EUR/USD ANALYSIS & TALKING POINTS

- Bullish conviction on EUR/USD is waning as US influences dictate market appetite.

- US PPI, Fed and ECB speak will dominate the calendar today.

- Will the ascending channel break hold?

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

Yesterday’s gains for the euro has been pared back this morning as the USD recovers. Despite US CPI falling in line with expectations and advocating for almost 3 rate cuts by year end (money market pricing), risk sentiment is souring due to the lack of confidence in US debt ceiling talks. The safe haven appeal of the US dollar has thus garnered support against the EUR and could provide a floor for EUR/USD until such time as a decision materializes.

The eurozone looks to further European Central Bank (ECB) officials today in what is a light economic calendar for the region. Expect more hawkish commentary particularly from the ECB’s Schnabel; however, as we saw yesterday, there was no real follow through from ECB guidance. The European session has already kicked off with the ECB’s Nagel citing sticky inflation and the need for higher for longer rates – but has not translated once again.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Chinese CPI and PPI data missed forecasts during the Asian session and has since dampened risk sentiment. Concerns around China’s economic growth and local demand has weighed on the euro thus exacerbating risk aversion from the US debt ceiling subject.

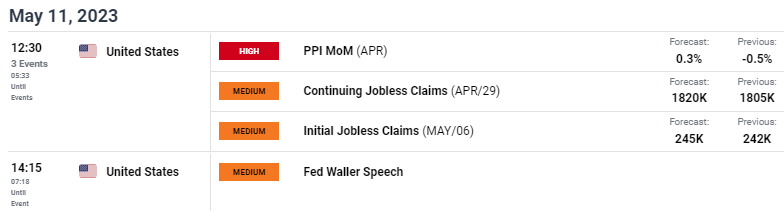

Later today (see economic calendar below), US PPI alongside jobless claims data will come into focus followed by FOMC members Waller and Kashkari.

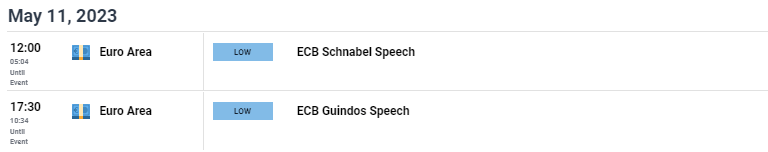

EUR/USD ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

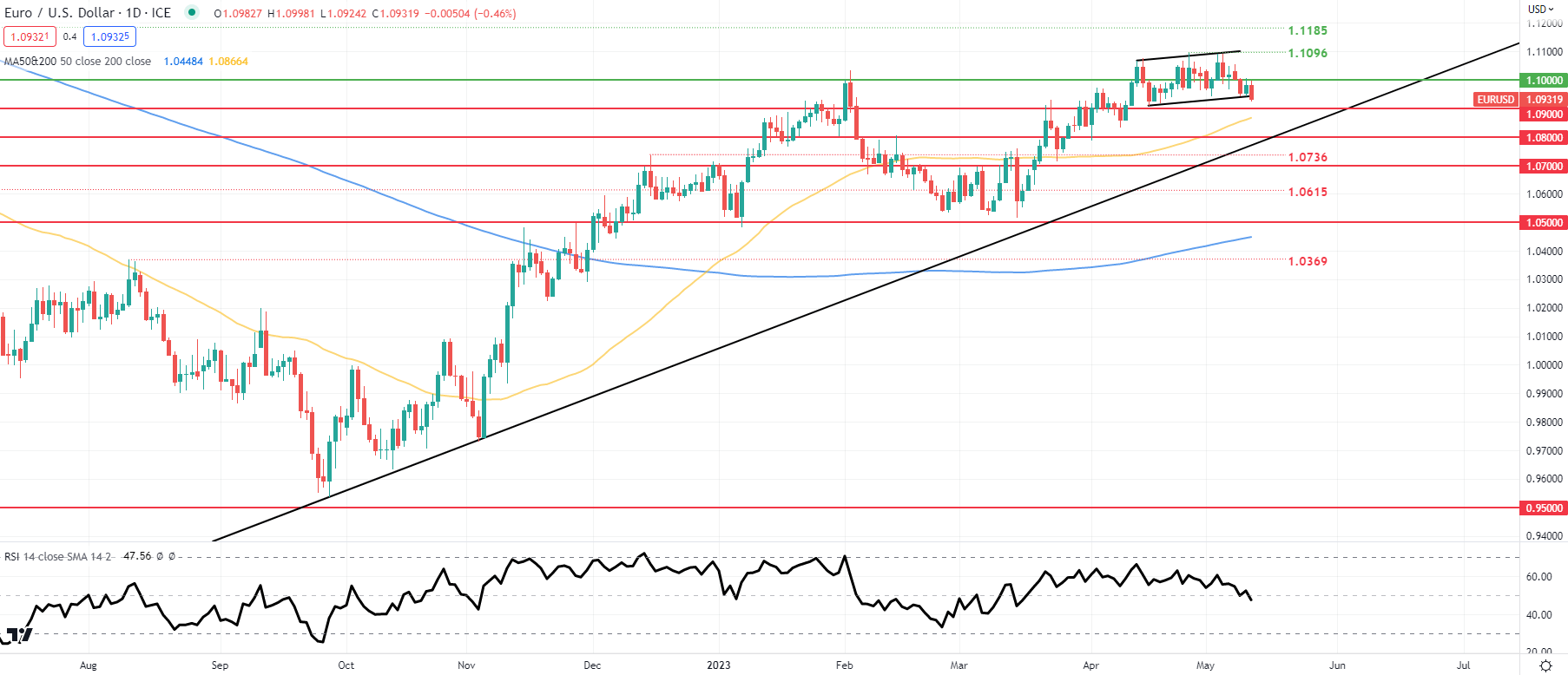

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily EUR/USD price action has broken below the ascending channel (black) and a daily candle close below this level could prompt a further euro sell-off. This will be contingent on US factors (primary debt ceiling guidance) which is why the Relative Strength Index (RSI) reflects hesitation.

Resistance levels:

- 1.1185

- 1.1096/Channel resistance

- 1.1000

- Channel support

Support levels:

- 1.0900

- 50-day moving average (yellow)

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently LONG on EUR/USD, with 51% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas