullish trend may be forming. The Relative Strength Index (RSI) is approaching the 60 level, indicating increasing buying

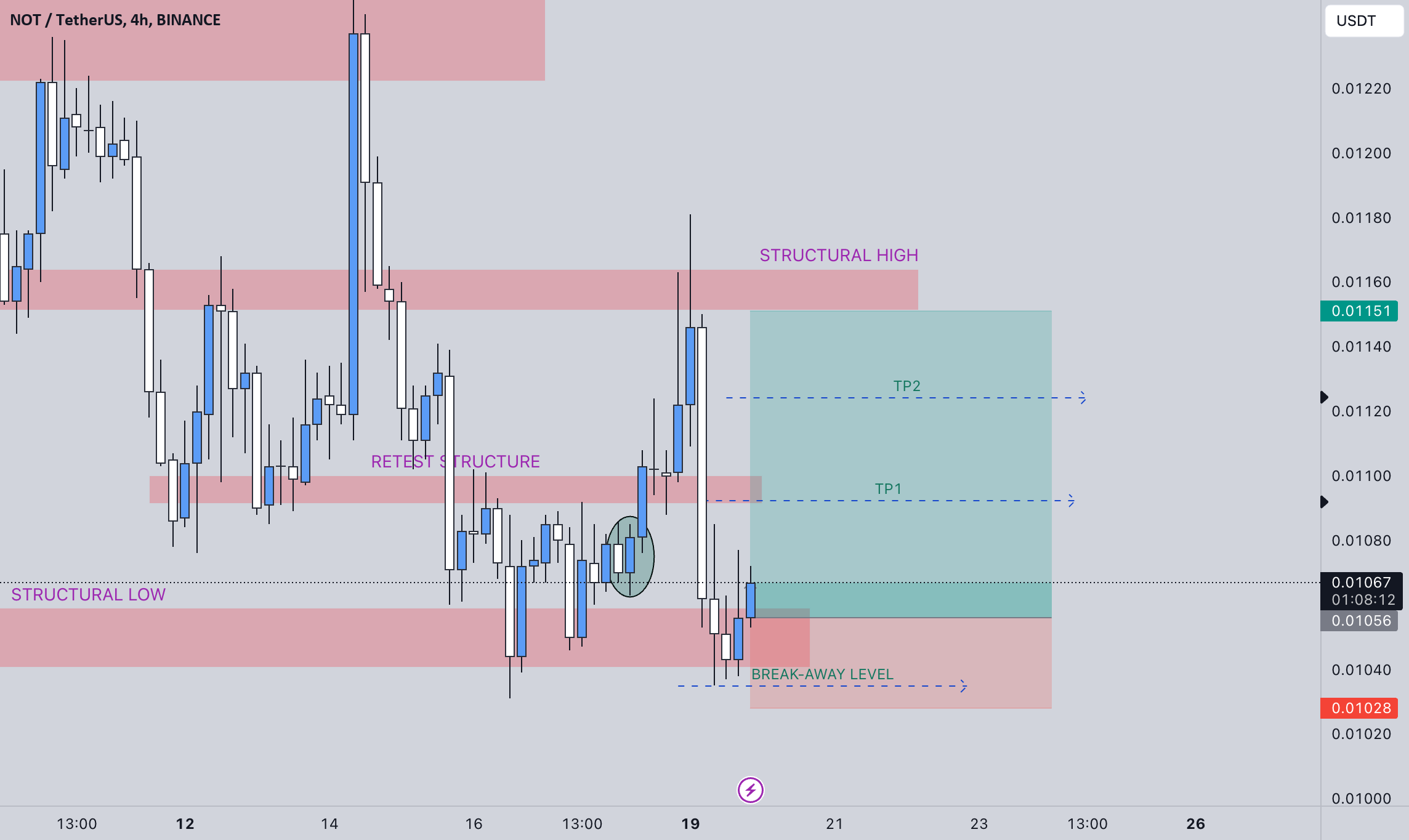

#NOTUSDT Analysis: The NOTUSDT pair is showing strong bullish momentum as the price steadily climbs towards the $0.01152 region. This move is supported by a clear buy bias, particularly evident

US Dollar (DXY), USD/JPY, and Gold LatestUS dollar weakens further ahead of key Fed chair speechUSD/JPY looks technically weakGold consolidating Friday’s record high.This year’s Jackson Hole Symposium – “Reassessing the

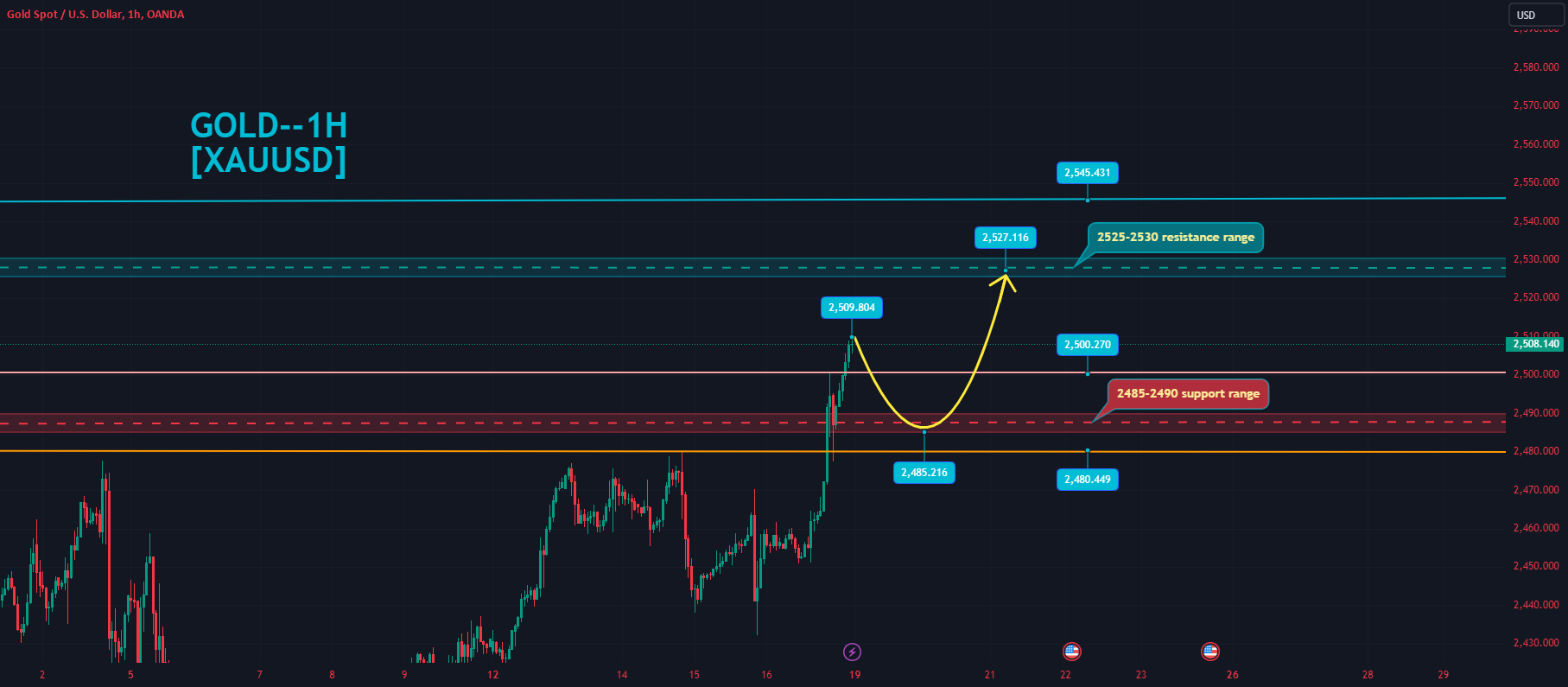

Hello traders and investors!I reviewed the assets and highlighted silver as an interesting opportunity for trades next week. For example, in gold, on the daily timeframe, the price has broken

Solana has trading sideways for the past week, the 7 days high is 151.60 and the low is 136.78. this sideways movement has made the pairs future uncertain therefore creating

Gold Trading Strategies Reference Strategy 1: Go Sell when gold rebounds to around 2525-2528, stop loss 6 points, target around 2510-2500, break the position and look at the 2490 line Strategy

The upcoming Jackson Hole symposium, scheduled for August 22-24, is expected to be a significant event for financial markets. Hosted by the Federal Reserve Bank of Kansas City, the gathering