Euro Weekly Forecast: Bearish

- ECB messaging on rates is clear.

- Escalating Middle East tensions control the short-term market narrative.

- Preliminary Q1 GDP and Core PCE among next week’s heavyweight data releases.

Our Q2 Euro Technical and Fundamental Forecasts are free to download

Recommended by Nick Cawley

Get Your Free EUR Forecast

The European Central Bank is set to change its monetary policy stance soon and start cutting interest rates with the next ECB meeting in June the likely start date, according to various ECB voting members. After President Lagarde gave a nod to the June 6th meeting back in March, the messaging coming from various central bank members since then has been clear and nearly unanimous, if inflation continues to move lower, interest rates are coming down. With the June meeting seen as a done deal, talk has already moved on to the second rate cut with the July meeting mooted by some. This has weighed on the single currency over the past weeks and with the Fed now seen lowering rates much later in the year, EUR/USD will struggle to move higher.

The latest escalation in the Israel-Iran conflict – Israel’s drone attack on Isfahan in Iran – prompted a sharp risk-off across markets today, including a US dollar haven bid. Iran later said that they had no ‘immediate plans’ to retaliate, hopefully drawing the two sides back from the edge of a full-blown conflict.

US Dollar Braced for Further Swings in Risk as Middle East Conflict Escalates

Next week is packed with economic and sentiment data releases, including the latest global PMI releases along with the first look at US Q1 GDP and the Fed’s preferred measure of inflation Core PCE. And to add to potential market volatility, some heavyweight companies report next week, including tech giants Microsoft and Alphabet, an underfire Tesla, along with some traditional stalwarts including General Electric, Ford, Intel, Chevron, and Exxon.

For a detailed list of high-impact data and events, see the real-time DailyFX Economic Calendar

For a detailed list of quarterly US earning releases, see the DailyFX Earnings Calendar

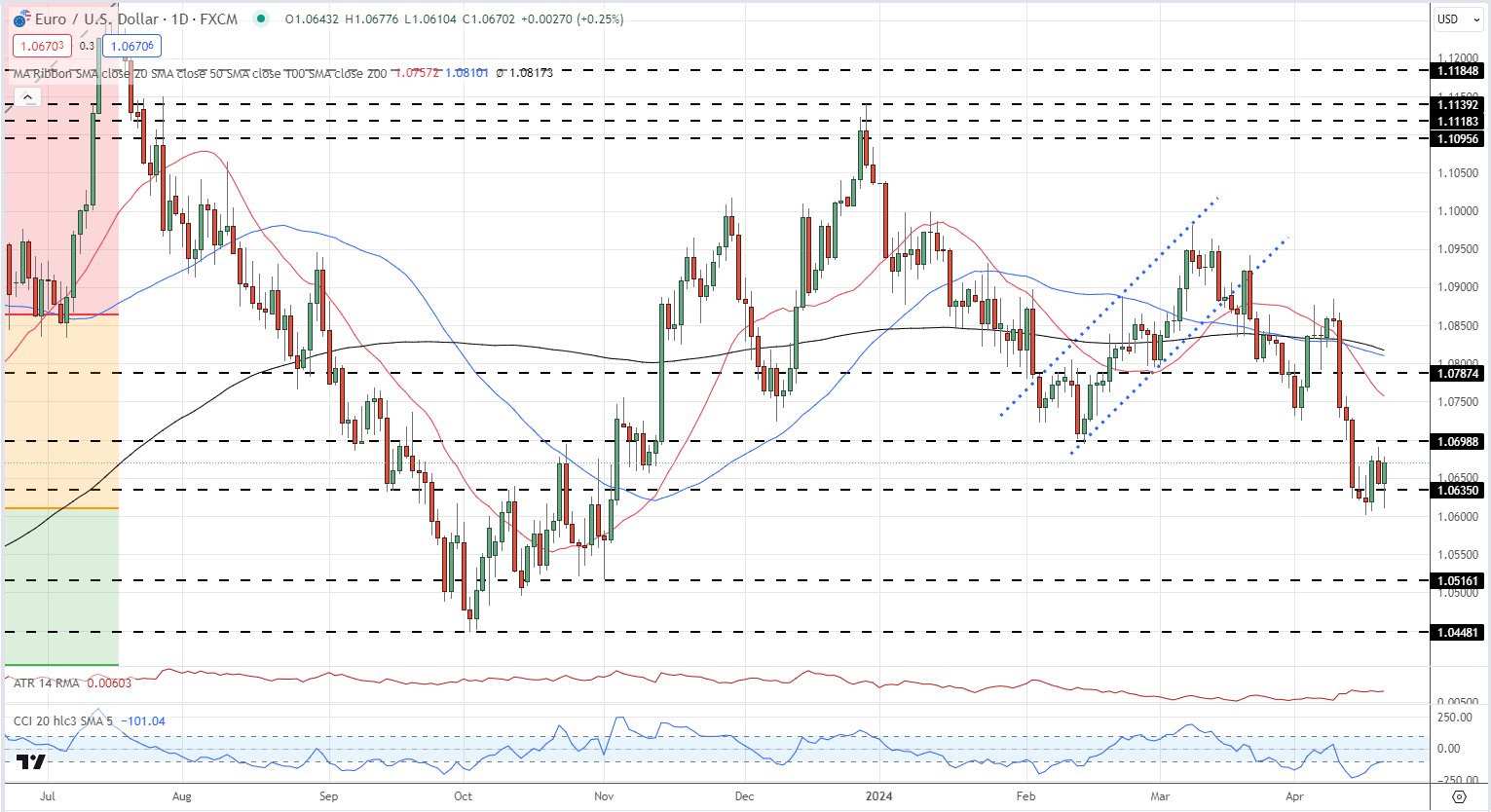

This week’s price action suggests that EUR/USD may struggle to break above 1.0700 convincingly. All three simple moving averages are in a bearish set-up, while the CCI indicator is moving out of oversold territory. Support is seen off the 38.2% Fibonacci retracement at 1.0610 before 1.0600 comes into play.

Learn How to Trade EUR/USD with our Expert Guide

Recommended by Nick Cawley

How to Trade EUR/USD

EUR/USD Daily Price Chart

Retail trader data shows 66.33% of traders are net-long with the ratio of traders long to short at 1.97 to 1.The number of traders net-long is 2.70% higher than yesterday and 3.63% lower than last week, while the number of traders net-short is 10.03% lower than yesterday and 13.43% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | 24% | -17% | 7% |

| Weekly | 25% | -31% | -1% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.