UK services activity continues to pick up, according to the latest S&P Global PMIs, and that is giving Sterling a boost in the FX market

Gold prices skittish before GDP data; copper upbeat on China stimulus

The U.S. dollar, as measured by the DXY index, traded lower on Wednesday despite better-than-forecast PMI results. U.S. GDP and PCE data will steal the limelight over the next two

Oil jumps, settles up 3% on strong US economy, Red Sea tensions

#GOLD... market hold your yesterday supporting area that was mentioned in my last idea, that was 2017 18 arround as you can check my last idea, now upside area was

U.S. economy grew by 3.3% in fourth quarter

In time H4, as mentioned in the previous post, if it is not able to break the range of $100, it will correct to the range of $81. Therefore, at

US economy shrugs off recession prediction with strong fourth-quarter performance

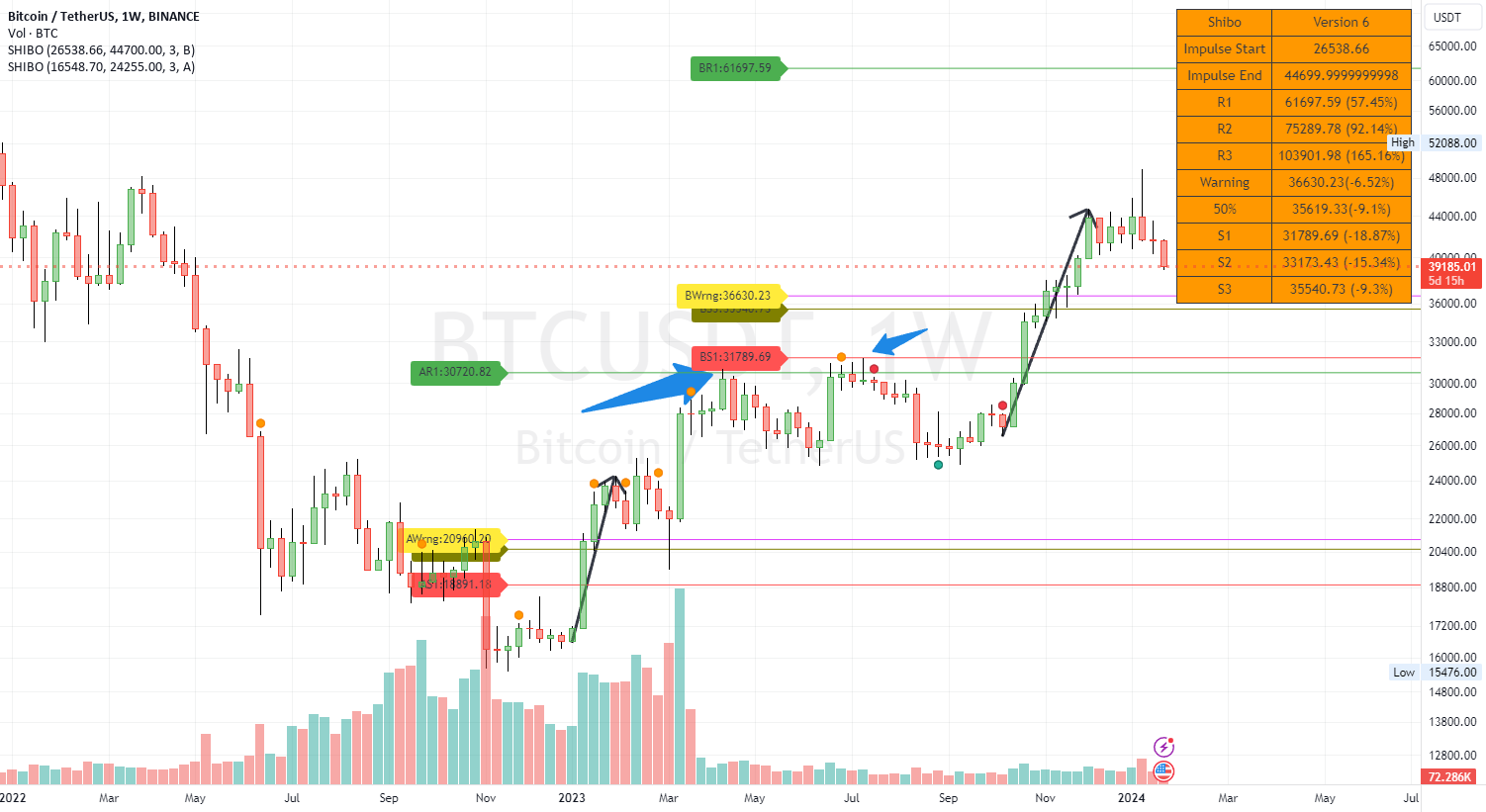

Hi everyone, If you've followed my ideas, you're probably familiar with the SHIBO indicator that predicts price after an impulse. In this weekly chart, I used two SHIBO indicators on

Marketmind: Tesla pothole as ECB and GDP awaited