Citi lowers Brent price outlook for 2024 and 2025 on oversupply fears

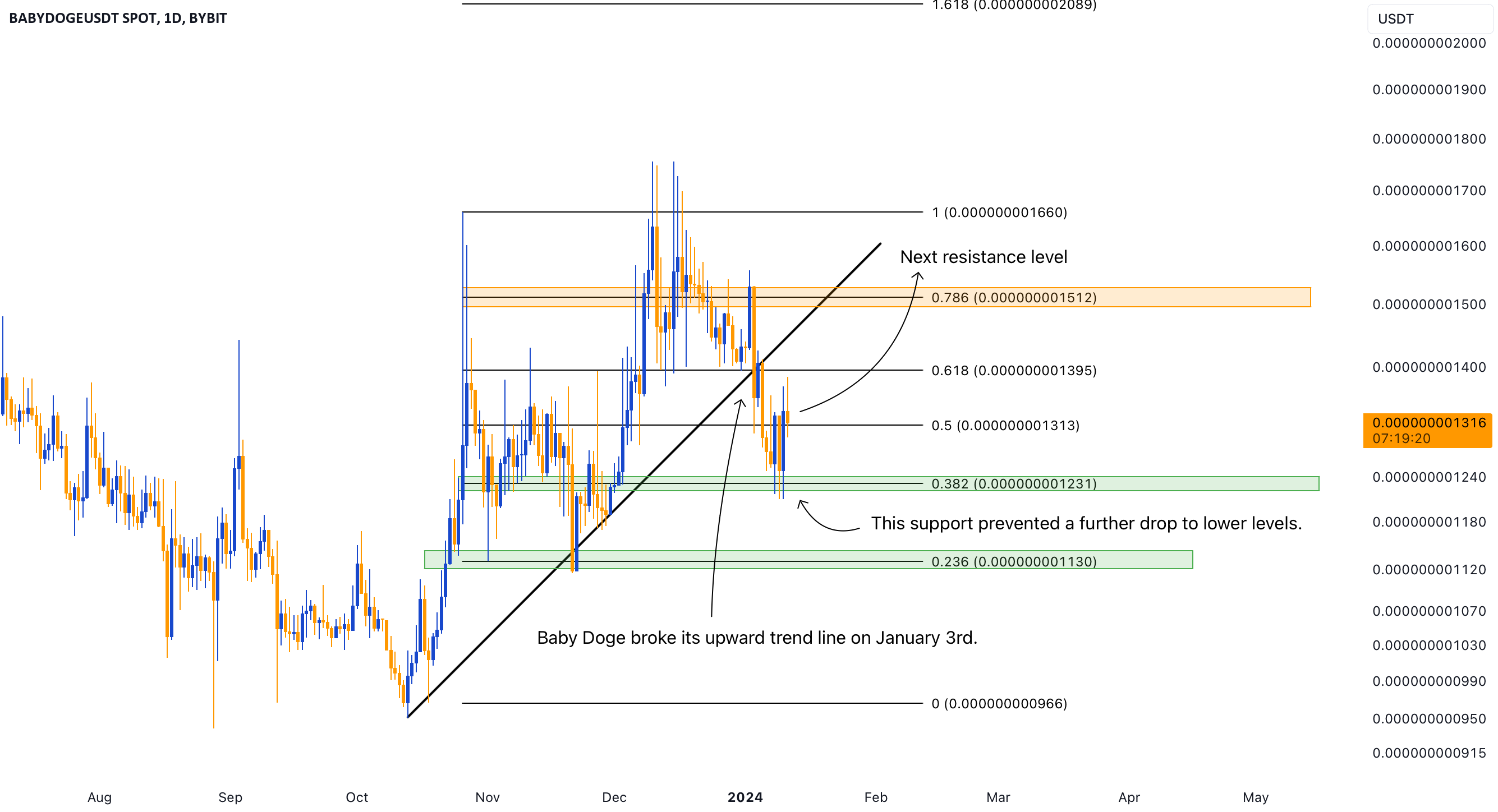

In the daily timeframe, Baby Doge, having broken its upward trend line on January 3rd, reached the 0.382 Fibonacci zone's support area, where the support prevented the price from descending

Marketmind: Crude shrugs at Yemen strikes, banks report

Oil prices are higher going into the weekend after US/UK attacks on Houthi rebel targets in Yemen spark fears of retaliatory action.

LME copper prices seesaw amid US dollar strength and China policy watch

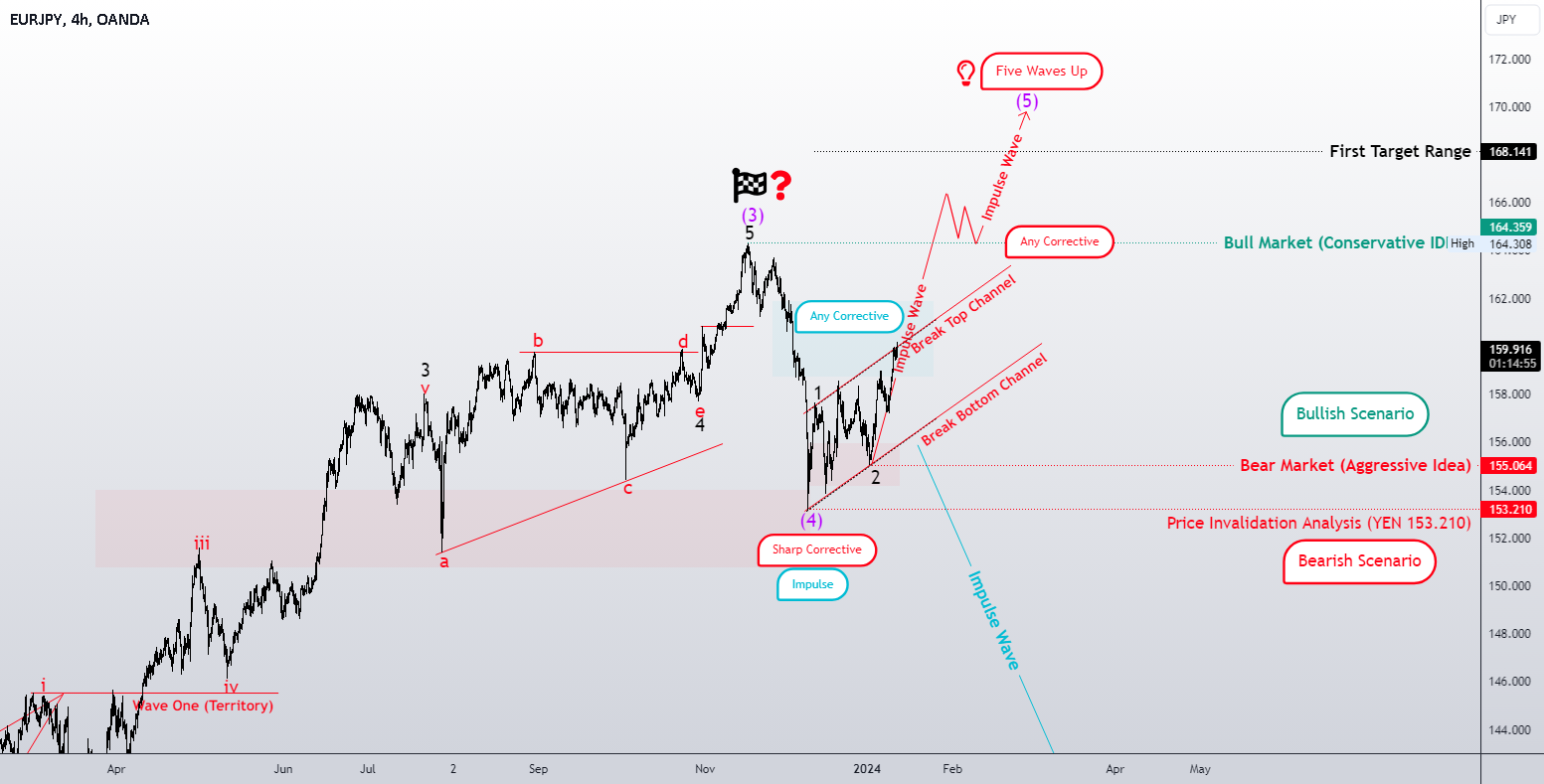

The CPI print which came out in green numbers boosted all USD pairs but over the last few hours prices have retraced. Now it looks as if the USD may

China CPI picks up slightly in Dec, but disinflation remains in play

Dear FRIEND, I hope you're doing well and that the new year has started on a good note for you. I wish you success in your business endeavors and a

China’s trade balance grows more than expected in Dec as exports improve

Escalating tensions in Yemen have boosted gold’s allure going into the weekend and with short-dated US Treasury yields falling further, XAU/USD may have more room to run.