Market consensus is heavily skewed towards rates remaining unchanged but the consequences of aggressive rate hikes emerge via spending, housing and economic data

Sri Lanka's consumer prices falls 0.2% m/m in October - statistics dept

Oil prices attempted a recovery today and was up around 2%. The 100-day MA is proving a stumbling block at present but can it inpsire another bullish run?

Morgan Stanley, UBS lead in oil and gas, power sector M&A advising

https://www.tradingview.com/x/tmMj9dKM/ Oil reached a minimum of 80.7. Because of the rapid decline, there will definitely be a certain rebound, so today we observe yesterday's high of 83.3 and the important

Pakistan hikes gas prices ahead of IMF's $3 billion loan review

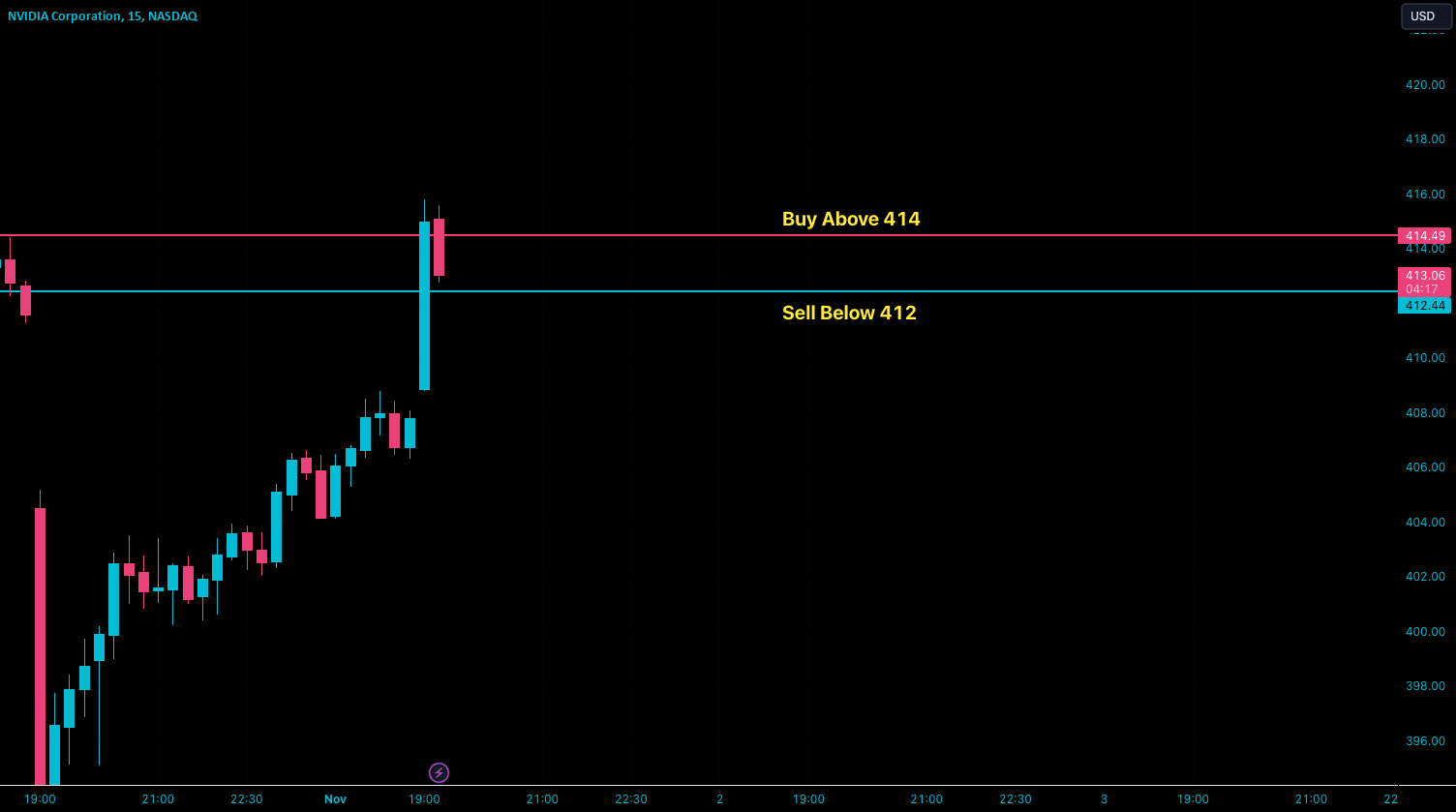

🟢 Buy Above - 414 🟢 Sell Below - 412 Levels Works Best on 5 Minutes Time Frame ️️ MARKET SECRET ️️ 1. Trade What You See & Not What

Oil down 2nd day in row, poised for huge October loss

The Fed held interest rates steady for the second straight meeting, but retained a tightening bias, signaling that future actions will be guided by financial conditions and the trajectory of

Portugal's October inflation slows down sharply to 2.1% yr/yr