Oil prices settle higher as US crude supplies rise less than expected

CVX is very bullish in our view. A large diametric is finished. CVX is expected to pump more soon. Note that the wave that CVX is in now is very

Gold prices rangebound as Fed reiterates higher-for-longer rates

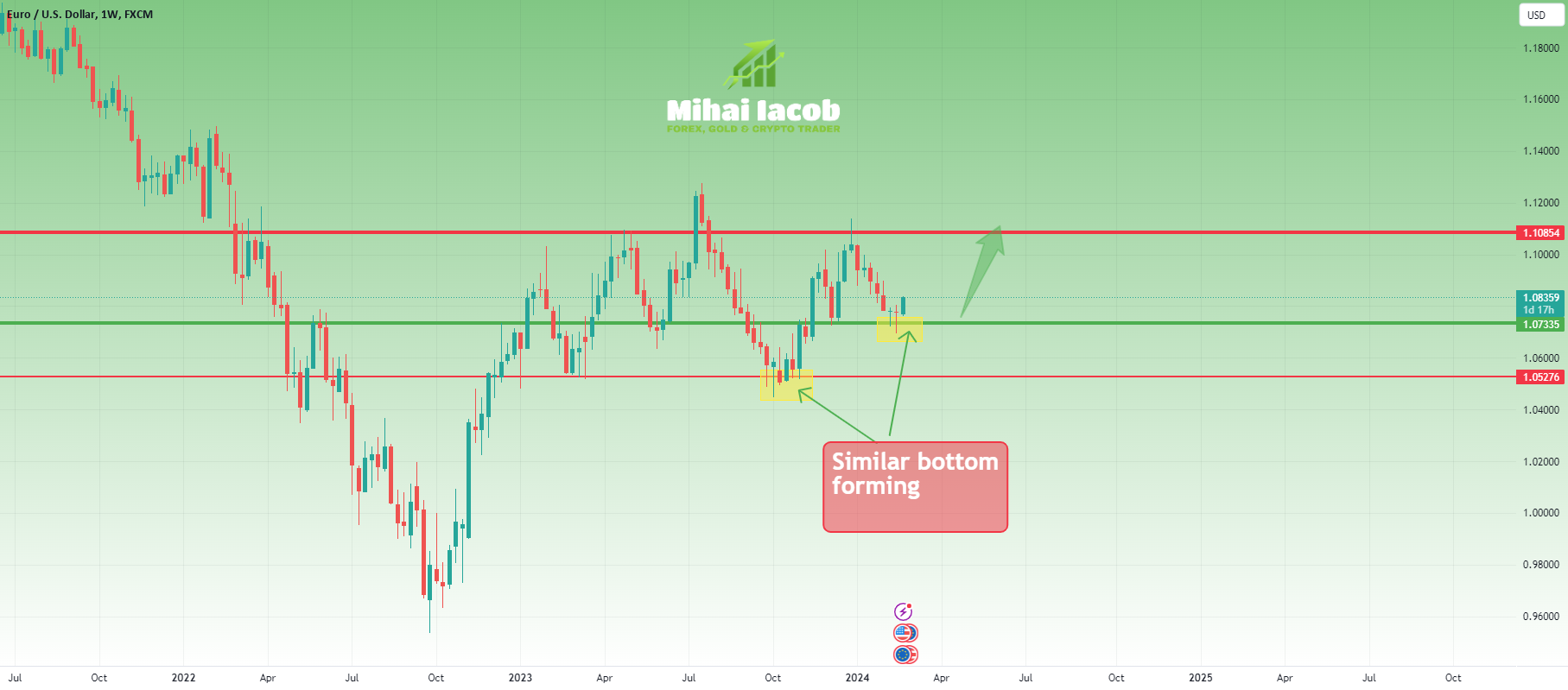

Two days ago, in a short-term analysis of FX:EURUSD, I mentioned that the 1.0790-1.0800 zone is pivotal for a potential reversal in the currency pair. The pair did break above

Oil rises on shipping tensions but US inventory build caps gains

The Fed minutes showed that most officials are wary of cutting interest rates quickly and want to see additional evidence of persistent disinflation before pulling the trigger. This policy stance

Swedish January inflation up as expected, rate cut set for mid-year

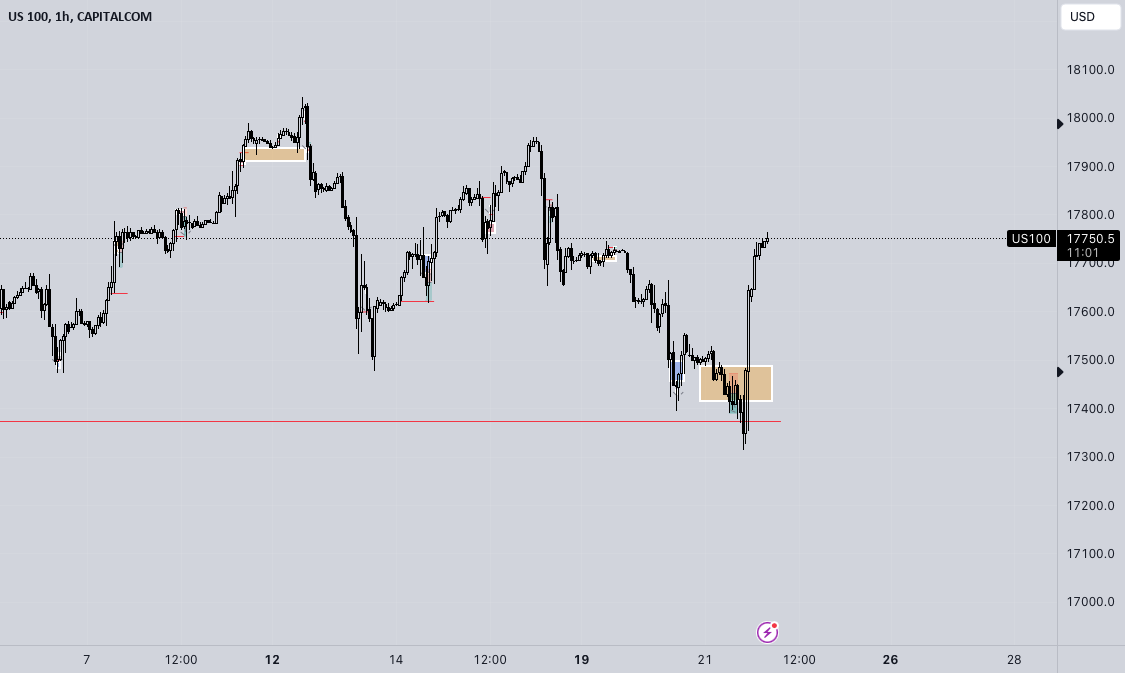

Patience played out for all of you guys who've taken the time to LET THE MARKET COME TO YOU. Trade moved like clockwork. For those onboard I would make sure

US farmers face harsh economics with record corn supplies in silos

Summary of Gold Analysis: 1) The decision is to sell within the plotted box. 2) In this zone, there's confluence with the trendline support turning into resistance. 3) The Awesome