EUR/USD Technical Forecast: Unattractive Price Action for Now

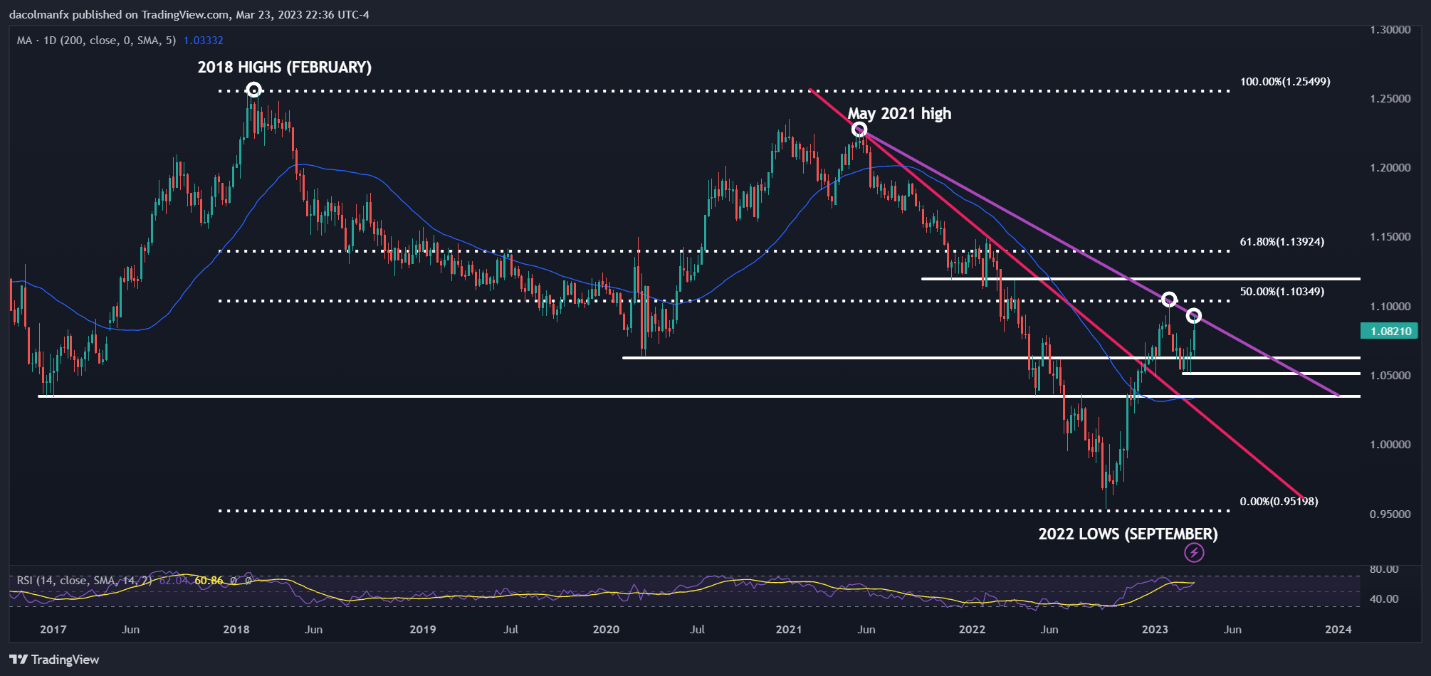

The euro pushed higher against the U.S. dollar during the first quarter of 2023 and briefly reached its best level since April 2022 in early February. When risk-off mood erupted in global markets, sellers returned, preventing EUR/USD from clearing the 1.1035 area, a major technical ceiling defined by the 50% Fibonacci retracement of the 2018/2022 decline.

EUR/USD has lacked strong bullish conviction but has retained a modest positive bias since late 2022 after overcoming its 200-day simple and breaking above long-term trendline resistance. Its slow upward trek, however, has not been impressive, with the exchange rate constantly ebbing and flowing to the beat of changes in sentiment.

Breakout Opportunities May Soon Emerge

There is no reason to believe that conditions will change significantly heading into the second quarter, as recent price action offers no signs of a meaningful and solid trend emerging just yet. Having said that, a snail’s pace ascent appears to be the baseline scenario for the euro, at least for now.

EUR/USD’s volatility deficiency could nudge traders looking for compelling trends and more attractive configurations to turn their attention to other forex pairs, but interesting breakout opportunities could still arise should key technical levels become tested and then invalidated in clean and decisive moves.

This article focuses on EUR/USD’s technical outlook. If you would like to learn about the euro’s fundamental prospects, download DailyFX’s complete quarterly guide by clicking the link below. It’s free!

Recommended by Diego Colman

Get Your Free EUR Forecast

Key Technical Setups to Watch

Focusing on bullish setups, traders should keep an eye on the descending trendline extended off the May 2021 high (purple line). If prices pierce this dynamic resistance on the topside (1.0920), bulls could launch an assault on the 2023 swing high. On further strength, attention shifts to the 1.1200 handle, followed by 1.1392, the 61.8% Fib retracement of the move discussed previously.

For bearish configurations triggered on a breakdown, traders could focus on support near 1.0630. If this zone is breached, EUR/USD could slide towards 1.0515 in short order. This looks like a very weak floor, so it could eventually cave in, setting the stage for a drop towards the 200-day simple moving average nestled around the 1.0350 mark.

EUR/USD Weekly Chart

Source: TradingView, prepared by Diego Colman

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | -10% | -8% | -8% |

| Weekly | 0% | 0% | 0% |