Euro, EUR/USD, US Dollar, CPI, Fed, ECB, China, Hang Seng Index – Talking Points

- Euro has support in the US Dollar demise as markets take stock

- US CPI reminded markets that the Fed still has work to do in the inflation fight

- If Euro CPI runs hot, will the ECB hike aggressively to boost EUR/USD?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The Euro has continued to climb today as the market digests the broader implications of the failure of 3 US banks and their subsequent rescue by authorities. Despite this, the US Dollar remains under pressure and EUR/USD is pushing toward a 4-week high above 1.0750.

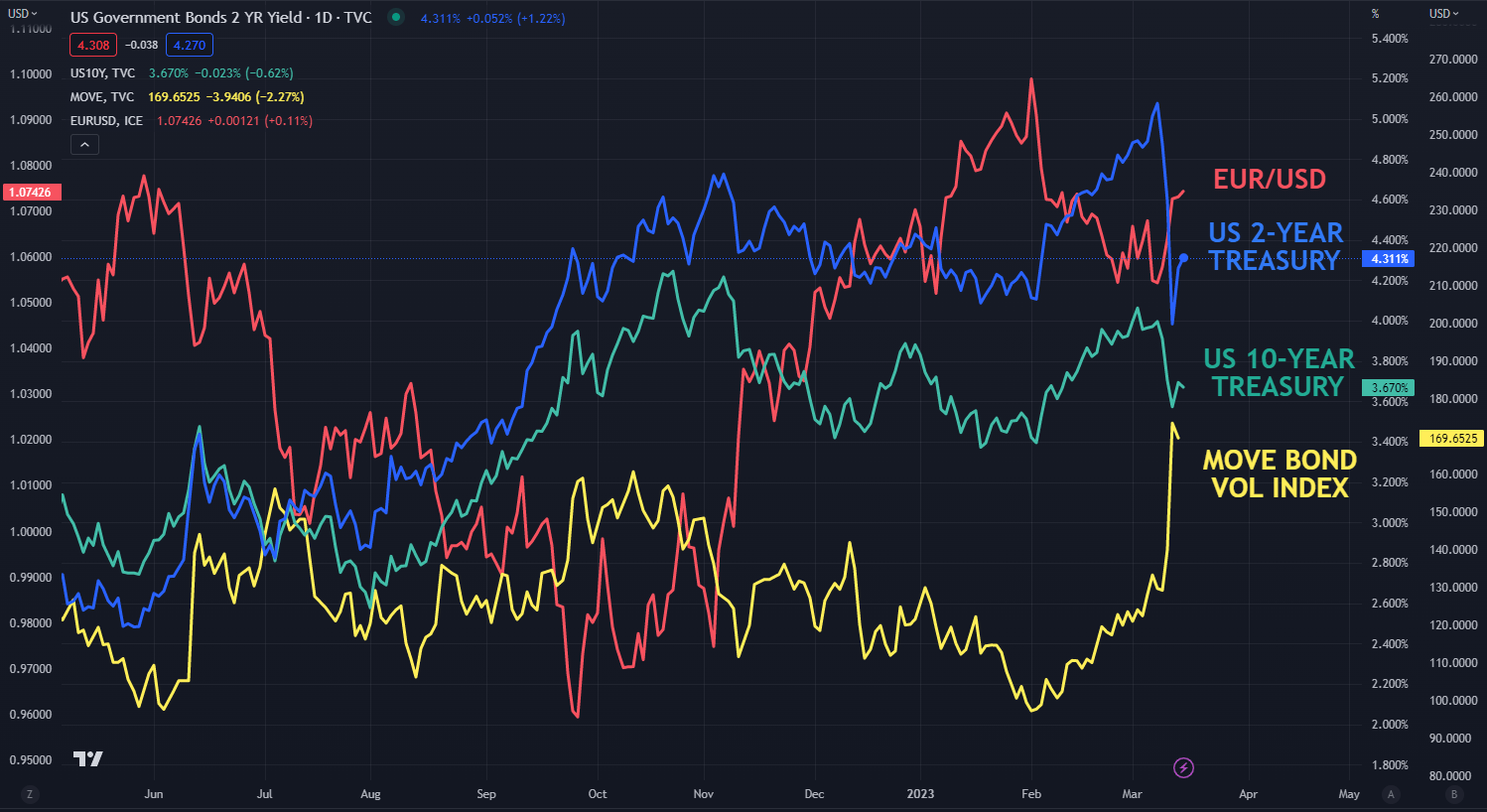

In general, financial markets stabilised on Wednesday after the tempestuous start to the week that saw wild swings across many asset classes. Of note was the moves in the 2-year Treasury bond. This has seen the MOVE index go to its highest level since 2008.

The MOVE index is a measure of bond market volatility in a similar sense to the way that the VIX index is a measure of implied volatility in the S&P 500.

Treasury yields went higher across the curve in the US session, but they have eased a touch from 5 years and beyond going into the European session.

EUR/USD AGAINST 2- AND 10-YEAR TREASURY NOTES AND MOVE INDEX

Headline US CPI came in at 6.0% year-on-year and 0.4% month-on-month as anticipated. The monthly core CPI was a slight beat at 0.5% instead of the 0.4% forecast but the annual number was in line at 5.5%.

This has sharpened the focus on next week’s Federal Open Market Committee (FOMC) meeting for the rate path ahead in light of the recent chaos.

APAC equities are all in the green to varying degrees today following on from Wall Street’s positive lead as calm appears to have been restored. Hong Kong’s Hang Seng Index (HSI) led the way, rallying over 1% after mixed Chinese data.

Industrial production there was a small miss at 2.4% YoY to the end of February rather than the 2.6% anticipated and retail sales were in line for the same period at 3.5%. Fixed assets ex-rural were a beat at 5.5% instead of the 4.5% forecast, again for the same period.

Additionally, the People’s Banks of China (PBoC) added more liquidity than expected at the 1-year medium-term lending facility (MLF).

Crude oil recovered after selling off again yesterday. The WTI futures contract is near US$ 72.50 bbl while the Brent contract is around US$ 78.50 bbl at the time of going to print. Gold is steadily straddling US$ 1,900 going into the Euro session.

There will be more CPI data across Europe today that may feed into expectations for the European Central Bank’s (ECB) meeting tomorrow. The interest rate market is leaning toward a 50 bp lift there.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade EUR/USD

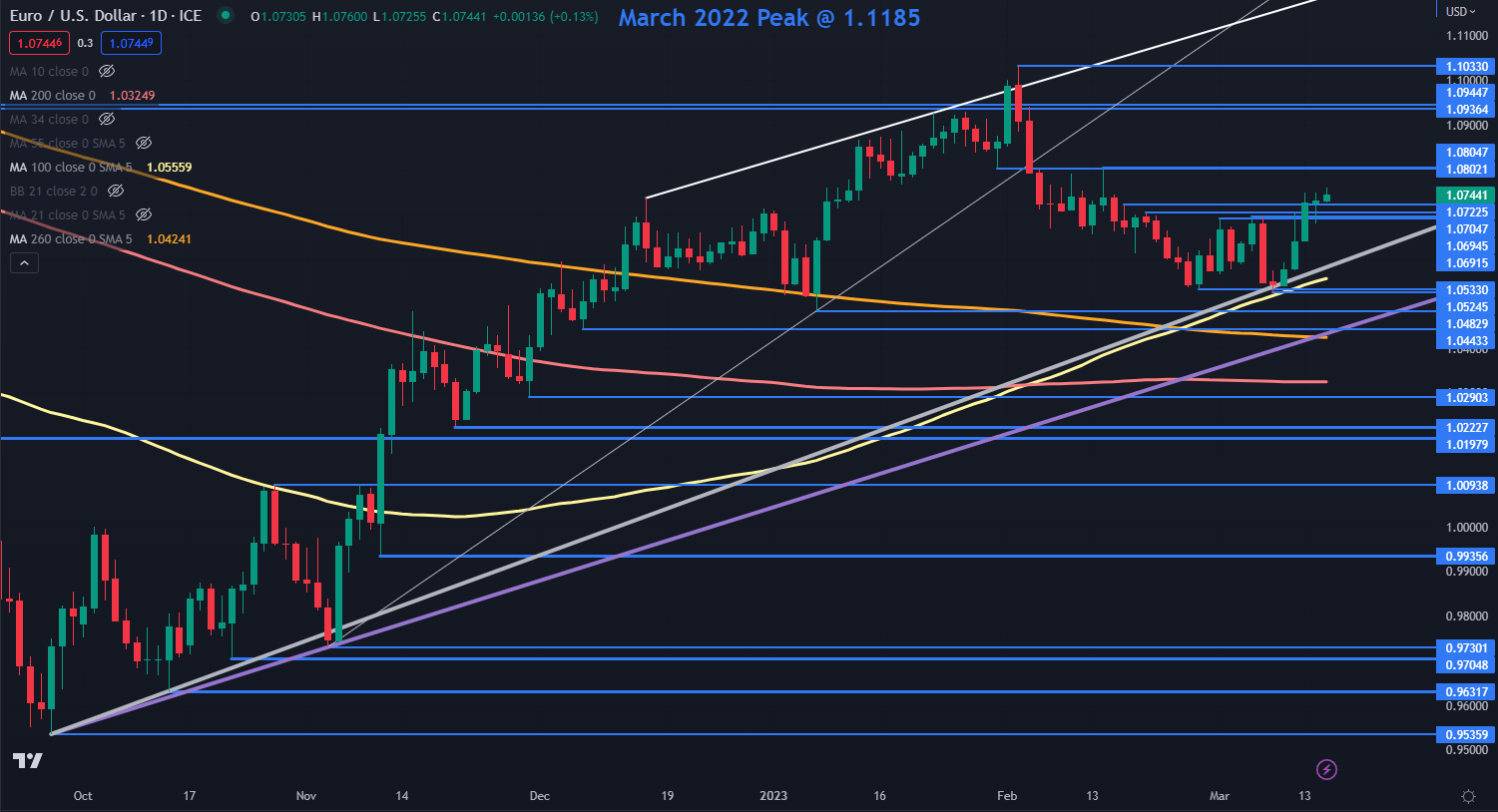

EUR/USD TECHNICAL ANALYSIS

EUR/USD remains in an ascending trend channel after testing the lower band last week. The price remains above the 100-, 200- and 260-day simple moving averages (SMA) and this may suggest that underlying long bullish momentum could be intact for now.

Resistance could be at the breakpoints and prior peaks of 1.0805, 1.0936, 1.0945 and 1.1030. On the downside, support may lie at the recent lows in the 1.0525 – 1.0535 area ahead of the prior lows of 1.0483 and 1.0443.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter