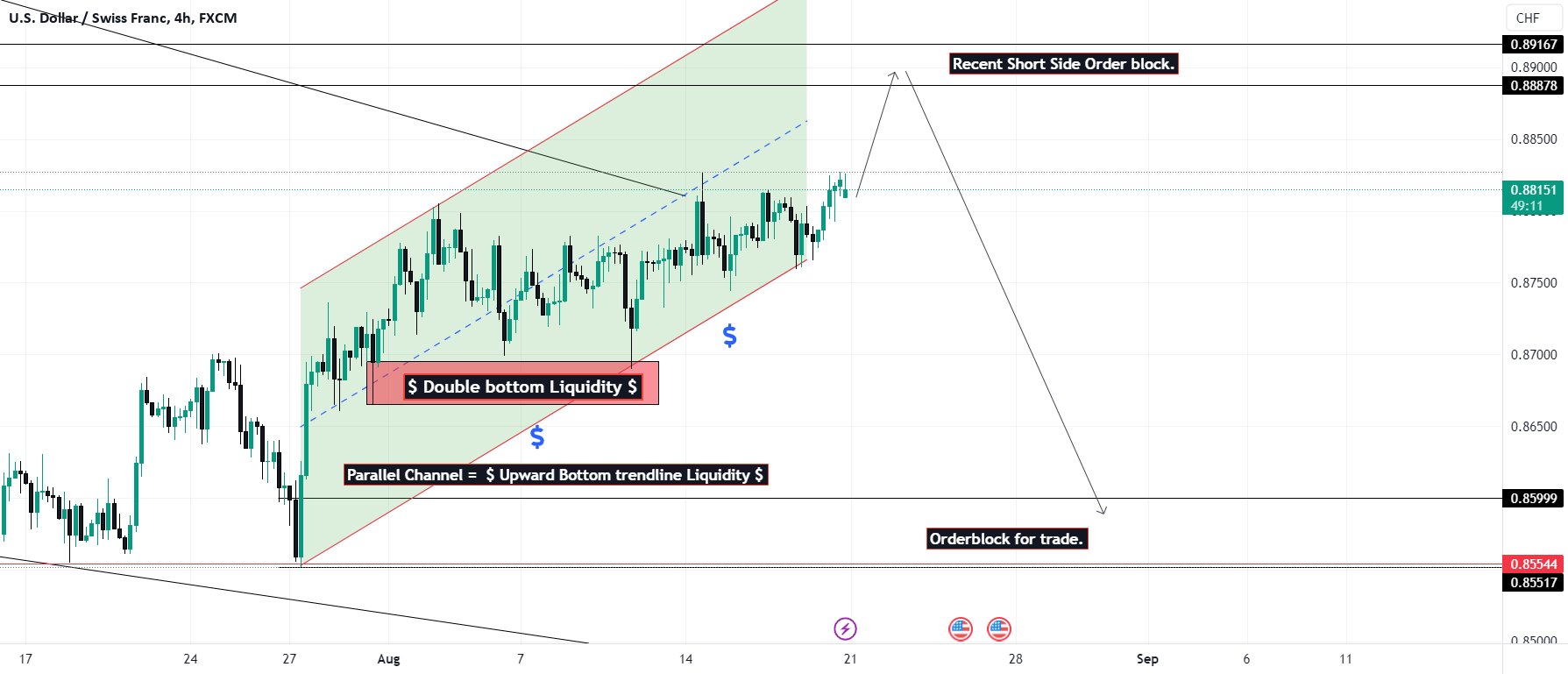

Educational Analysis says USDCHF trade set up according to my technical. This is not an entry signal. I have no concerns with your profit and loss from this analysis. Why

EUR/USD and EUR/GBP Forecast - Prices, Charts, and Analysis Recommended by Nick Cawley How to Trade EUR/USD The Euro remains on the back foot after Wednesday’s anemic PMIs showed the

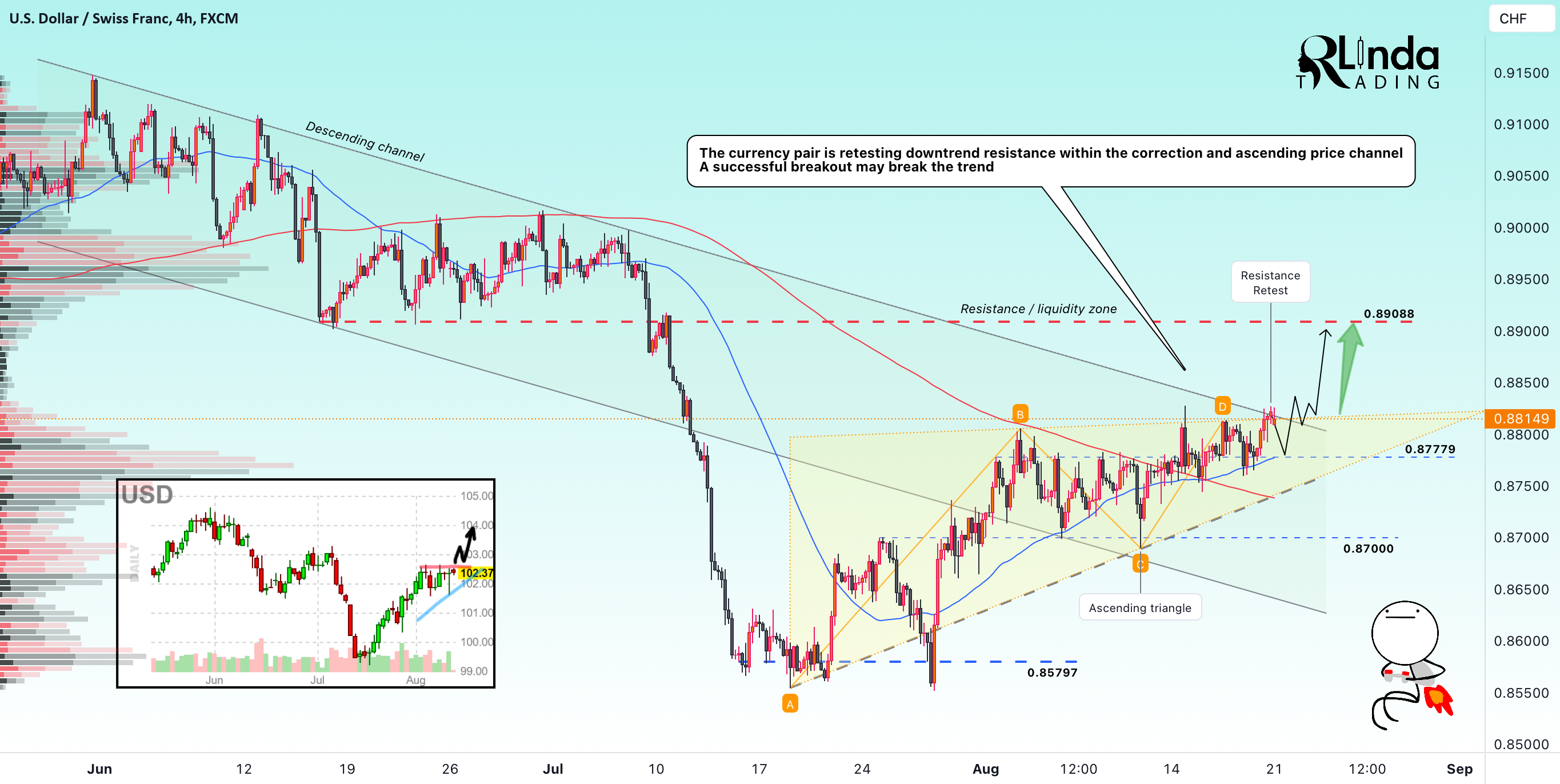

This pair is currently locked within a long-term range on the Monthly charts, spanning from 0.82 to 0.92. Our current path is leading us downwards, inching closer to the lower

Gold, XAU/USD, Silver, XAG/USD – Price Action & Outlook:XAU/USD is attempting to break below a vital support.XAG/USD is nearing quite a strong cushion.What is the outlook and what are the

Market RecapThe value-growth divide since the start of the month continued to play out last Friday, as market participants pare their exposure in US big tech and semiconductors, while value

Australian Dollar Forecast: NeutralThe Australian Dollar has been crushed by a bullish US Dollar outlookTreasury yields climbed through last week with investors dumping the risk-free assetThe Aussie is testing bigger-picture

We are likely still in Minor wave 4 moving upward. It was originally forecasted to last 7 to 10 to 13 hours. The 7th hour will be the first hour

USDCHF continues to strengthen within the ascending triangle. The price is retesting the trend resistance. What can happen? As we can see on the chart on the bottom left, the

Japanese Yen (USD/JPY, EUR/JPY) AnalysisIndicator of broader price pressures reach record highsIG client sentiment hints at bullish extensionEUR/JPY breakdown scenario may receive a boost from dovish leaning ECBThe analysis in

Euro (EUR/USD, EUR/JPY) ForecastBearish EUR/USD: US treasury yields bolster USD, aided further by strong economic dataBearish EUR/JPY: Elevated Japanese inflation and Evergrande’s bankruptcy protection application favour the safe-haven yenRisk events: