EUR/USD, EUR/JPY Weekly Forecast:

Recommended by Richard Snow

Get Your Free EUR Forecast

ECB Officials Eye September Meeting for Final Rate Hike

One day after the ECB voted to raise benchmark interest rates by 25-basis points members of the governing council have already come forward to talk about the September meeting. ECB dove, Yannis Stournaras struggles to see another hike but if the committee does vote in favour of one, it will be the last. Fellow dove, Gediminas Simkus hinted we are close or potentially already at the peak while on the other side of the divide, Bostjan Vasle saw the possibility of a hike or pause. Therefore, it appears the hawkish undertones previously supporting the euro are disappearing.

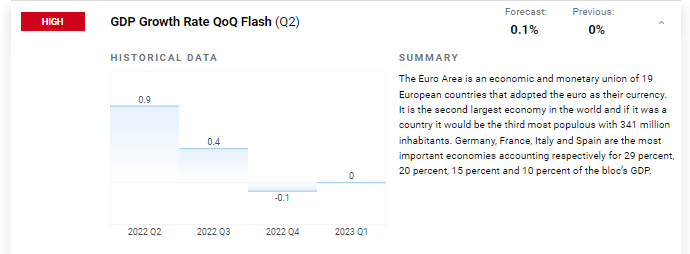

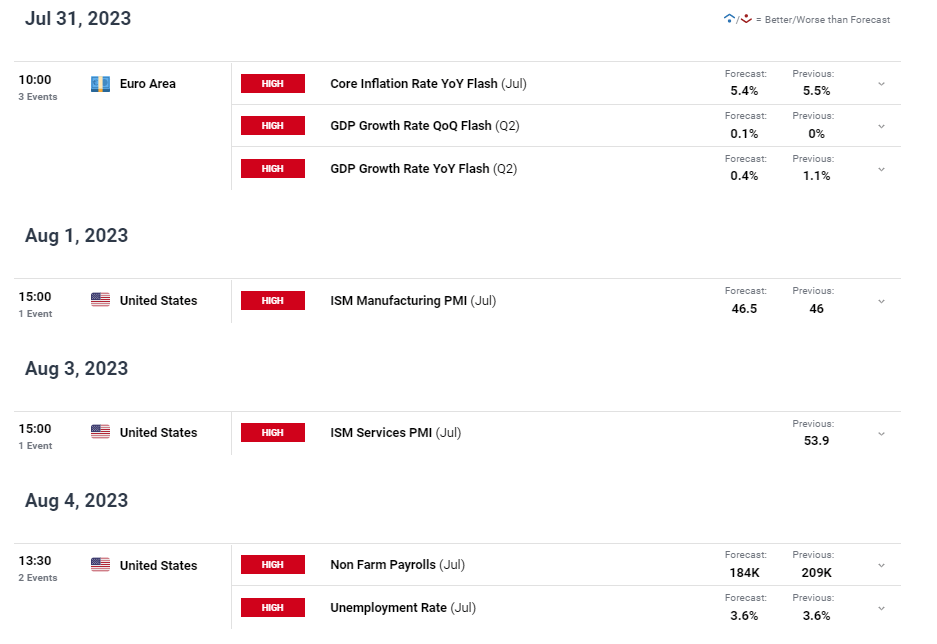

Next week Monday EU core inflation data is due and after Junes slight rise, the battle is still far from over. ECB officials will be hoping that encouraging inflation data is forthcoming, particularly at a time when growth in the euro area has stagnated. The Q1 print of 0% growth is expected to see a marginal improvement of 0.1% – extending the period of low/zero growth.

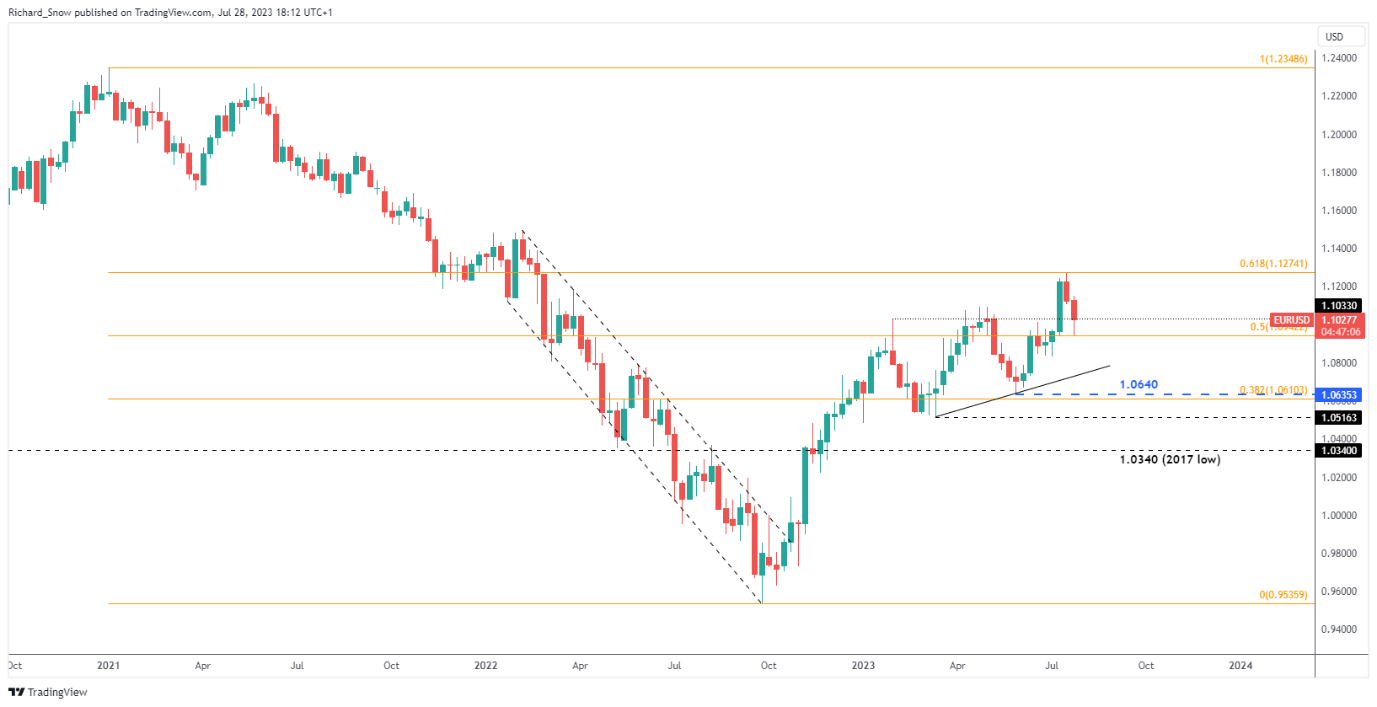

Looking at the weekly EUR/USD chart, the broader uptrend since October 2022 continue to edge higher in a rather choppy fashion, characterised by extended periods of declines and advances with the overall direction pointing higher still.

At the end of the week price action is likely to close the week lower but a late pullback could see the pair close above the late January swing high of 1.1033. Failure to do so may entertain a continuation of the bearish directional move after reversing off the 61.8% Fibonacci retracement relating to the 2021 – 2022 major selloff. Price action is likely to take early direction from the EU inflation and GDP data before gauges of US economic performance offer an opportunity to extend the current hot streak. If the data is likely to follow recent trends, EUR/USD could come under pressure at the start of the week.

EUR/USD Weekly Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

EUR/JPY Fails to Deliver Upon Breakdown, Fully Recovering Lost Ground

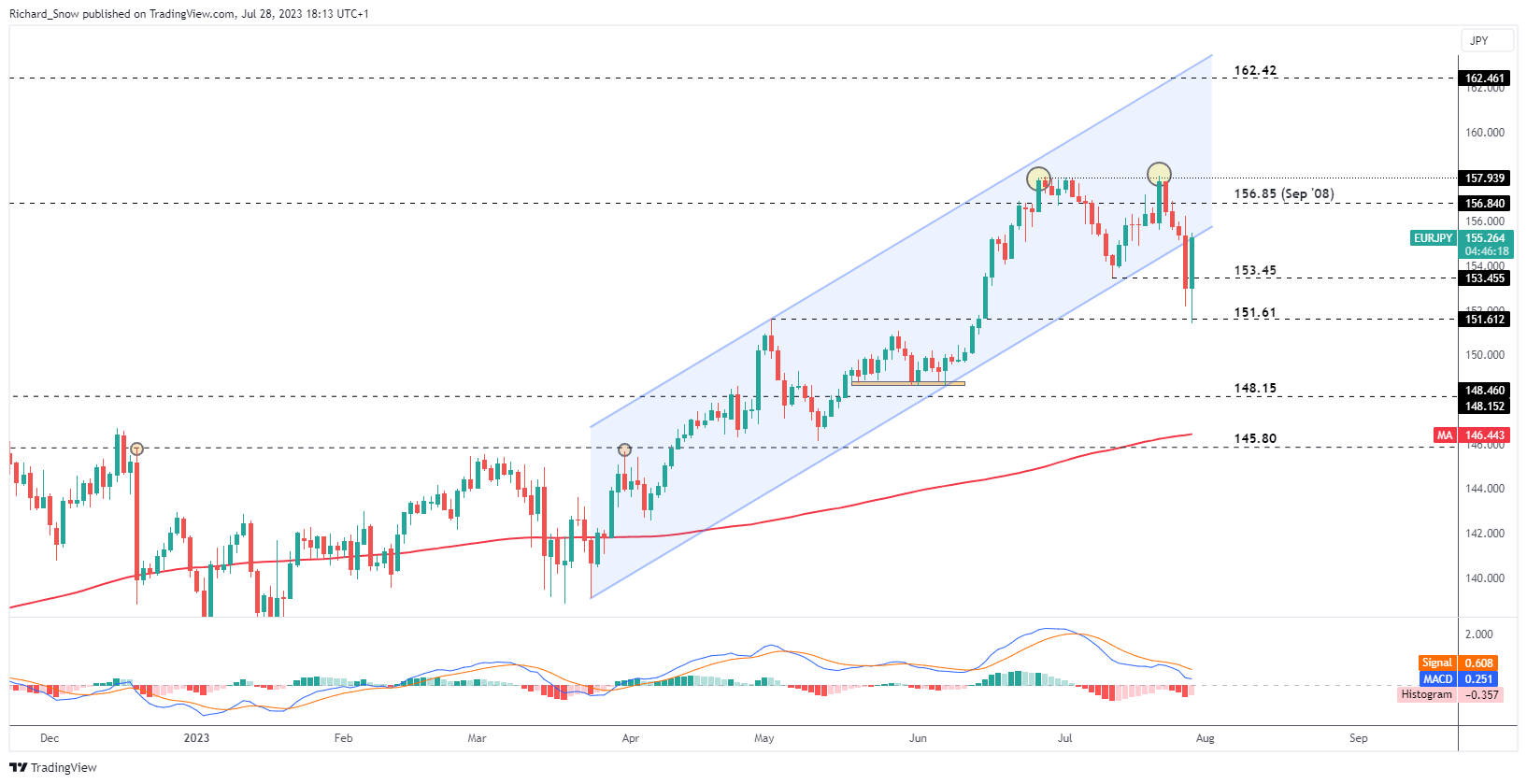

EUR/JPY ended the week in rather volatile fashion as speculation built ahead of Friday’s Band of Japan interest rate meeting that there could be a policy tweak. Naturally, the most likely adjustment would be another tweak to the Bank’s yield curve control measures and that is precisely what the market got.

Allowing the yield on the 10-year Japanese Government Bond to rise in excess of the prior 0.5% cap is viewed as the first step towards policy normalization. As such, the Yen appreciated against the euro, trading comfortably below 153.45 in the lead up to the announcement. Fast forward to Friday afternoon (UK time) and the pair has recovered all of Thursday’s losses.

Nevertheless, the appearance of what appears to be a double top, remains in play despite the failed attempt at a breakout. A retest of channel support, this time as resistance, could provide an opportunity for bears into next week, especially if EU inflation cools.

As the ECB nears the end of the rate hiking cycle and the BoJ contemplates tapering ultra-loose measures, EUR/JPY is one to watch into the end of the year. In the coming week, Japanese related data is scarce apart form the minutes of Friday’s meeting which is due Wednesday.

EUR/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Economic Calendar

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX