Euro Weekly Forecast: EUR/USD and EUR/GBP

- A lack of any important data or events next week will leave the Euro vulnerable.

- EUR/USD fading the NFP rally, eyes trend support.

Our Q2 Euro Fundamental and Technical Forecasts are available to download for free:

Recommended by Nick Cawley

Get Your Free EUR Forecast

US Dollar Slumps After NFPs Miss Expectations, US Equities Bid

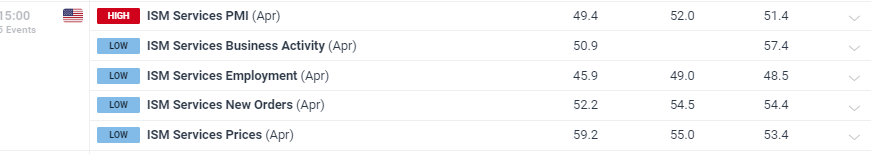

A sharp move lower in the US dollar after the latest US Jobs Report is being retraced as concerns that US inflation will remain elevated continue to dominate USD price action. The latest US ISM services release showed US growth slowing, while prices paid jumped higher. The services PMI fell to its lowest level in two years, while prices paid jumped to a three-month high.

A lack of any notable EU data releases or events next week will leave the Euro vulnerable to moves in other currencies. In the UK the Bank of England will announce its latest policy decision on Thursday 10th at 12:00 UK with all policy dials expected to be left untouched. There may be a shift in voting patterns with more members voting for a rate cut, a move that would weaken the British Pound. The BoE will also release its latest Quarterly Inflation and Growth reports.

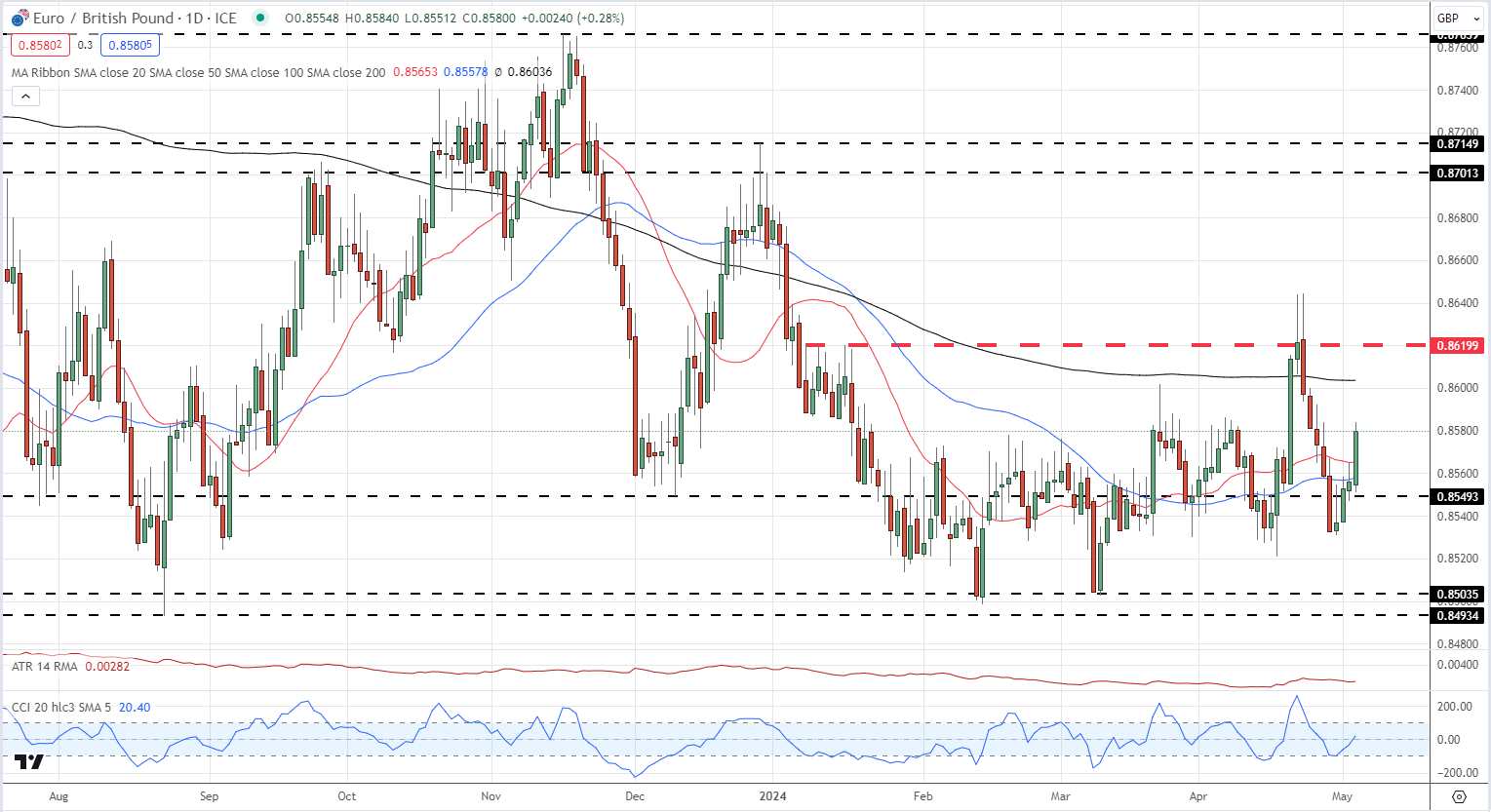

This week, EUR/GBP has pulled back some of its recent losses and broken back above the 20- and 50-day simple moving averages. The next level of resistance is seen at 0.8600 before the 200-day sma comes into play at 0.8603. Above here, 0.8620 and 0.8645. A move lower sees support at 0.8550 and 0.8520.

EUR/GBP Daily Price Chart

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | -1% | 12% | 2% |

| Weekly | 15% | -11% | 9% |

The US economic calendar is also light next week, although markets can expect a flurry of Federal Reserve speakers after this week’s FOMC decision and NFP release. Interest rate differentials between the Euro and the US dollar will continue to be watched closely with the ECB fully expected to start cutting rates at the June policy meeting.

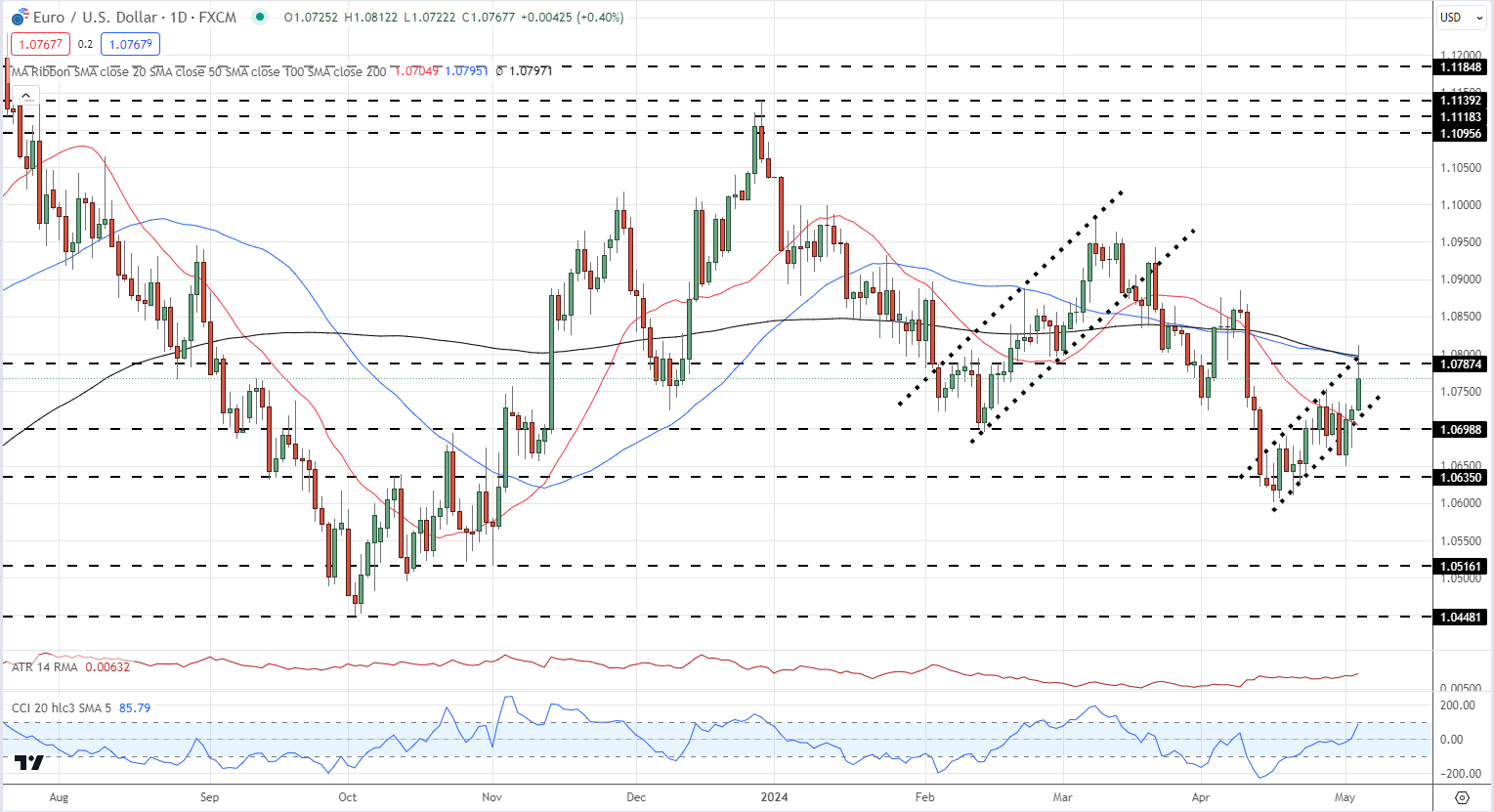

EUR/USD remains within an upward trending channel, but this could easily turn into a negative bear flag if the pair breaks trend support. A longer-term trend of lower highs and lower lows is still in place with a break below 1.0600 seen as the next negative signal. Before then, trend support, the 20-day sma, and a prior swing low of around 1.0700 will act as first-line support. Rallies will find initial resistance between 1.0780 and 1.0795 before a gap up to 1.0885.

Learn how to trade EUR/USD like a professional with our complimentary guide

Recommended by Nick Cawley

How to Trade EUR/USD

EUR/USD Daily Price Chart

Retail trader datashows 47.54% of traders are net-long with the ratio of traders short to long at 1.10 to 1.The number of traders net-long is 9.02% lower than yesterday and 5.35% lower than last week, while the number of traders net-short is 18.22% higher than yesterday and 17.35% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.