EUR/USD ANALYSIS

- ECB revisions help bolster bullish market reaction.

- US retail sales unable to deter EUR.

- Euro rallies to levels last seen in mid-May.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

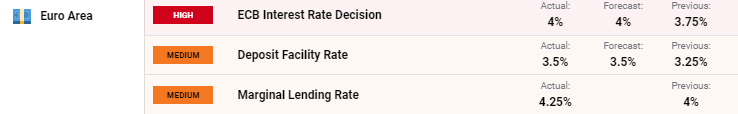

The euro has pushed higher on the European Central Bank (ECB) announcement to hike interest rates by 25bps as expected (see economic calendar below). The stronger euro comes via higher revised projections for inflation despite lowering economic growth estimates. The average inflation and GDP revisions are as follows:

- 2023 = 5.4%; 2024 = 3.0%; 2025 = 2.2% – HEADLINE INFLATION

- 2023 = 5.1%; 2024 = 3.0%; 2025 = 2.3% – CORE INFLATION

- 2023 = 0.9%; 2024 = 1.5%; 2025 = 1.6% – ECONOMIC GROWTH

Taking these projections into account, the ECB could be forecasting the region to hit its 2% target post 2025 which may be farfetched considering recent readings have been on the decline (albeit slower than the preferred rate of decline). Global rate hikes have shown there is a lagged effect on the overall economy and may see more significant results quicker than expected.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

EUR/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

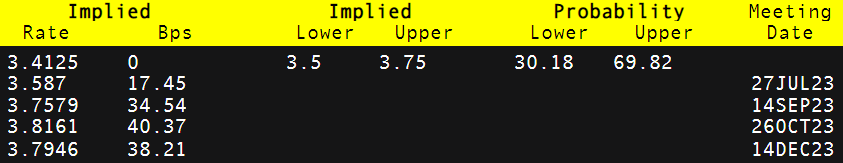

Interestingly money markets (refer to table below), have ‘dovishly’ repriced their expectations for 2023 down from over 60bps of cumulative rate hikes to 40bps. This could be due to the lower economic growth projections that could be heightening recessionary fears in the eurozone while taking into account the regions declining manufacturing statistics.

ECB INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

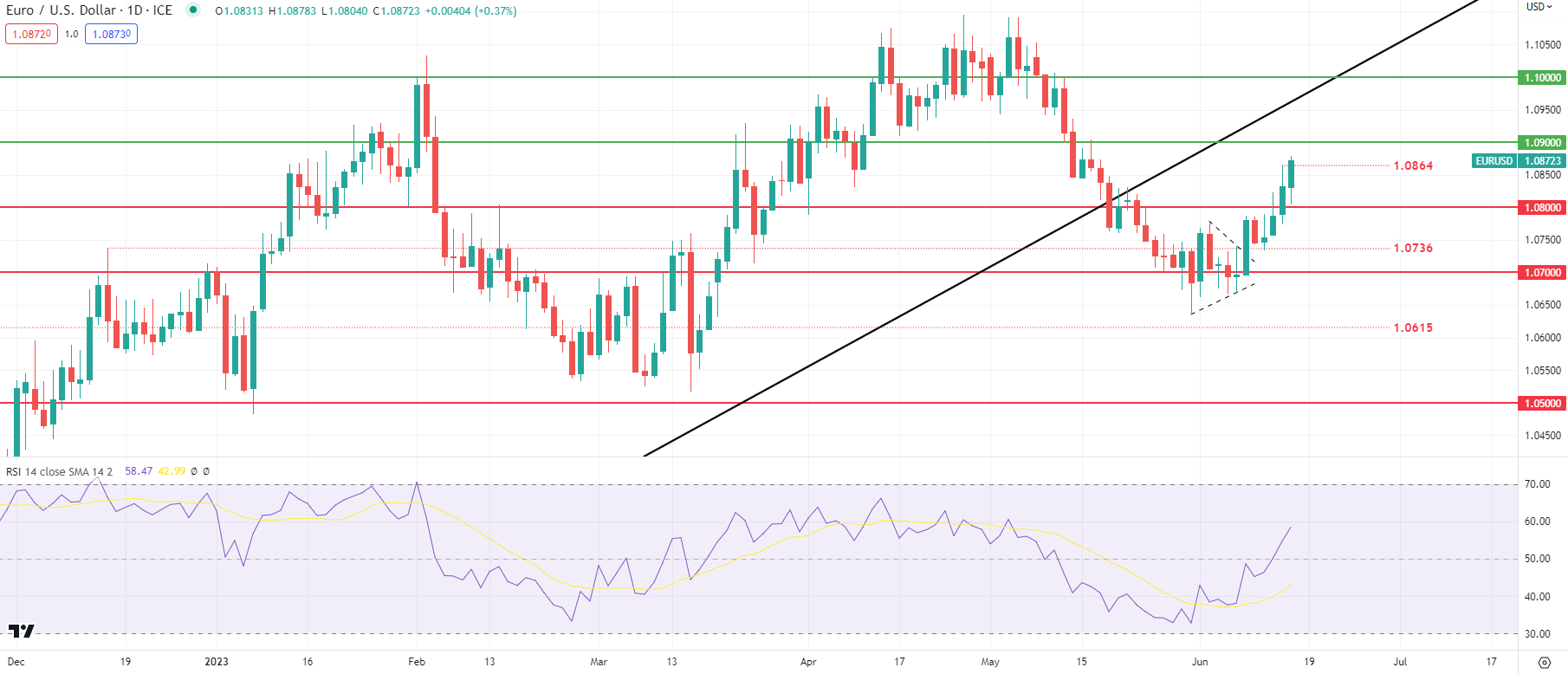

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily EUR/USD price action shows the markets bullish reaction to the news despite the better than expected US retail sales report which included a beat on initial jobless claims. With no further high impact data scheduled for today, it will be interesting to see whether or not these levels can hold throughout the US trading session.

Resistance levels:

Support levels:

IG CLIENT SENTIMENT DATA: BULLISH

IGCS shows retail traders are currently LONG on EUR/USD, with 52% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning we arrive at a short-term upside bias.

Contact and followWarrenon Twitter:@WVenketas