Euro Weekly Forecast: Neutral

- Euro fends off a push from the US Dollar last week after NFPs

- From a technical standpoint, EUR/USD faces a Morning Star

- Meanwhile, EUR/JPY remains stuck in range-bound action

Recommended by Daniel Dubrovsky

Get Your Free EUR Forecast

The Euro was able to fend off a push from the US Dollar throughout the course of last week. By Friday, EUR/USD finished the 5-day period little changed and recovered from what was appearing to be a -1% drop in the exchange rate. A slight miss in headline US non-farm payrolls data pushed down Treasury yields and the US Dollar, although the latter may yet recover in the days ahead.

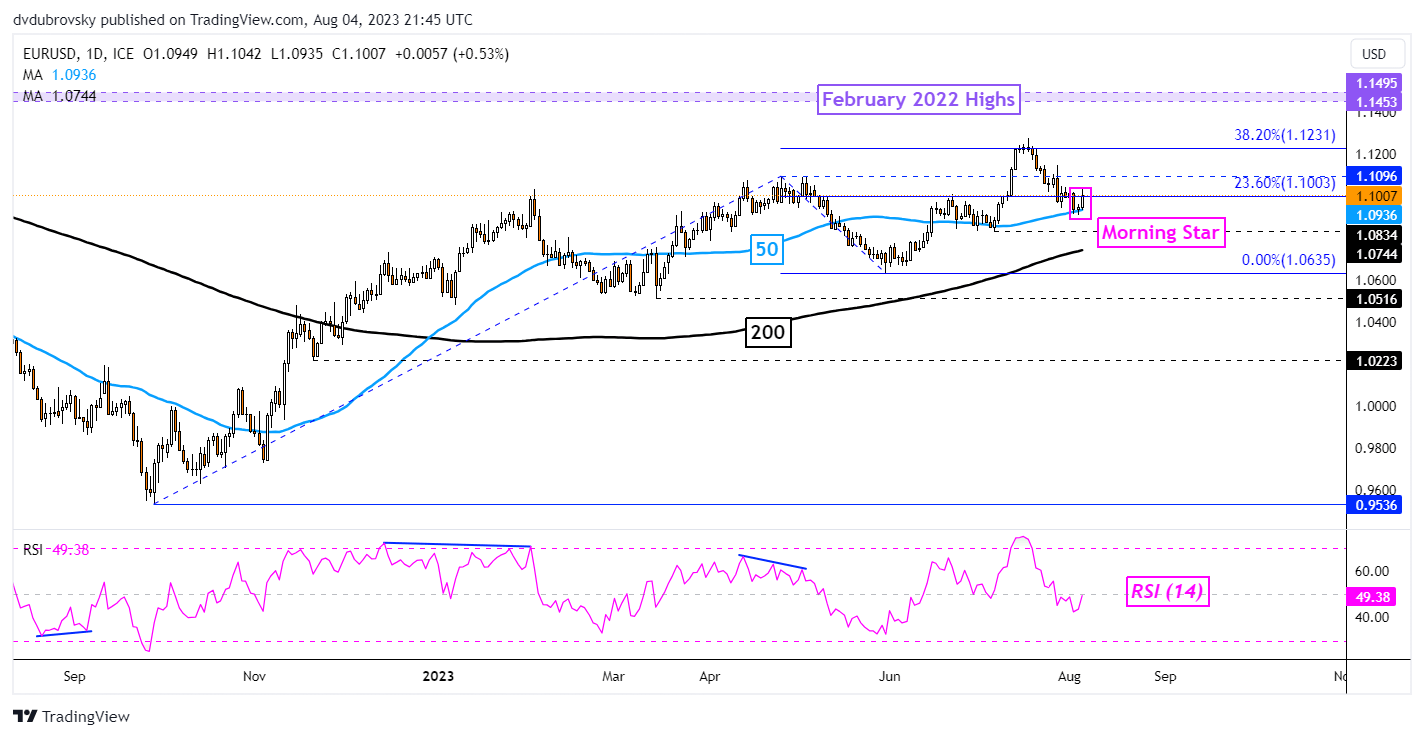

How has price action left the single currency heading into the new week? On the daily chart below, EUR/USD formed a bullish Morning Star candlestick pattern after failing to push through the 50-day Moving Average (MA). While upside confirmation is lacking as of the end of last week, this could leave the Euro in a position of strength in the coming days.

From here, immediate resistance seems to be the 1.1096 inflection point. Beyond that is the 38.2% Fibonacci extension level at 1.1231. In the event of further gains, that would place the focus on highs from February 2022. The latter makes for a zone of resistance between 1.1453 and 1.1495.

Otherwise, a turn lower through the 50-day MA would reinstate a bearish technical posture. That would place the focus on the July low of 1.0834. Beyond that sits the 200-day MA. Clearing these would offer a stronger bearish conviction, exposing the May low of 1.0635.

Recommended by Daniel Dubrovsky

How to Trade EUR/USD

EUR/USD Daily Chart

Chart Created in TradingView

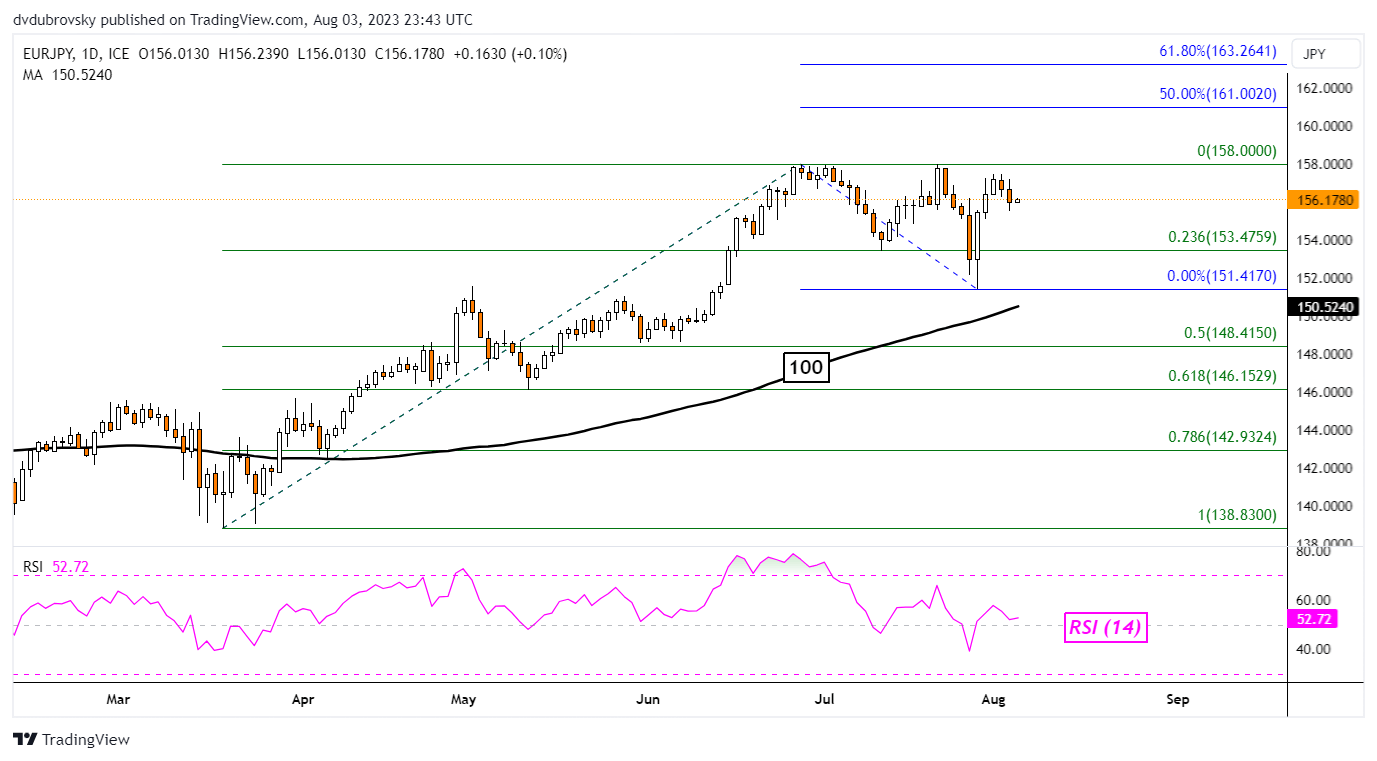

Meanwhile, the Euro remains in a neutral setting against the Japanese Yen. This still marks a key pause from the perspective of the longer-term upside bias since 2020. Key resistance is 158, which was the most recent high achieved in early June. Clearing above this point exposes the midpoint and 61.8% Fibonacci extension levels at 161 and 163.26, respectively.

In terms of support, there are two key levels to watch. The first is the 23.6% Fibonacci retracement level at 153.47. Clearing this price exposes lows from June just above 151.4. Furthermore, the 100-day Moving Average is sitting just below these points. This line may hold as key support, maintaining the broader upside technical bias.

If not, a downside breakout would mark a significant deviation from the trend, exposing the midpoint of the Fibonacci retracement at 148.41. Further losses open the door to potentially revisiting lows from March.

EUR/JPY Daily Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com