Euro, CAC 40 Sink on French Snap Election Call; EUR/USD and EUR/GBP Latest

- The Euro is under pressure after a surprise French election call.

- CAC 40 drops sharply on renewed political uncertainty.

- EUR/GBP hits a near two-year low.

Recommended by Nick Cawley

Trading Forex News: The Strategy

The Euro is weakening across a range of EUR-pairs in early trade after this weekend’s European elections saw a marked shift to the right. After being heavily defeated by Marine Le Pen’s National Party, French President Emmanuel Macron called a snap election, while in Germany Chancellor Olaf Scholz saw his Social Democrat Party beaten by the far-right Alternative for Germany (AFG) party. France will go to the polls on June 30th, while Chancellor Scholz is now under pressure also to call an election.

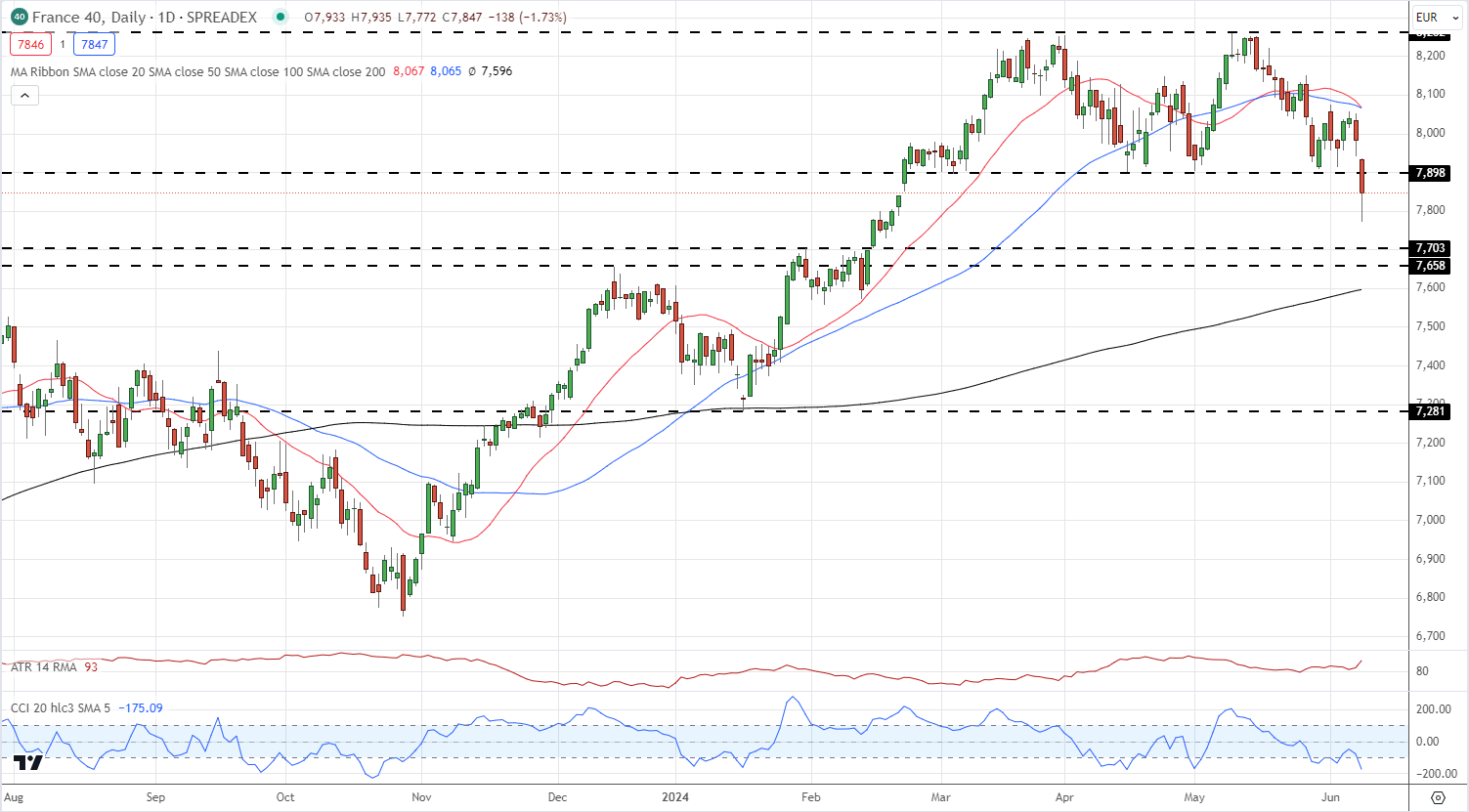

The renewed political uncertainty can be seen across a range of assets Monday, with the French CAC 40 currently trading over 1.7% lower, while the Euro is weak against a range of currencies. The CAC 40 is trading at a fresh multi-month low after breaking support around the 7,900 level. The next zone of support is seen between 7,703 and 7,658.

CAC 40 Daily Chart

Recent changes in sentiment warn that the current France 40 price trend may soon reverse lower despite the fact traders remain net short.

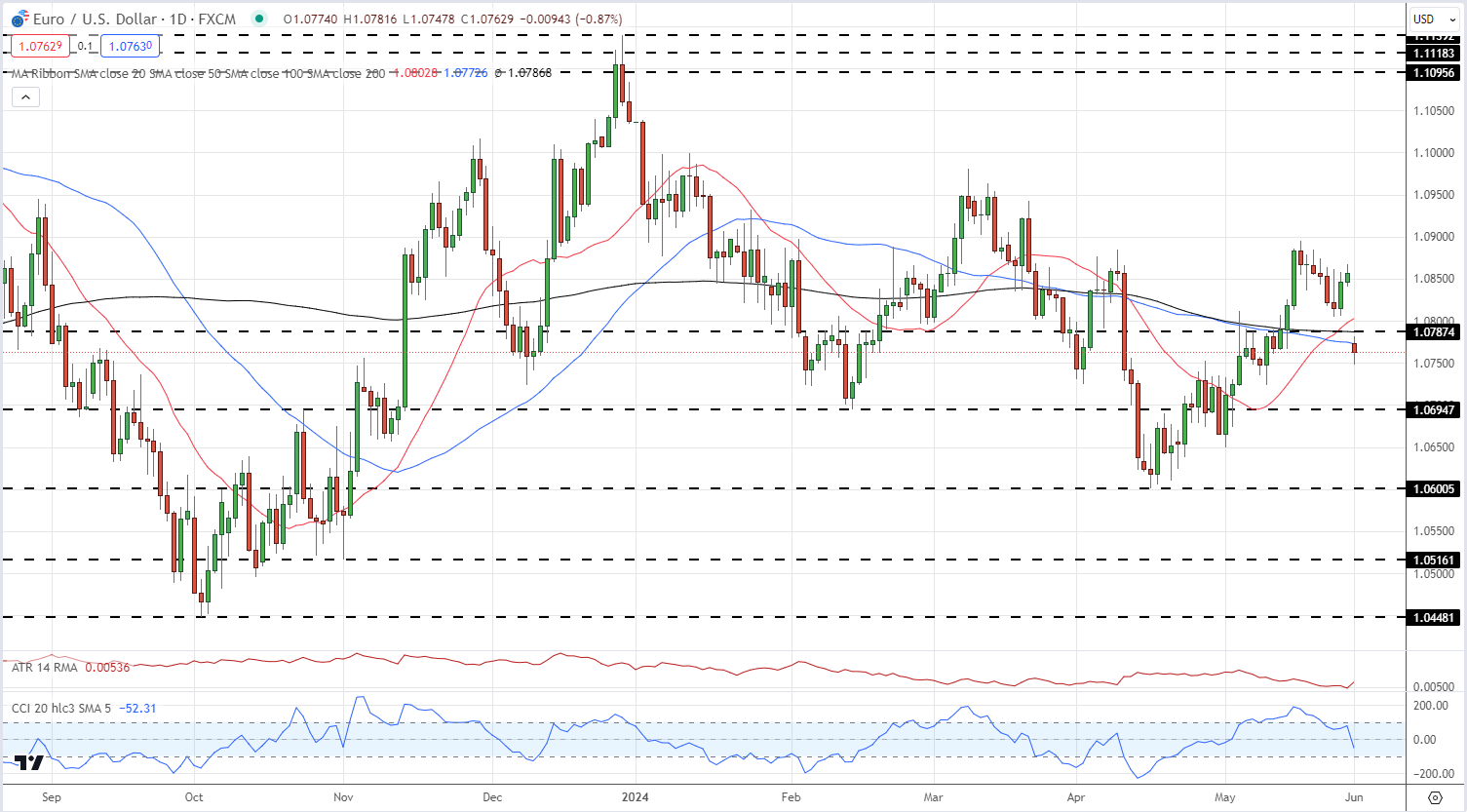

EUR/USD fell through all three simple moving averages and prior horizontal support in early trade before finding stability around 1.0750. The next level of support is seen just below 1.0700.

EUR/USD Daily Price Chart

Recommended by Nick Cawley

How to Trade EUR/USD

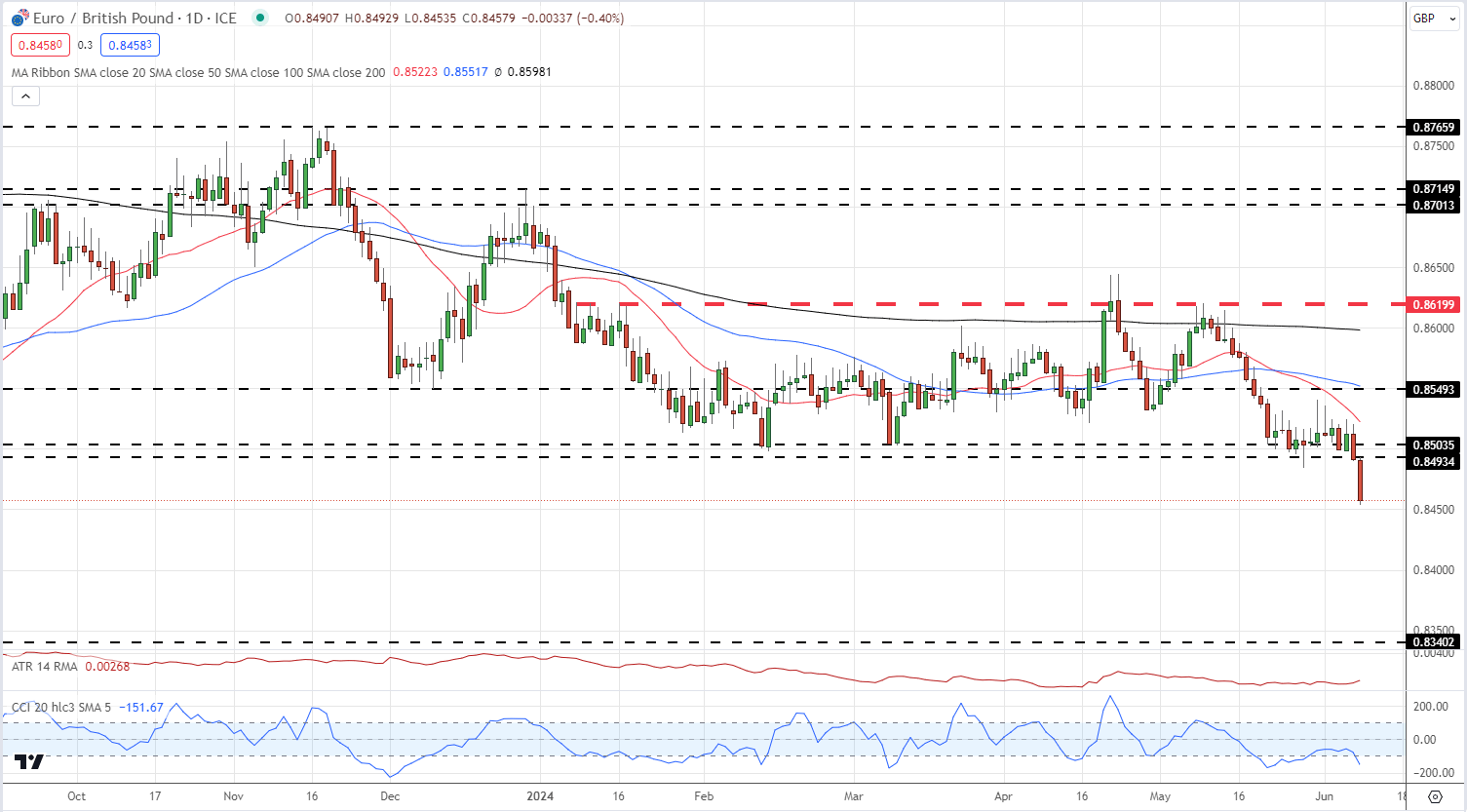

EUR/GBP is now back at lows seen 22 months ago after support around the 0.8500 area fell with ease earlier today. This area now turns into short-term resistance. The next level of support is seen at around 0.8340, the early August 2022 swing-low.

EUR/GBP Daily Chart

All charts using TradingView

Retail Trader Sentiment Analysis: EUR/GBP Bias Remains Mixed

According to the latest IG retail trader data, 79.17% of traders are net-long with the ratio of traders long to short at 3.80 to 1.The number of traders net-long is 0.41% higher than yesterday and 3.78% higher than last week, while the number of traders net-short is 4.84% higher than yesterday and 7.80% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBPprices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/GBP trading bias.

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | -3% | 16% | 1% |

| Weekly | -8% | 25% | -1% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or contact the author via Twitter @nickcawley1.