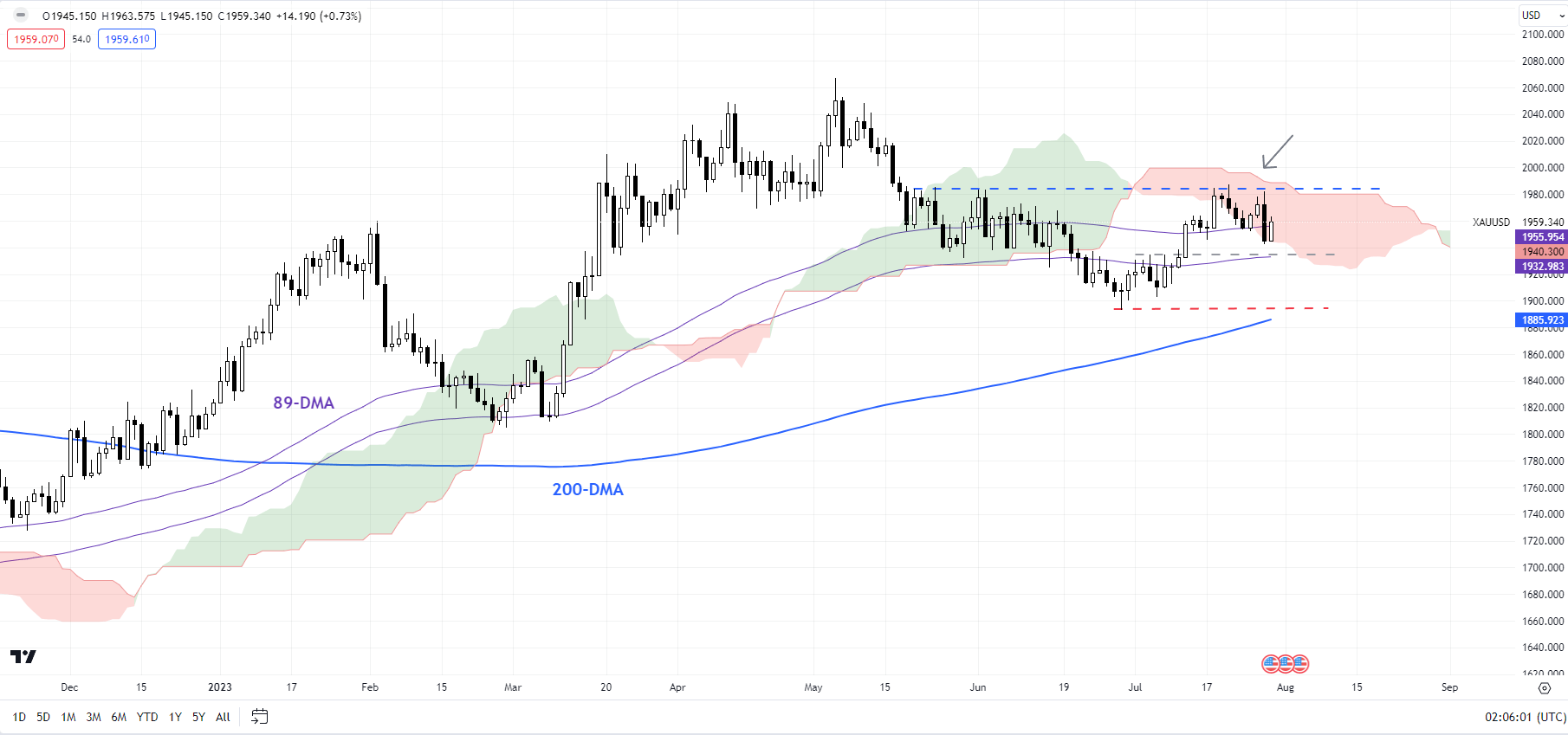

Gold, XAU/USD – Price Action & Outlook:

- Gold appears to be capped at solid resistance around 1980.

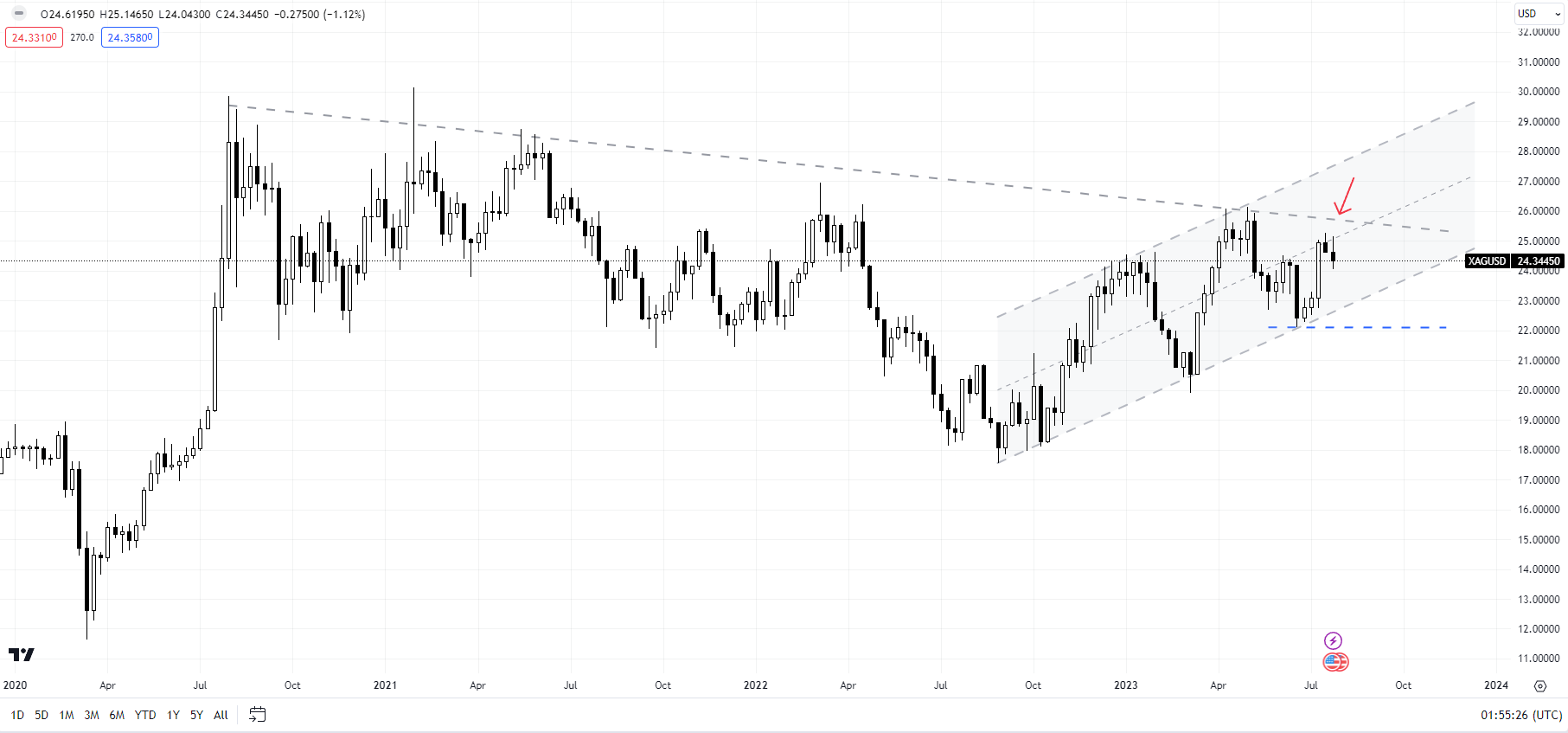

- Silver remains in a choppy/sideway range.

- What is the outlook and what are the key levels to watch in XAU/USD and XAG/USD?

Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

Interest rate hikes by the US Federal Reserve and the European Central Bank are keeping a lid on gold and silver. However, Fed Chair Jerome Powell and ECB President Christine Lagarde sounded more neutral at the respective press conferences, boosting expectations that interest rates are close to peaking.

XAU/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

On technical charts, XAU/USD has retreated from stiff resistance at the early-June high of 1983, slightly below the upper edge of the Ichimoku cloud on the daily charts – a risk pointed out in the previous update. See “Is Gold’s Rebound Over Ahead of FOMC? XAU/USD Price Setups,” published July 25. Earlier, gold met the price objective of the minor reverse head & shoulders pattern of about 1980 that was triggered earlier in July.

XAU/USD 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

XAU/USD is so far holding above crucial converged support, including the mid-July low of 1945 and the late-July lows of 1953. A decisive break below the support could expose downside risks toward the June low of 1892. On the upside, gold would need to clear the barrier in 1987 for the one-month-long rebound to extend.

XAG/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

XAG/USD continues to be in a broad range, weighed by a slightly downward-sloping trendline from 2020 and the median line of a rising channel from late 2022. Silver would need to break above the May high of 26.15 or the June low of 22.10 for a clear trend to emerge.

Recommended by Manish Jaradi

How to Trade Gold

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish