Euro Forecast: Deteriorating Economic Outlook Weighs on the Euro

EUR/USD Forecast: Bearish

EUR/USD has been a one-sided trade since topping out in mid-July. A slight recovery at the end of August wasn’t enough to change the direction of travel for the pair which has then gone on to trade well below the 200-day simple moving average (SMA).

The big challenges next week appear via US CPI data and the European Central Bank (ECB) rate decision. The disinflationary trend is still largely being observed despite occasional prints above consensus estimates but sharp rising oil prices are likely to filter into the general level of prices heading into the final quarter of the year. In the absence of a drop below estimates for August CPI, it is rather difficult to spot clear headwinds for the US dollar as data continues to outperform.

The ECB meeting could throw a curve ball and hike another 25 basis points next week but the deteriorating economic environment suggests the council may err on the side of caution and keep rates unchanged. 1.0700 is a significant level of support, having provided a strong pivot point in the past, this is EUR/USD’s most imminent challenge.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

In the late August Euro forecast, longer-term channel support was initially highlighted as the EUR/USD headed lower. Fast forward to today and the breakdown of this level is clear to see. The break to the downside now sees 1.0640 as a realistic level of support in the weeks to come – especially if the European economic outlook fails to improve.

EUR/USD Weekly Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade EUR/USD

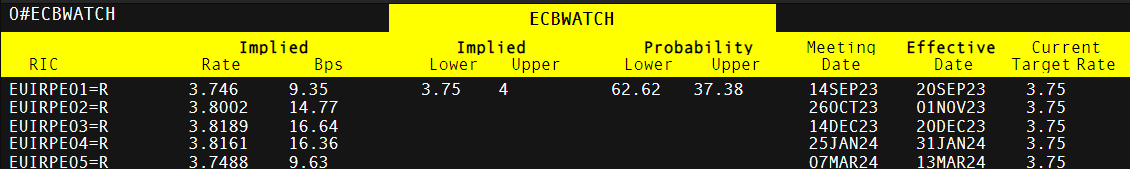

ECB Implied Interest Rate Probabilities

Source: TradingView, prepared by Richard Snow

EUR/GBP Forecast: Neutral

The reason for the neutral outlook this week is informed by the recent sterling weakness that could arrest the decline on a better GDP print with potentially elevated average earnings data for August. Inflation has proven stickiest in the UK and so it is not difficult to envision hot wage pressures. If UK GDP follows on from July’s upside beat, sterling could receive a lift and recover recent losses.

Technically, the pair also trades in no man’s land at the moment – in the middle of the well-established trading range, nearing a point where prices reversed prematurely without testing channel resistance. Such an area (0.8610) could be problematic once again.

Lastly, there is only an outside chance of another ECB hike meaning EUR/GBP bullish momentum may start to wane next week. Ultimately, with markets increasingly sensitive to incoming data as major central banks reach a turning point (peak rates), price action will take its cue from the data, potentially even dismissing the recent directional moves.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

Learn the #1 mistake traders make and avoid it by reading the findings – based on actual client accounts – below:

Recommended by Richard Snow

Traits of Successful Traders

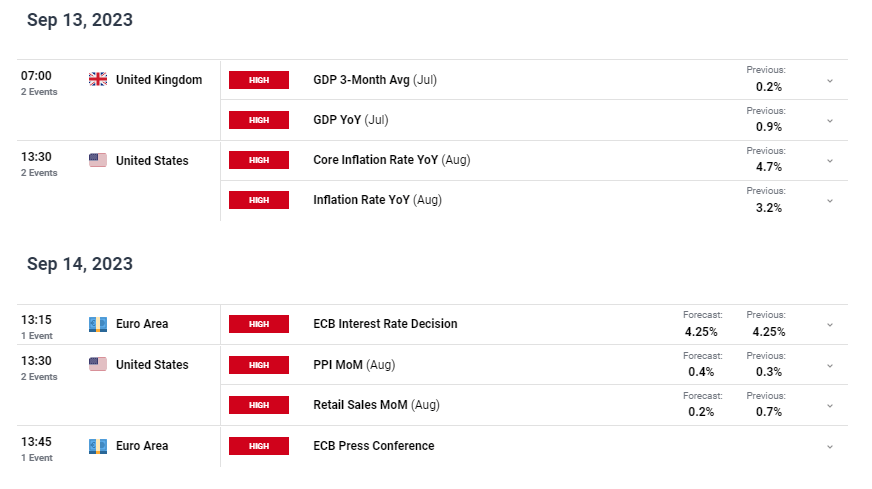

High Impact Economic Data and Events in the Week to Come

Next week sees a lift in high importance economic data for the US, UK and EU. UK unemployment and GDP data will help markets assess whether tighter financial conditions are beginning to constrain average earnings and also weigh on the labour market. Sterling could experience further weakness in the event GDP and wages head lower while unemployment rises – something that could see interest expectations revised even lower.

In the US CPI remains a key focus and major determinant of whether the Fed decides to hike interest rates into the end of the year or leave them at their current ‘restrictive’ level. US CPI appears to be the only real challenge to the elevated US dollar, with EUR/USD bulls desperate to see the possible combination of lower CPI and a surprise ECB hike. Speaking of the ECB, the governing council communicated a more cautions mood from within the rate setting body in light of deteriorating fundamental data – seeing interest rate expectations of a rate hike later this month contract to around 38% from what was essentially a coin toss not too long ago. This week, the ECB hawks suggested that markets may underappreciate the risk of a possible hike next week – raising the risk of EUR/USD repricing in the event the council go ahead with the less likely hike.

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX