Euro (EUR/USD, EUR/JPY) Forecast

- Bearish EUR/USD: US treasury yields bolster USD, aided further by strong economic data

- Bearish EUR/JPY: Elevated Japanese inflation and Evergrande’s bankruptcy protection application favour the safe-haven yen

- Risk events: Chinese LPR, EU PMI flash data for August and Jackson Hole

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free EUR Forecast

EUR/USD Bearish: Downtrend Continues as US Data Hots up

The euro has taken a back seat in the absence of high impact economic data in the last few weeks. At the same time, US economic data continues to tell the story of an economy in recovery as the labor market remains tight, activity data solid and growth data on the up. In fact, the Fed’s GDPNow forecast tool reached 5.8% this week. The tool uses incoming data to forecast quarterly GDP but has tended to flatter actual growth in past forecasts.

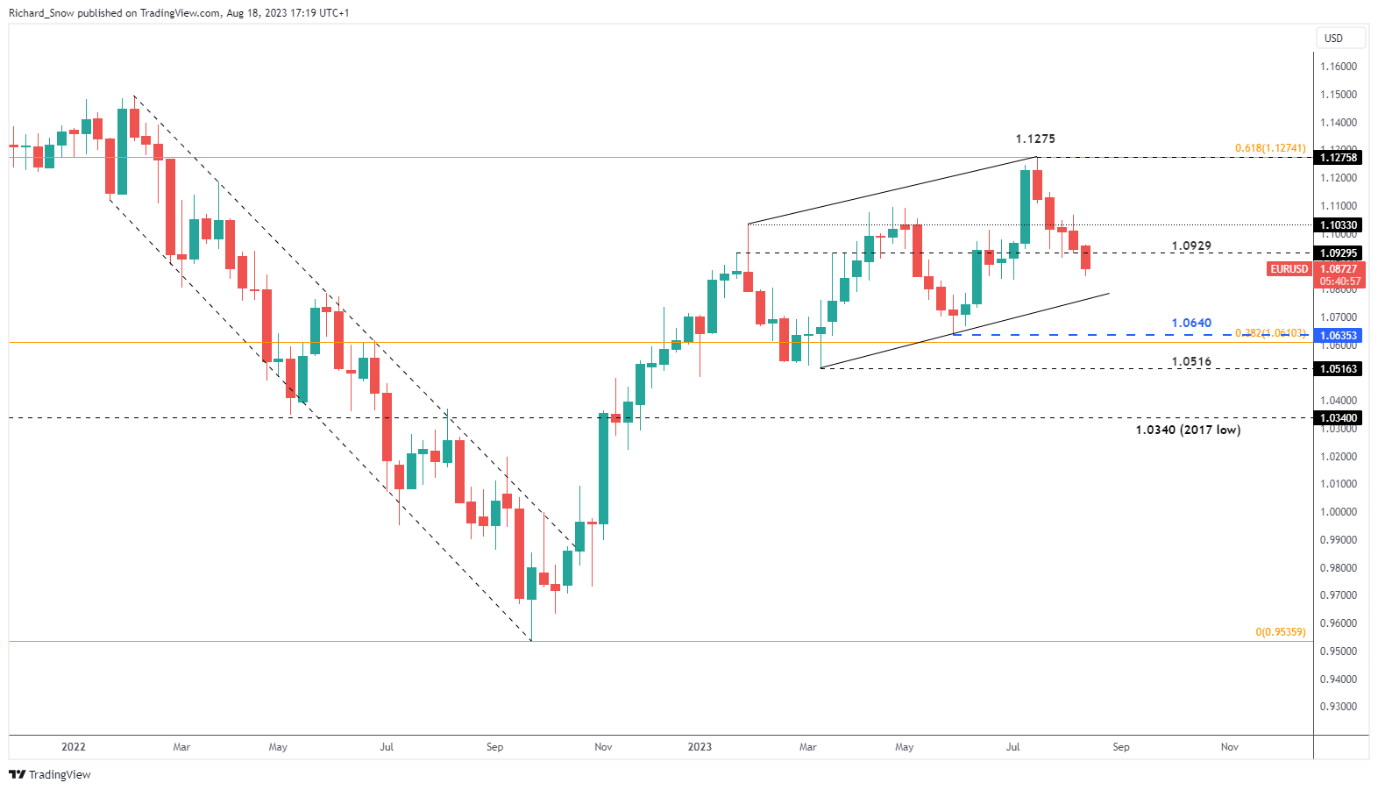

As a result of the strengthening US data, bond markets anticipate a ‘higher for longer’ outcome, seeing yields for longer-dated treasuries trending higher – supporting the dollar. EUR/USD therefore, remains vulnerable. The weekly chart reveals a fifth straight weekly move lower within a broader uptrend. While recent direction has been decisively lower, the longer-term uptrend remains. A close below 1.0929 opens up the pair for bearish continuation towards trendline support.

EUR/USD Weekly Chart

Source: TradingView, prepared by Richard Snow

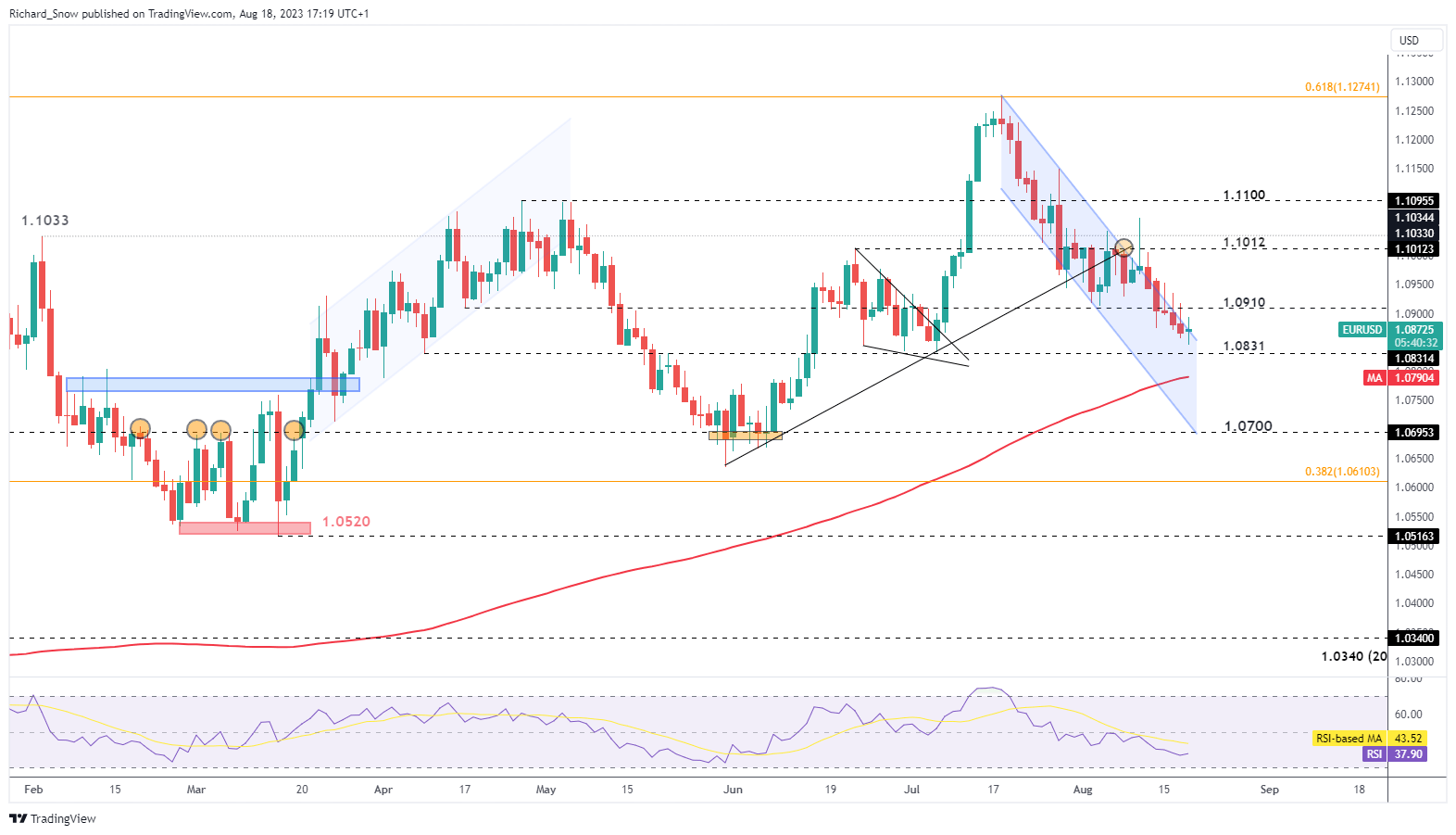

The daily chart shows the pair maintaining the bearish price action but not at the same pace as before. The dollar’s slow and steady rise sees EUR/USD trade in a similar fashion, without any major impetus. As such, with the pair nearing the 200 day simple moving average (SMA), bearish momentum could soon abate, but for now the downtrend remains constructive. A potential risk the downtrend emerges via the Chinese loan prime rate on Monday. A show of intent by Chinese authorities and a meaningful rate cut could see current trends ease and even pullback a touch.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

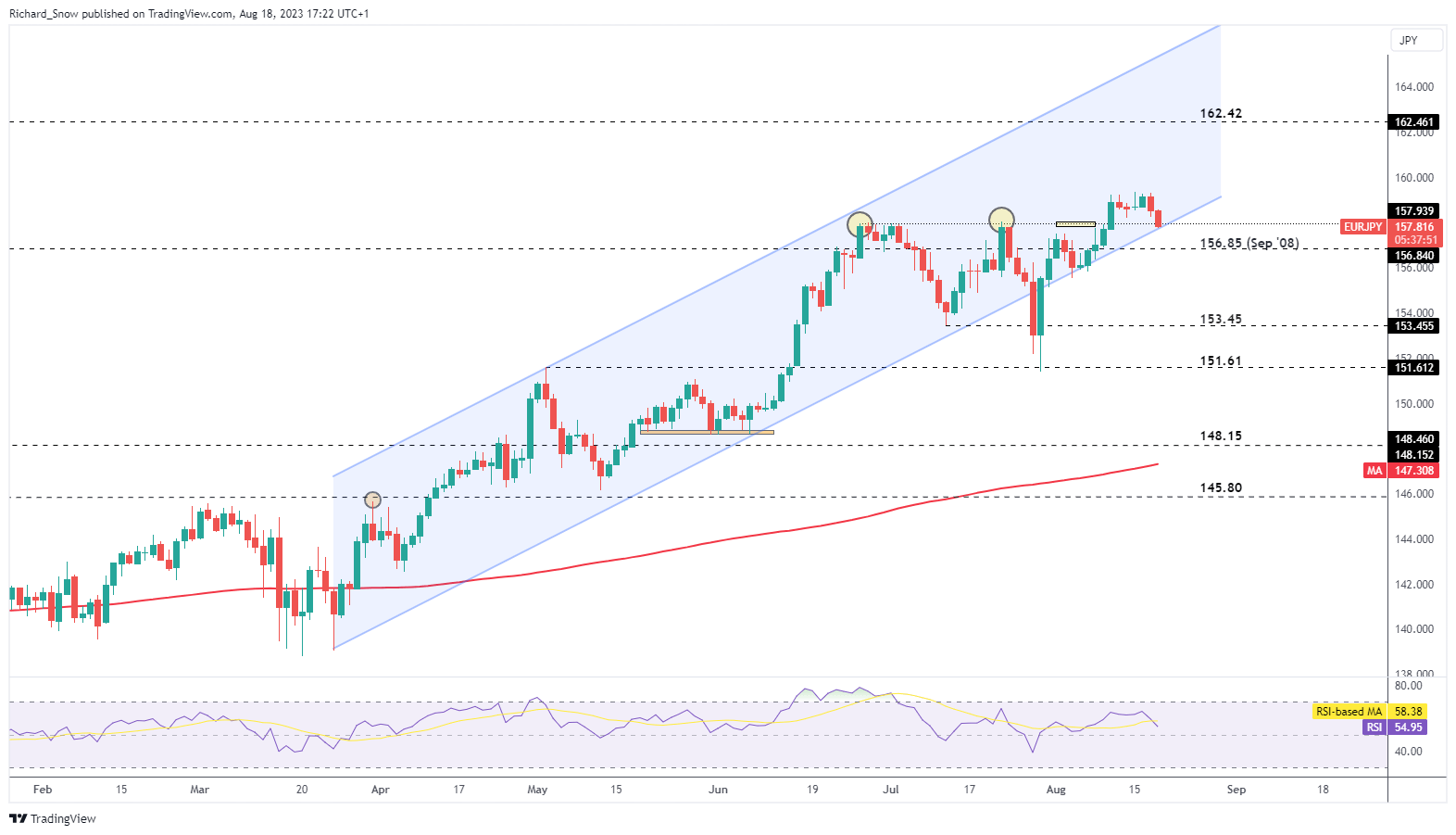

EUR/JPY Bearish: Japanese Inflation and Safe Haven Appeal Threaten Bullish Momentum

EUR/JPY broke above the prior stubborn level of resistance that kept prices at bay (157.94). Prior attempts have been highlighted in yellow. However, prices have headed lower since breaking above 157.94 as the Japanese yen witnessed a renewed bid upon distressing news from China’s second biggest property developer. Evergrande applied for bankruptcy protection in the US in a bid to restructure its debt. The news comes after a plethora of worsening news out of China which has soured sentiment further. Price action tests channel support with the next level of interest at 156.84.

The bearish outlook relies upon the safe haven bid continuing but risk to the outlook appear in the form of Chinese stimulus – which has been unconvincing for markets thus far. While cutting interest rates seems sensible to support the economy, it undermines the value of the Yuan at a time when the ECB is expected to hike rates again next month.

EUR/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Building Confidence in Trading

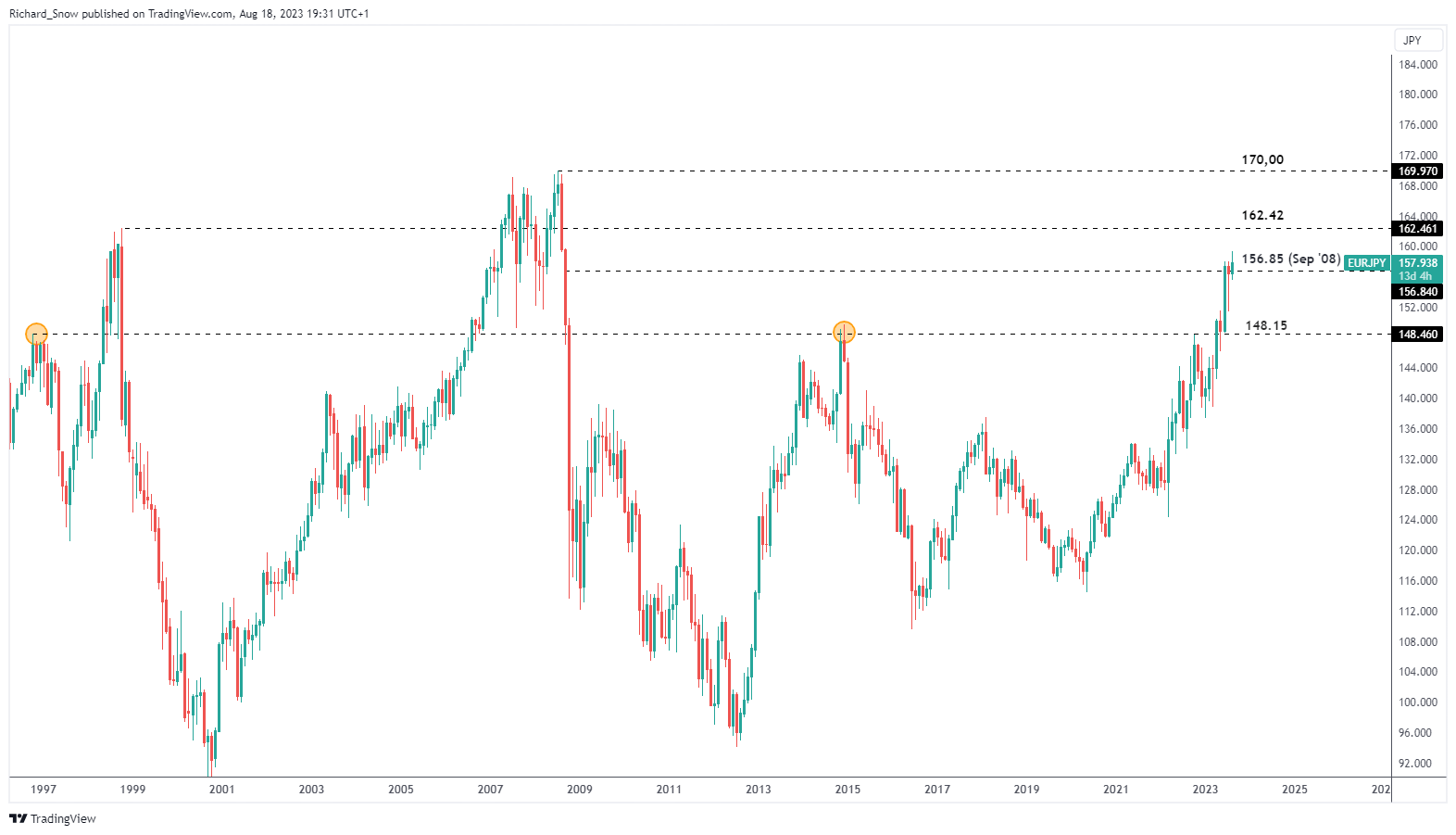

The monthly chart helps to highlight the consistency of the longer-term uptrend, reaching prior levels of resistance with relative ease. 162.42 is the next level of resistance – a level of resistance last seen in 1998 before the 170 mark which appeared in 2008.

EUR/JPY Monthly Chart

Source: TradingView, prepared by Richard Snow

Risk Events Ahead

In the week to come we get flash PMI data for Germany, the EU and the US for the month of August. German manufacturing PMI data has dragged the rest of Europe lower as the growth outlook for the Euro area remains sombre.

Something that has not made the list here but has become a large focus with respect to risk sentiment is the Chinese loan prime rate (LPR) which analysts suggest is due for a cut. The 15-bps haircut in the medium-term lending facility this week opened the door for further support from Chinese officials. If markets perceive the cuts as a step in the right direction to revive the vulnerable economy, we could see counter trend moves in both currency pairs.

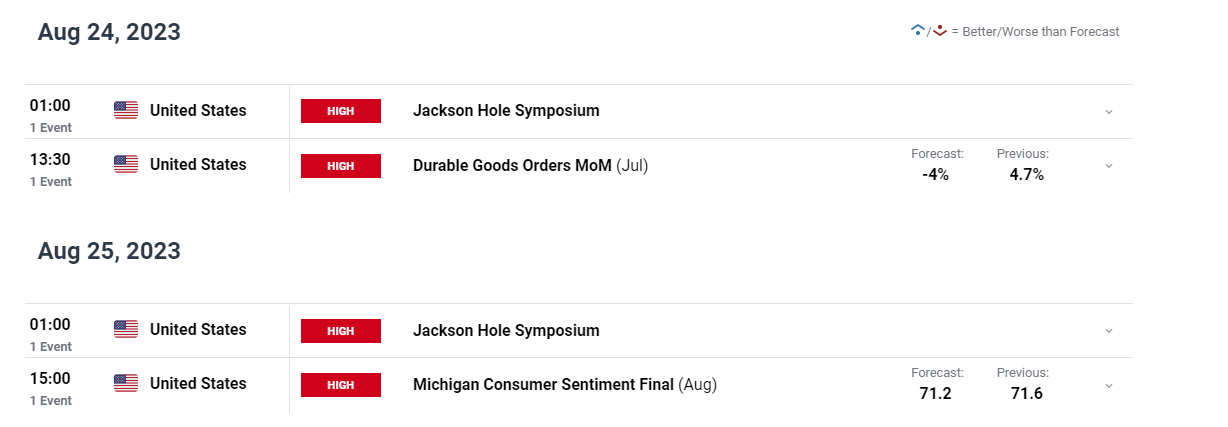

Thereafter, markets shift their focus to Thursday and Friday when the Fed is due to host major central bank heads at its annual Jackson Hole Economic Symposium

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX