The Federal Reserve kept interest rates unchanged for the fourth consecutive meeting, but adopted a slightly more dovish outlook by removing its tightening bias from the monetary policy statement.

Canada's economy likely grew in December, avoiding recession

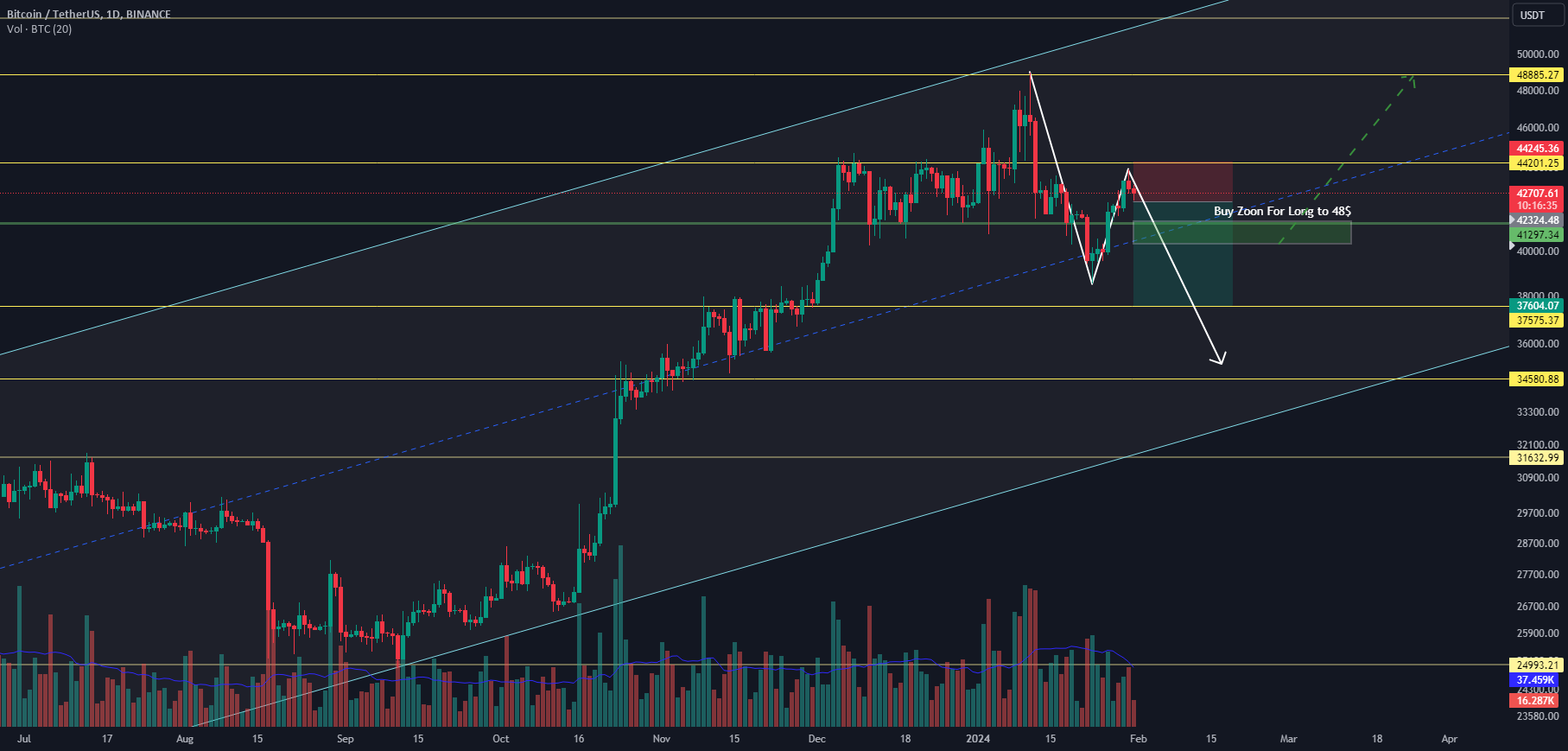

We are waiting for the monthly candle close to determine the direction of the next month. We are still in the same bearish outlook currently, but a strong price action

Oil prices drop 2% on false rumors of Middle East ceasefire

EUR/USD is testing crucial levels ahead of today's FOMC statement, having previously exhibited weakness. It has been moving slowly downwards inside of its descending channel. Despite rebounding from support at

Exclusive-LME targets Hong Kong as option for warehouse expansion

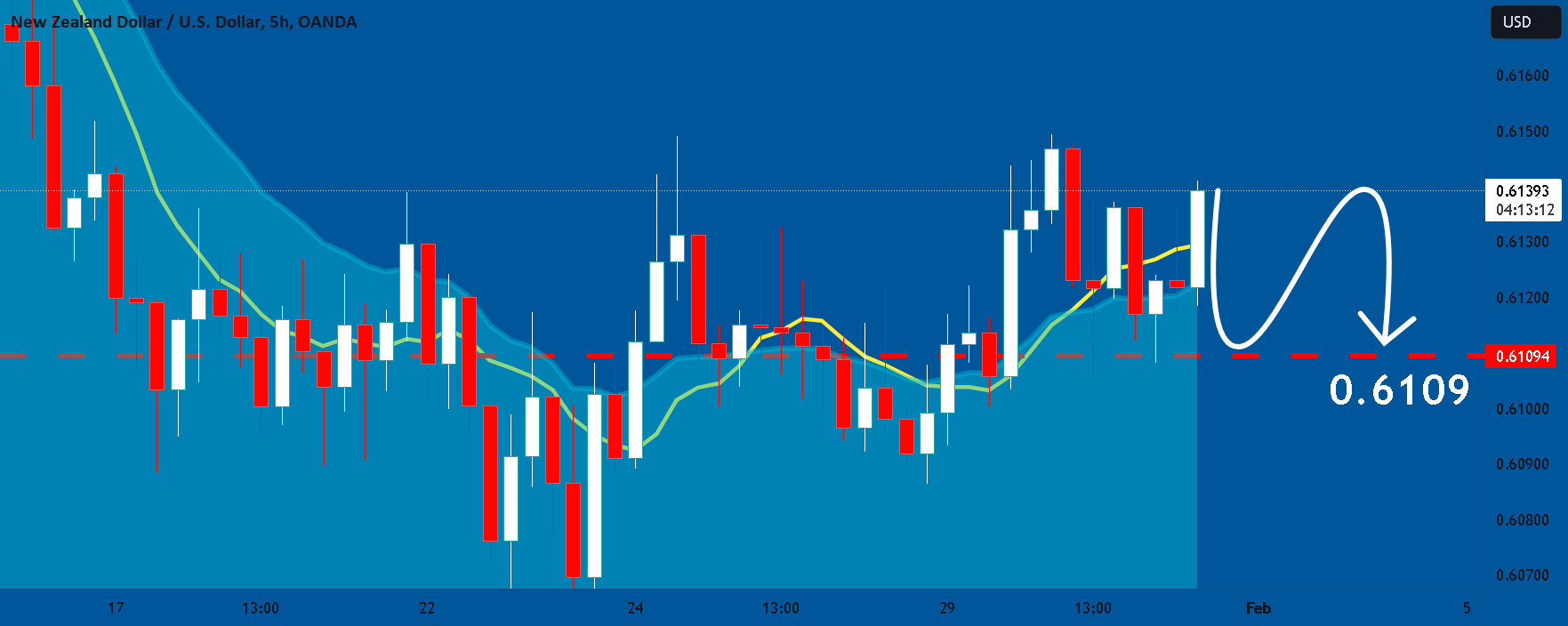

https://www.tradingview.com/x/tkgFPyek/ It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current NZDUSD chart which, if analyzed

Chevron reroutes Kazakh oil to Asia around Africa - sources, LSEG data

Price is exactly closed at trendline resistance... which is also a strong resistance... I am sharing the important levels of Support and Resistance. These levels plays a crucial role in

Gaza's economy could take decades to recover, UN trade body says