TURKEY RUNOFF ELECTION RESULTS, USD/TRY:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

READ MORE: EUR/USD, GBP/USD Eyeing Recovery on Low Liquidity Monday Following US Debt Deal

Turkey has seen the re-election of Recep Tayyip Erdogan in a runoff election on Sunday. The result will see Erdogan’s rule stretch into a third decade with the President stating that “it is time to put aside debates and conflicts and focus on our national goals and dreams.”

Results from Turkeys Supreme Election Council on Sunday showed Erdogan winning 52.14% of the votes. The president further pledged that the Governments main priority would be combatting inflation and healing wounds as the country still recovers from February’s devastating earthquake. Erdogan received congratulatory messages from both US President Joe Biden and Russian counterpart Vladimir Putting among a host of other foreign leaders.

According to Asli Aydintasbas, a visiting fellow at Brookings Institution, the results indicate a divided country with both camps envisioning a different future for Turkey. Other analysts have pointed to Erdogan’s personality as a key factor victory with Hakan Akbas, senior adviser at Albright Stonebridge Group stating, “I think a big part of it is Erdogan’s cult-like personality; he’s a great orator and his messages are simple yet inspire confidence in his electorate.” Either way Erdogan is here to stay for now at least as Turkey faces a host of economic challenges moving forward.

Erdogan Supporters in Bursa

Source: Sergen Sezgin/Anadolu Agency

ECONOMIC OUTLOOK AND IMPLICATIONS OF THE ELECTIONS

Turkish inflation has been the major concern over the past 24 months as discussed in my piece on the Turkish Lira on May 16. The issue around inflation and the rising cost of living played a central role in the elections with Erdogan making a point of addressing it following his victory.

President Erdogan stated that solving the inflation conundrum is not difficult as he looks to eliminate the problem arising from price increases and to compensate for welfare losses. Erdogan had come under increasing pressure in the lead up to the election as the current monetary policy path of keeping rates low and financial conditions supportive while emphasizing alternative policy instruments and alignment of all policy instruments with “Liraisation” targets. Many have blamed Erdogan’s policy for the untenable rate of inflation as well as the Liras subsequent decline over the past 20 month or so (From September 2021).

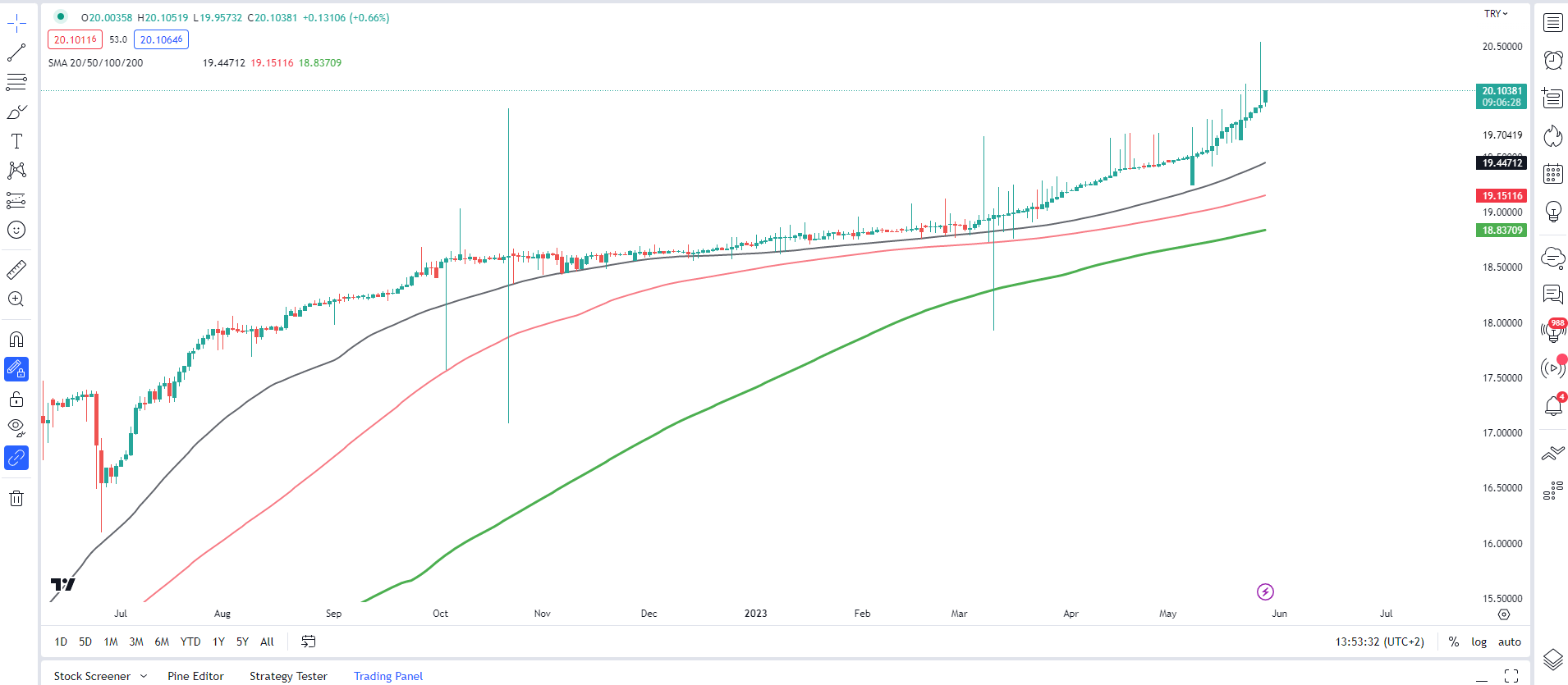

The Central Bank faces a challenging task of keeping the Lira steady following the election as any hope of a monetary policy pivot may begin to wane. This seems clear if one looks at the reaction of USD/TRY in early trade on Monday spiking back above the 20.0000 mark.

Recommended by Zain Vawda

Traits of Successful Traders

TECHNICAL OUTLOOK AND FINAL THOUGHTS

Looking at the bigger picture, volatility is expected to remain high over the coming days. USDTRY continues to tick higher with little in the way of price action to analyze as the moves have been so abrupt and volatile.

A deal on the US debt ceiling may hamper further USD/TRY upside in the short-term, however we have also seen some hawkish repricing of the Federal Reserve’s rate hike probabilities moving forward. This could keep the US dollar supported despite its safe haven appeal somewhat dissipating in the aftermath of the debt ceiling deal.

The Lira is largely expected to remain weak unless President Erdogan announces some form or potential shift in monetary policy. On the US dollar side, it will be interesting to see the reaction once markets are back in full swing tomorrow post bank holiday. A continuation of US dollar Strength could see the Lira push further away from the psychological 20.0000 and continue making fresh highs.

Alternatively, any push lower from here may find support at the 50-day MA around 19.44 with the 100 and 200-day MA resting lower at 19.1500 and 18.8300 respectively.

USD/TRY Daily Chart – May 29, 2023

Source: TradingView

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda