POUND STERLING ANALYSIS & TALKING POINTS

- Doubts still linger around US debt ceiling.

- Fed and BoE rate forecasts may indulge pound bears.

- GBP/USD faces bearish chart pattern.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD FUNDAMENTAL BACKDROP

The British pound currently reflects the external environment as the US debt ceiling theme holds sway. Although there has been some progress by way of a deal, uncertainty has crept back in to global markets as several Republicans have stated that they would resist the deal within the Republican dominated House. That being said, the majority seem to be in favor of a successful passing of a deal through but markets remain cautious for now.

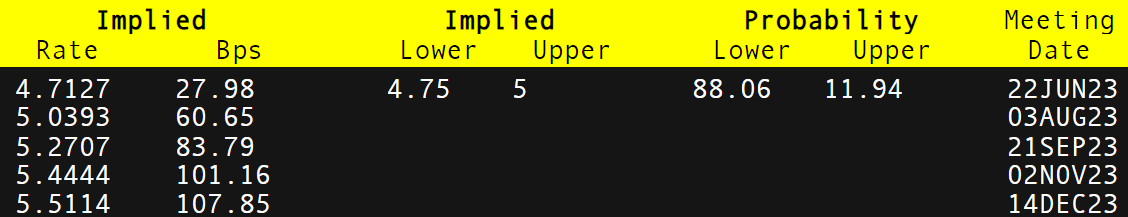

Interest rate probabilities for the Bank of England (BoE) reflect roughly 100bps in cumulative hikes by year end whereas the Federal Reserve has been ‘hawkishly’ repriced to of recent giving the USD added support. From a UK perspective, the below seems slightly optimistic from money markets leaving the pound exposed to further weakness against the greenback.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

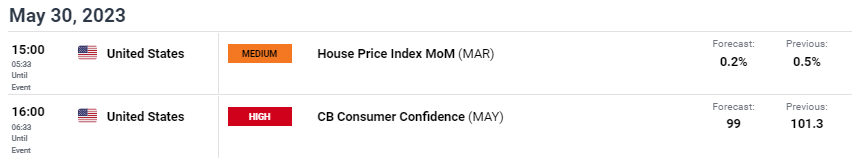

The economic calendar is very much US centric and will be focused on the CB consumer confidence. If forecasts are accurate, this could be the first reading since July 2022 below 100 (a benchmark based on levels of optimism in 1985). The week ahead should add more clarity to the US economic outlook with Non-Farm Payroll (NFP) data being the focal point.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

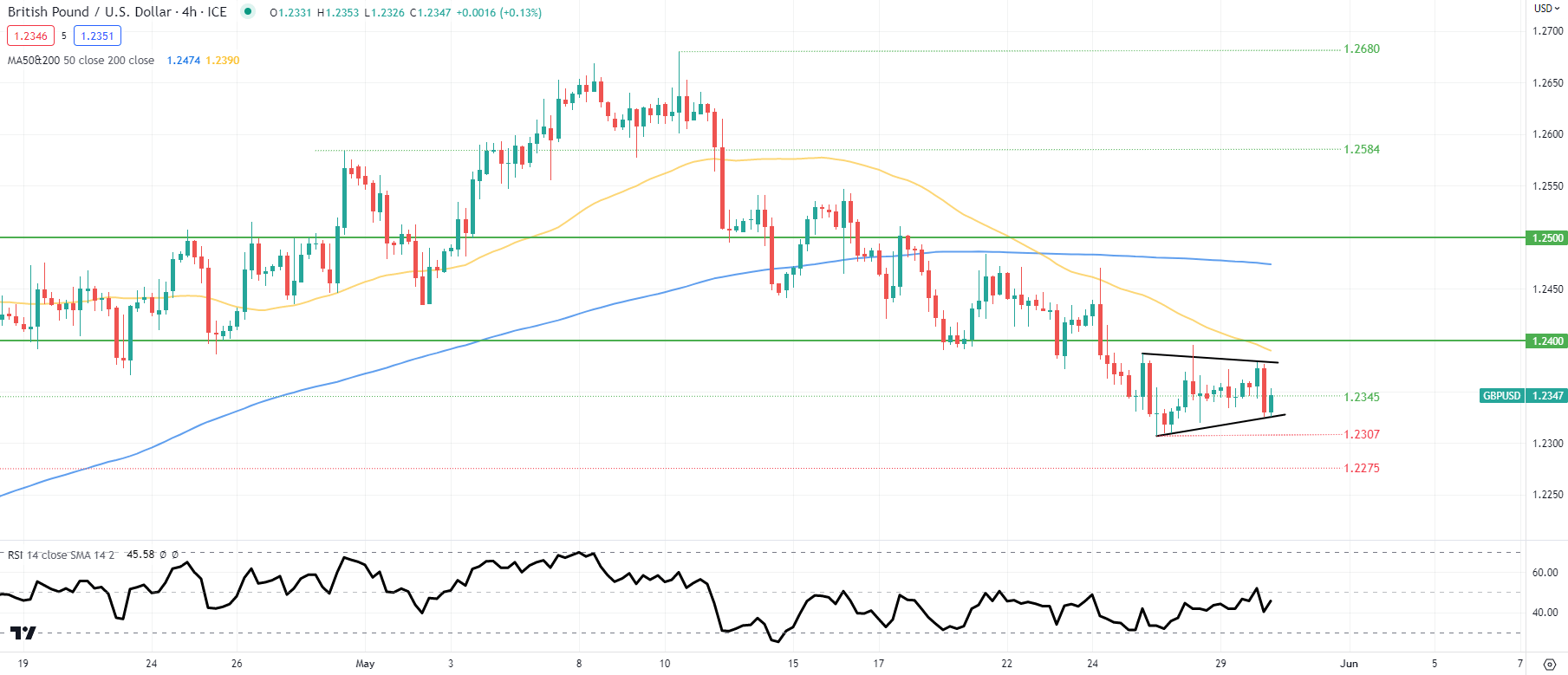

GBP/USD 4-HOUR CHART

Chart prepared by Warren Venketas, IG

The 4-hour cable chart shows a clearer view of the short-term picture facing GBP/USD traders. There is a definitive consolidation of recent forming a pennant chart pattern. More specifically, a bearish pennant due to the preceding downside trend. With prices trading below both moving averages as well as the Relative Strength Index (RSI) under the midpoint, momentum favors more downside to come. A break below pennant support could spark a move lower while a close above pennant resistance will likely invalidate the pattern.

Key resistance levels:

- 1.2400

- 50-day MA (yellow)

- Pennant resistance

- 1.2345

Key support levels:

- Pennant support

- 1.2307

- 1.2275

BEARISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 57% of traders holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside disposition.

Contact and followWarrenon Twitter:@WVenketas