US manufacturing mired in weakness, economy heading for slowdown

The Euro has sold off against a range of other currencies this week as expectations of an ECB rate cut grow and bond yields slump.

India's construction sector levels up as housing demand spurs economy

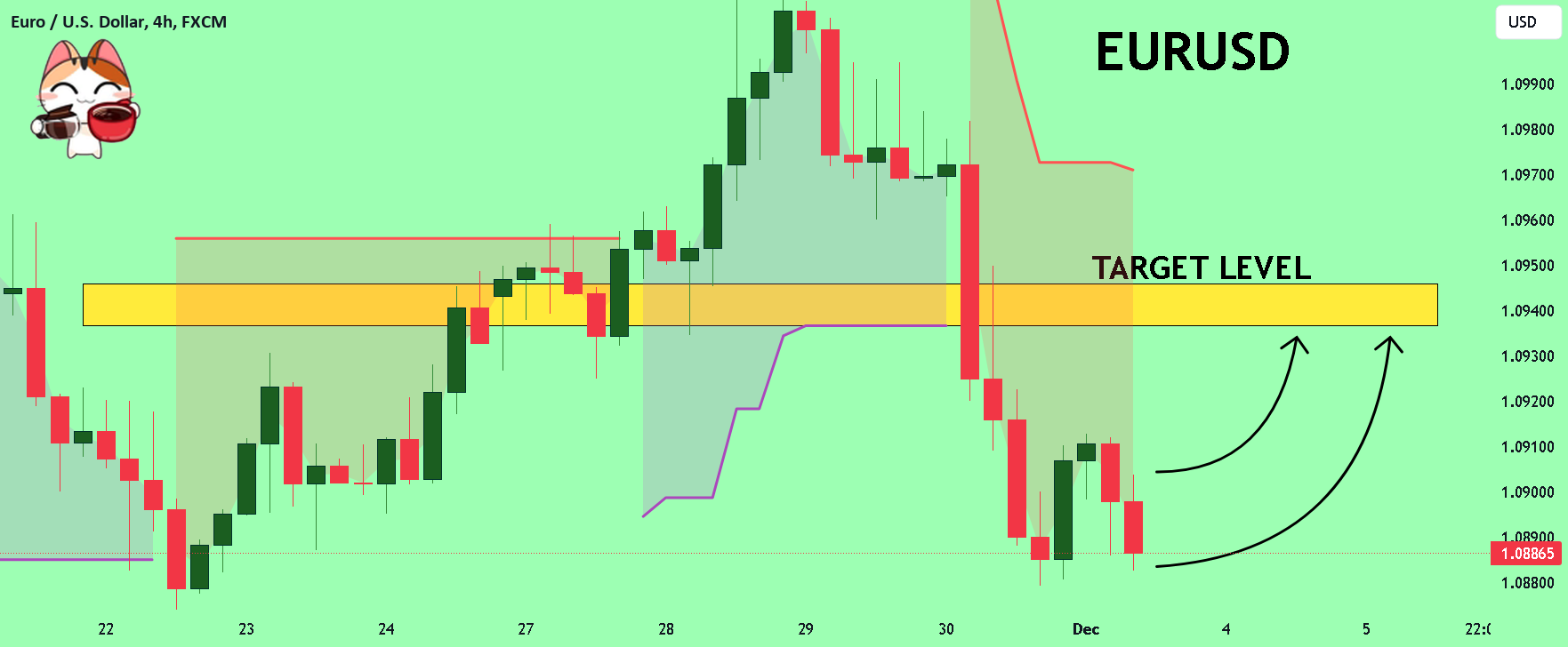

https://www.tradingview.com/x/jKc2f4Le/ My dear followers, I analysed this chart on EURUSD and concluded the following: The market is trading on 1.0888 pivot level. Bias - Bullish Technical Indicators: Both Super Trend

EU nuclear agency sees some Russia imports up again in 2023 from before Ukraine war

There are many different variations of patterns showing. And they are all leading to downside. We have small Rounding Tops, small Inverse Cup and Handles. We have a break in

US imposes fresh sanctions over shipment of Russian oil above price cap

US PCE data continued the recent trend of softening data from the US. The PCE print is likely to add to expectations for rate cuts in 2024 heading into the

Oil prices in 6th weekly side as bears sharpen claws after OPEC+ cuts fall short

The Japanese Yen has been strengthened by expectations that the Bank of Japan could tighten its ultra-loose monetary policy. However, these may have been premature