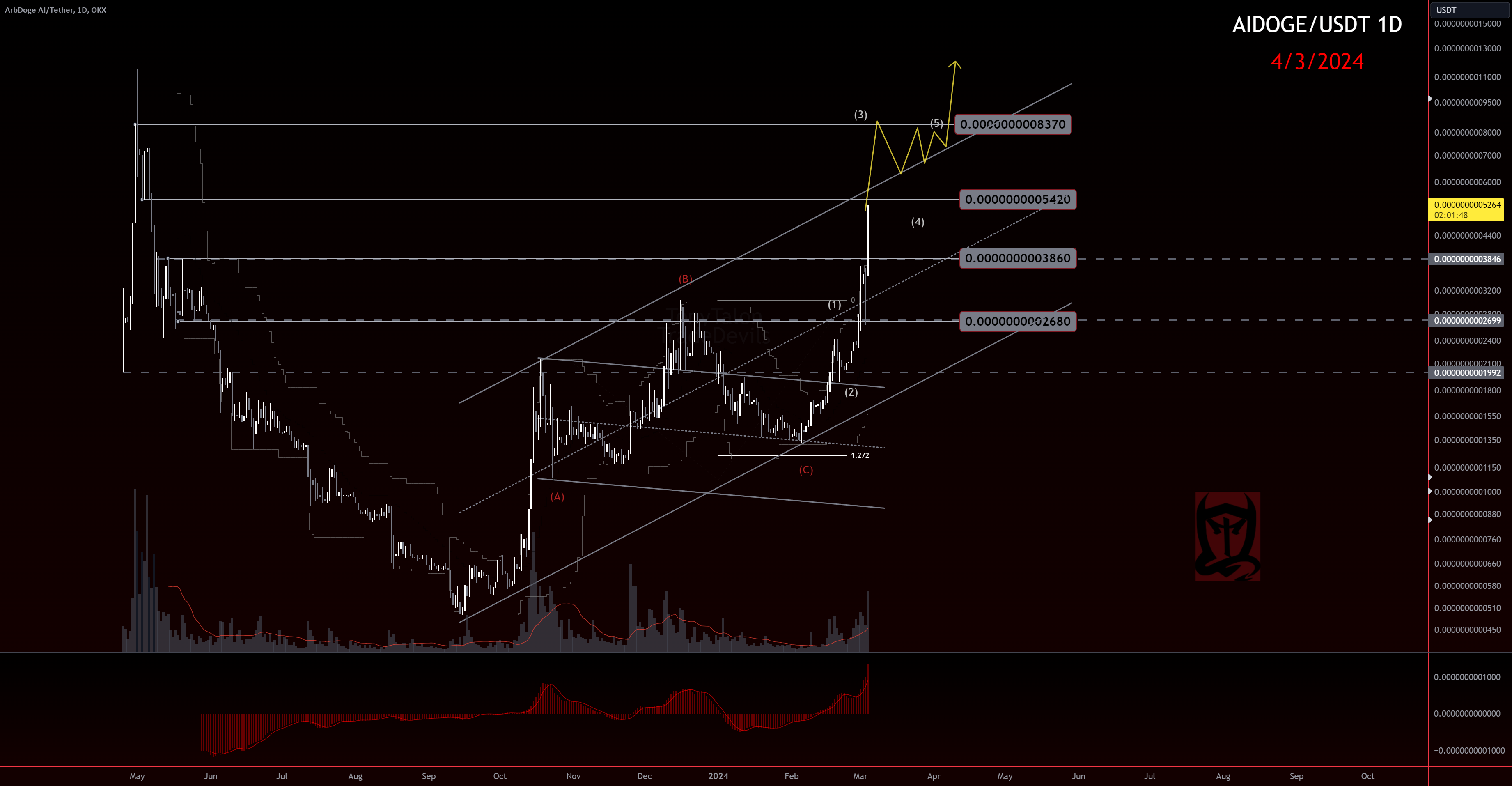

If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment! Well I got in, but the waves are not super

OPEC+ producers extend oil output cuts to second quarter

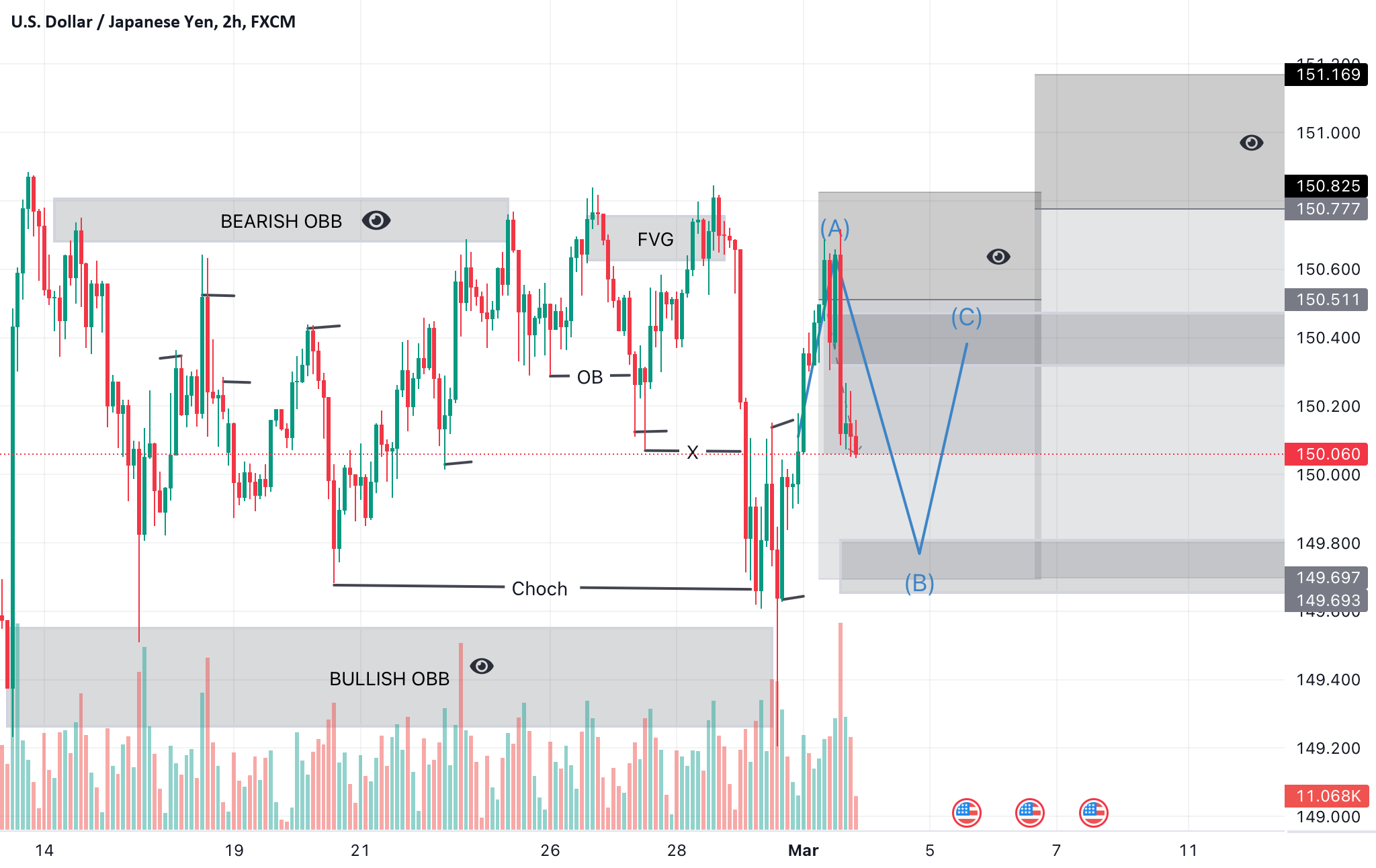

Hey there USDJPY has been extended on Friday From 150.700 to recovery and has gone downside for previous orders and go down continue We now seems of Fibonacci retrace from

Brazil's economy up 2.9% in 2023 but stagnates in Q4

Welspun India Ltd. (WIL) a Welspun Group company, started its activities in 1985 as Welspun Winilon Silk Mills Pvt. Ltd, a synthetic yarn business which went on to become Welspun

Oil prices choppy amid Gaza ceasefire talks, OPEC+ supply cut decision

The upcoming week brings a flurry of central bank activity and high-impact economic data, setting the stage for potential volatility in financial markets.

Gold prices steady near 2-mth high before Fed, data-heavy week

Last Friday’s sharp rally sent gold back to levels not seen since early-December. With little in the way of technical resistance ahead of last year’s spike high, will gold continue

Oil steadies after OPEC+ extends output cuts as expected