EUR/USD Price, Chart, and Analysis

- Deutsche Bank shares slump as insurance costs balloon.

- PMIs show services robust, but manufacturing continues to struggle.

- EUR/USD slips as the US dollar gains a safe-haven bid.

Recommended by Nick Cawley

How to Trade EUR/USD

Most Read: Euro (EUR) Weekly Forecast: Hawkish ECB Hikes Rates, Bank Stocks Highlight Risk

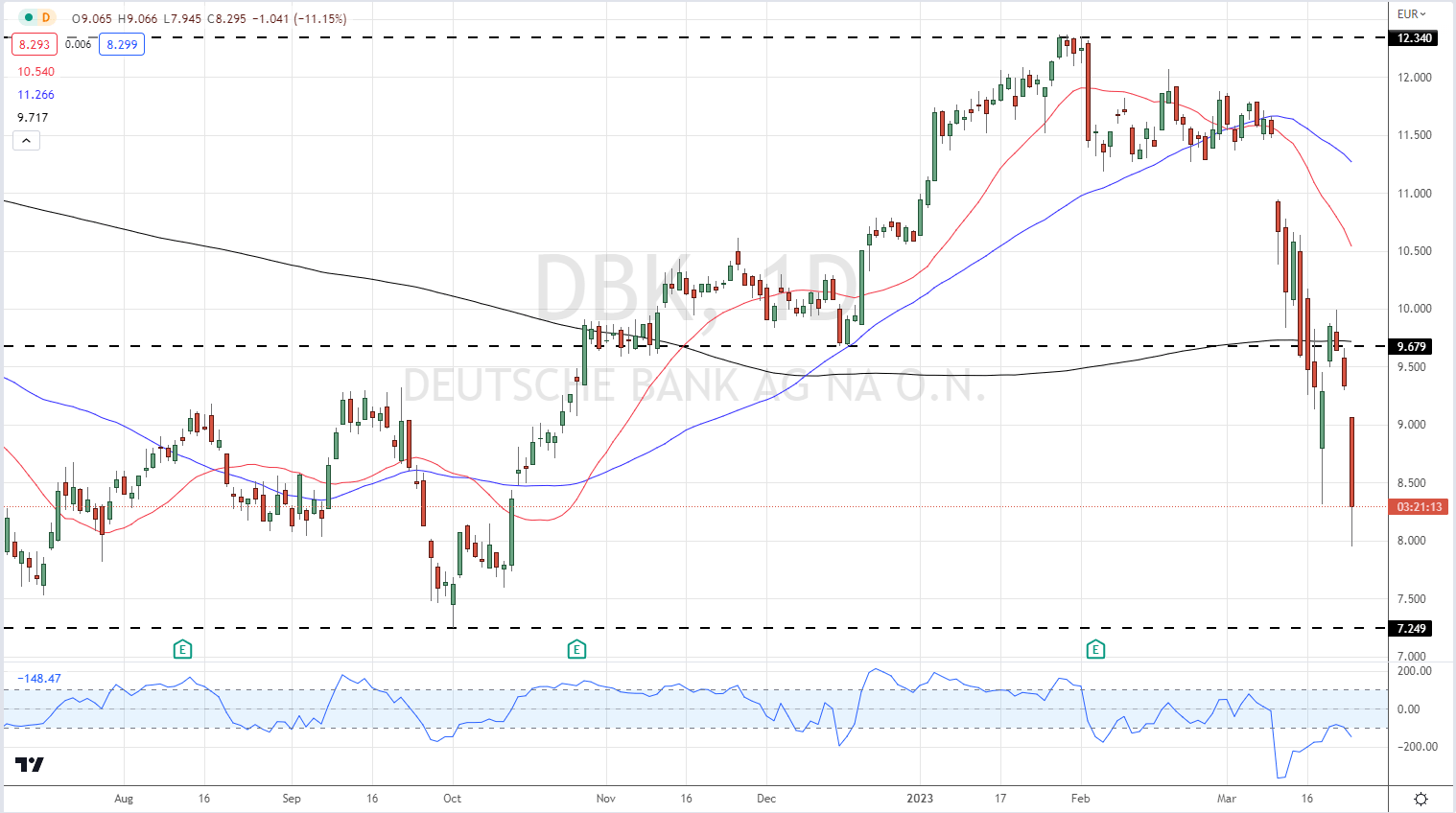

German banking giant Deutsche Bank is the latest financial company to come under heavy selling pressure as banking fears return to the Eurozone. The company’s shares fell by in excess of 10% in early trade to a fresh multi-month low, and have lost over 20% of their value this month. This fresh sell-off was sparked by sharply higher insurance costs – seen via the credit default swap market – while the bank’s AT1 bonds also met with heavy selling. If this situation persists, it remains to be seen if ECB President Lagarde opens the central bank’s toolbox that she repeatedly mentioned last week to provide the necessary liquidity if needed.

Deutsche Bank Daily Price Chart

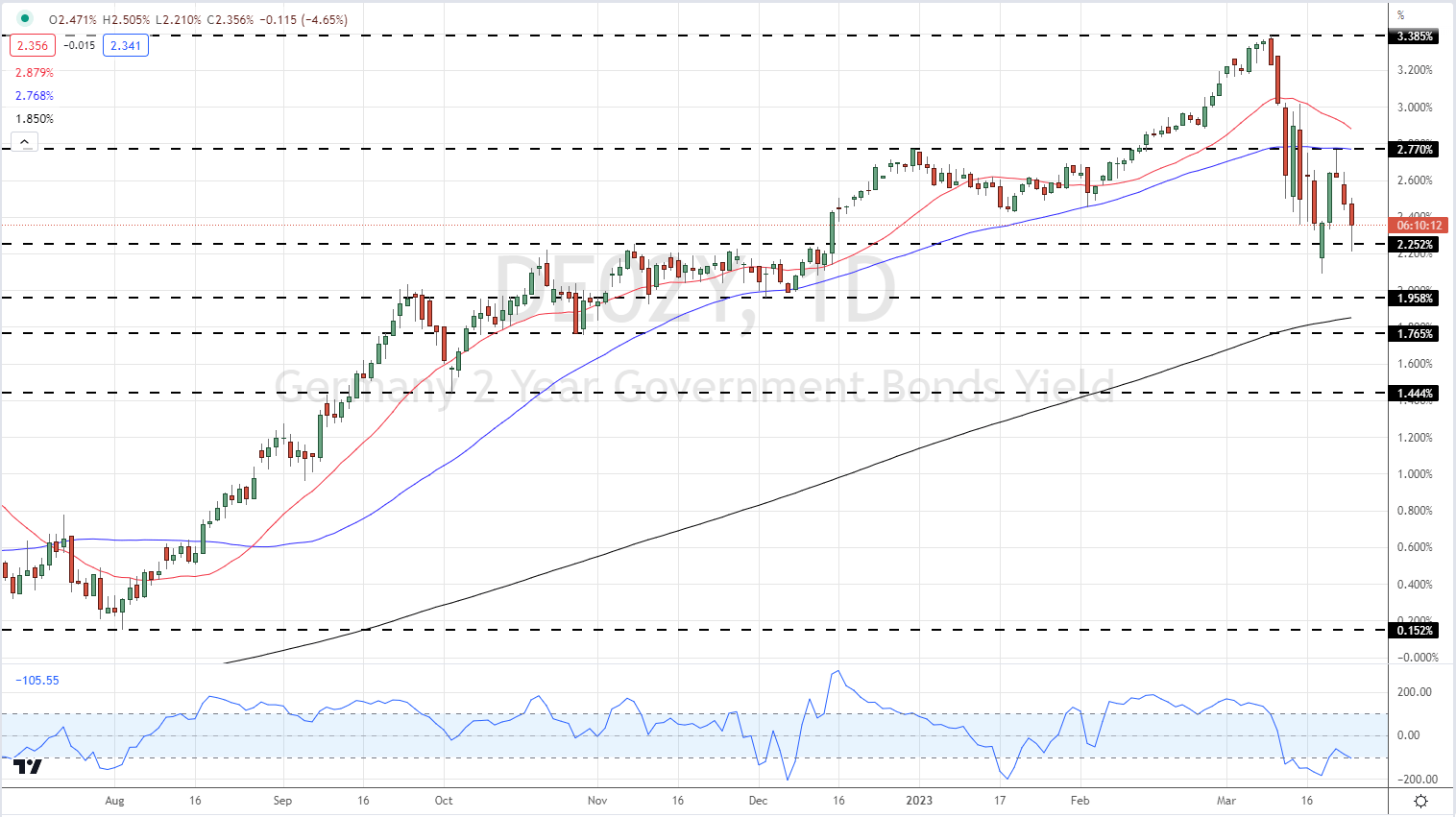

This latest bout of banking fear boosted the appeal of Euro Area safe-haven assets with the yield on the German 2-year government bond falling sharply (bond yields fall as prices rise).

German 2-year Bond (Schatz) Yield Daily Chart

Recommended by Nick Cawley

Traits of Successful Traders

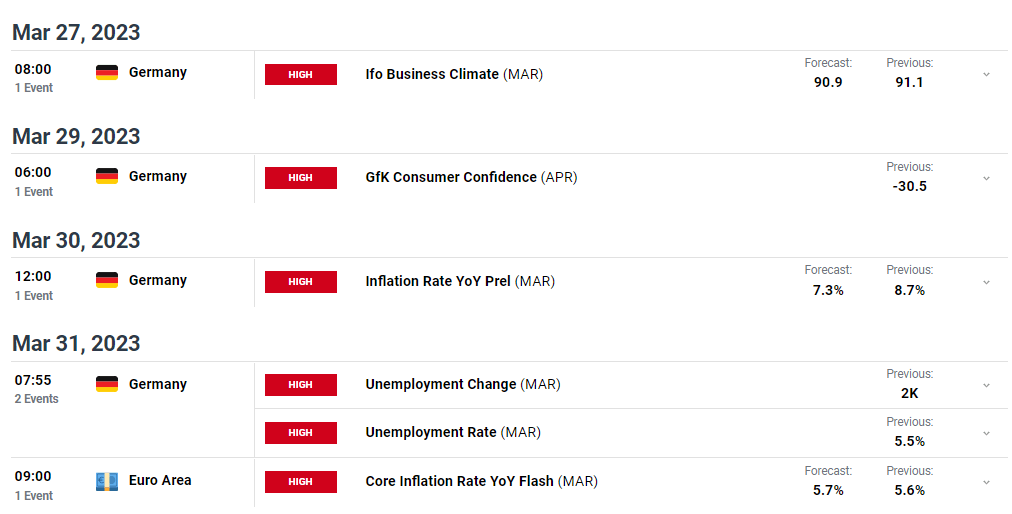

Next week’s Euro Area calendar has a handful of high-importance data releases with the first look at German inflation on March 30th and Euro Area flash inflation on March 31st the two standouts.

For all market-moving events and economic data releases, see the real-time DailyFX Calendar

Economic data out today in the Eurozone show the manufacturing and services sectors taking different paths. While the services sector continued to power ahead, the manufacturing sector suffered a further loss of new orders, while overall input costs and selling price inflation rates remain elevated, according to data provider S&P Global.

S&P Global Flash Eurozone PMIs

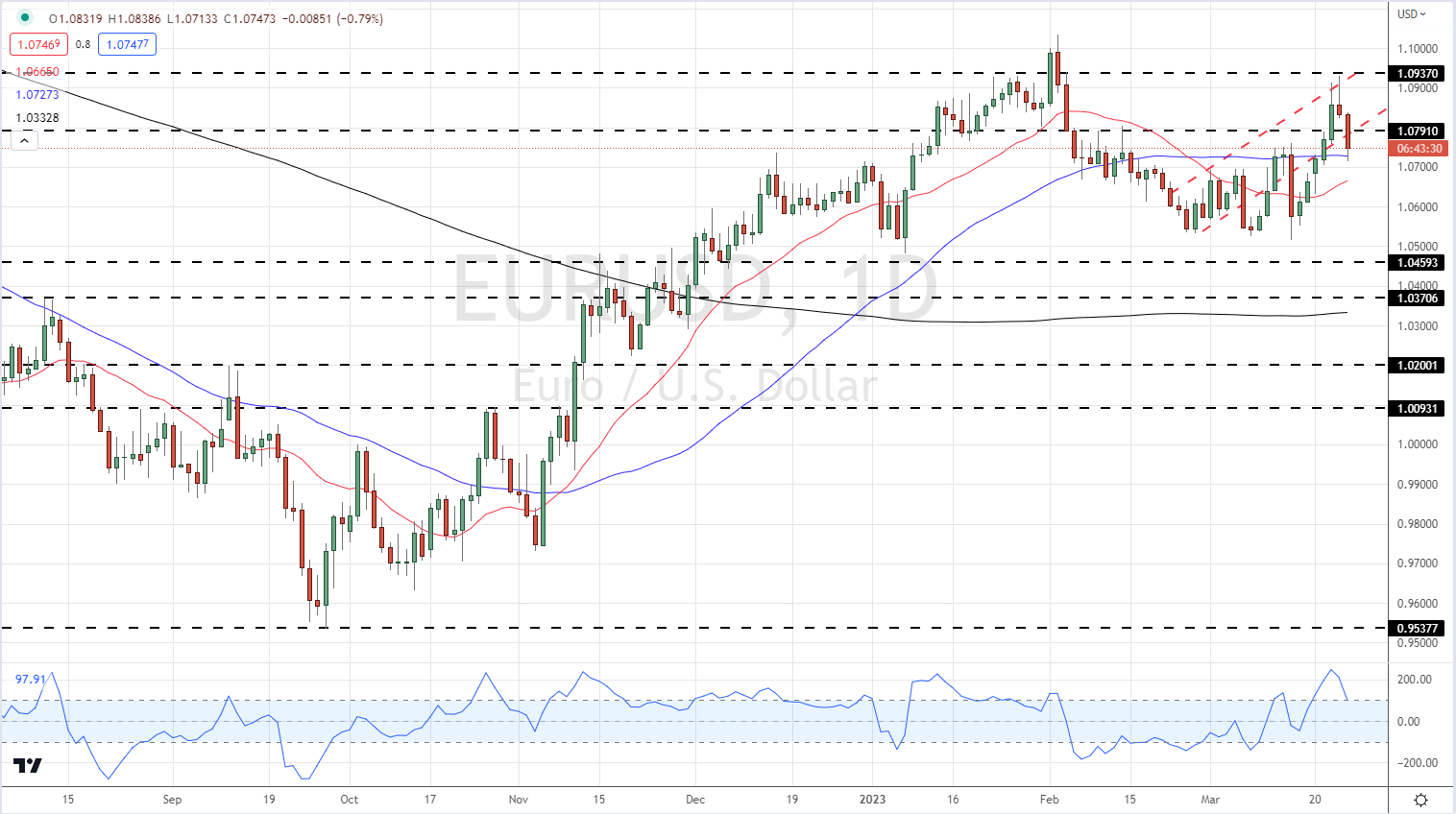

The Euro has weakened against the US dollar on both Eurozone contagion and a US dollar safety bid. While the banking system in the US is also under the microscope, the greenback still remains the de facto currency of choice in times of financial stress. After posting a 1.0930 high on the daily chart yesterday, EUR/USD has slipped back by nearly two full points to a current quote of 1.0740. The move over the last 24 hours has broken a series of higher highs and higher lows and leaves the pair vulnerable to further losses if the Eurozone banking crisis continues.

EUR/USD Daily Price Chart – March 24, 2023

All Charts via TradingView

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | 13% | -15% | -5% |

| Weekly | -5% | 18% | 8% |

Retail Traders Remain Net-Short

Retail trader data show 44.63% of traders are net-long with the ratio of traders short to long at 1.24 to 1.The number of traders net-long is 24.84% higher than yesterday and 16.46% lower from last week, while the number of traders net-short is 28.38% lower than yesterday and 13.71% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.