Gold and Silver Outlooks – Neutral Short-term, Bullish Medium-Term

Learn how to trade gold like an expert with our free guide:

Recommended by Nick Cawley

How to Trade Gold

US jobless claims jumped to their highest level in eight months on Thursday, another sign that the US labor market may be cooling. This follows from the recent US Jobs Report (NFP) that showed hiring slowed in the US. The April NFP report showed 175k new jobs added last month, compared to market forecasts of 243k and 315k in March.

US Dollar Slumps After NFPs Miss Expectations, US Equities Bid

On Friday, the latest Michigan Consumer Sentiment Report showed consumer confidence falling but inflation expectations rising. Next week’s US inflation report now becomes key for a range of markets.

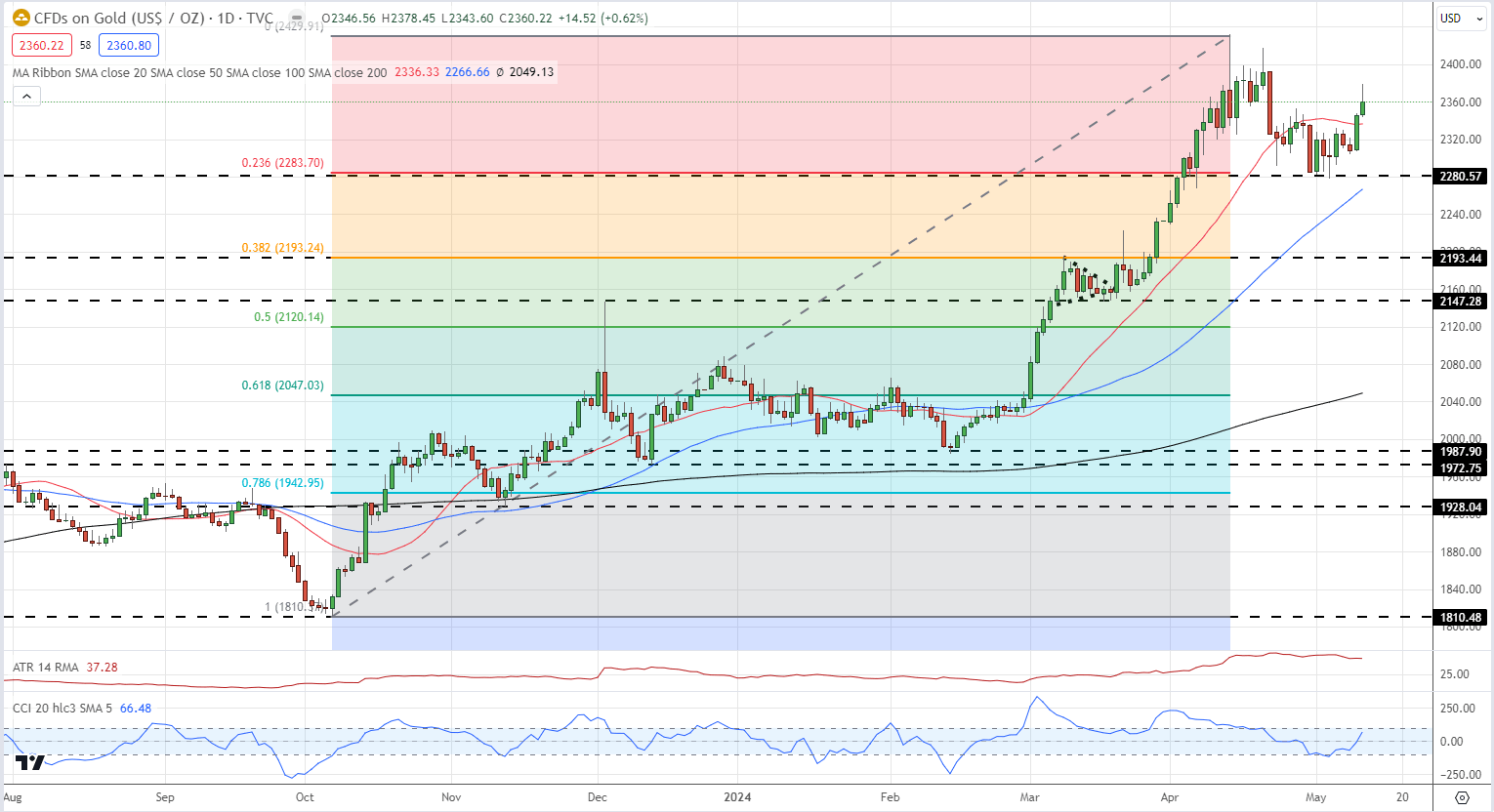

Gold’s recent period of consolidation – support around $2,280/oz. and resistance around $2,340/oz. – has now been broken as buyers sent gold to a near three-week high on Friday. The precious metal also opened back above the 20-day short-term moving average, a positive sign, and if gold can remain above this indicator, then further gains now look likely. Traders should remain aware of the situation in the Middle East where any increased military action will give gold another boost higher.

Gold Daily Price Chart

Retail trader data shows 52.50% of traders are net-long with the ratio of traders long to short at 1.11 to 1.The number of traders net-long is 4.81% lower than yesterday and 4.94% lower than last week, while the number of traders net-short is 1.73% higher than yesterday and 13.71% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall.

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | -9% | 3% | -5% |

| Weekly | 9% | -8% | 1% |

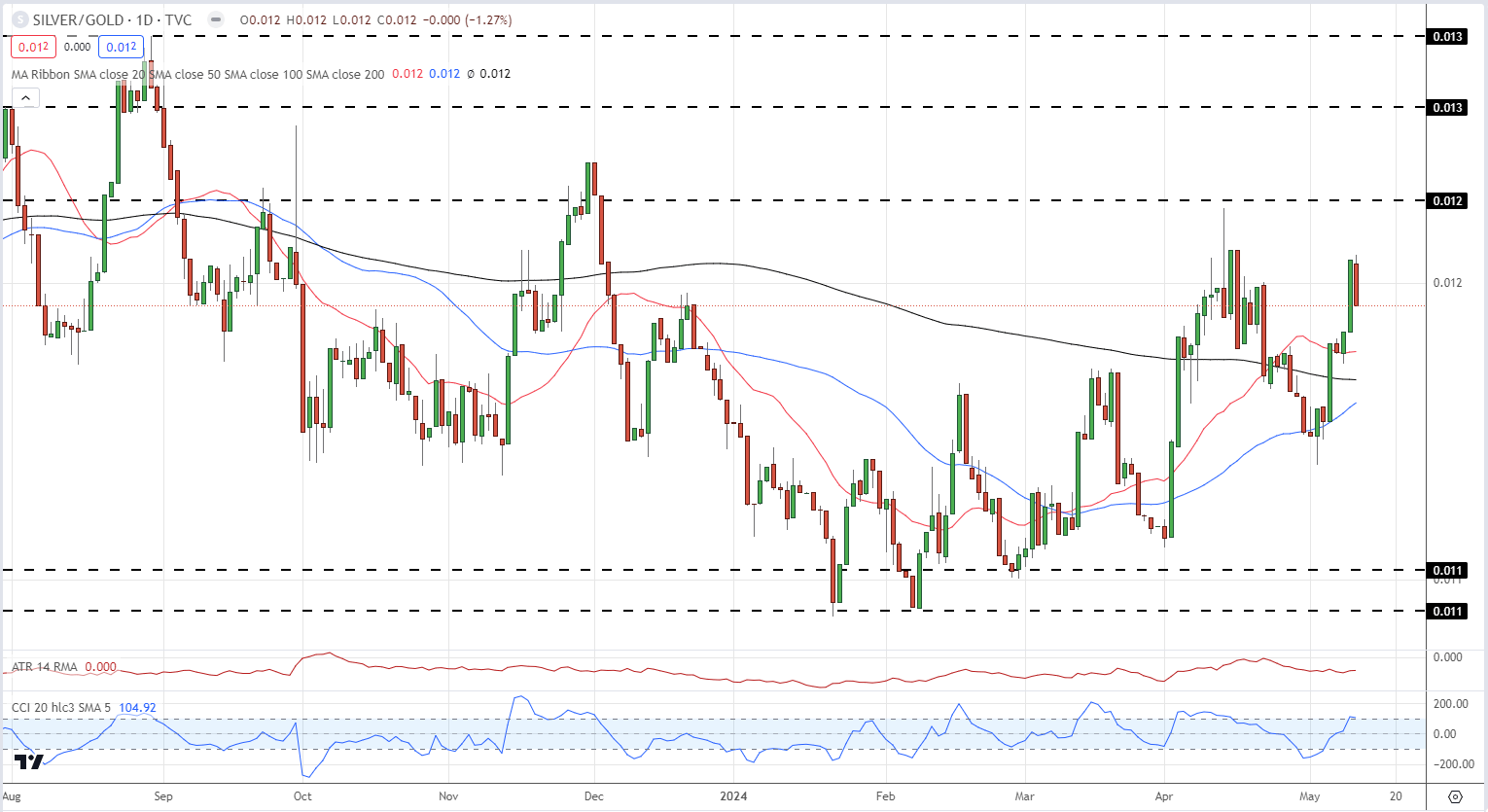

Silver has outperformed gold since early January and the Silver/Gold remains positive and set to move higher. A series of higher lows and higher highs since the start of the year remain in place and a print above the mid-April spike high at just under 0.012 will see this trend continue.

Silver/Gold Daily Price Chart

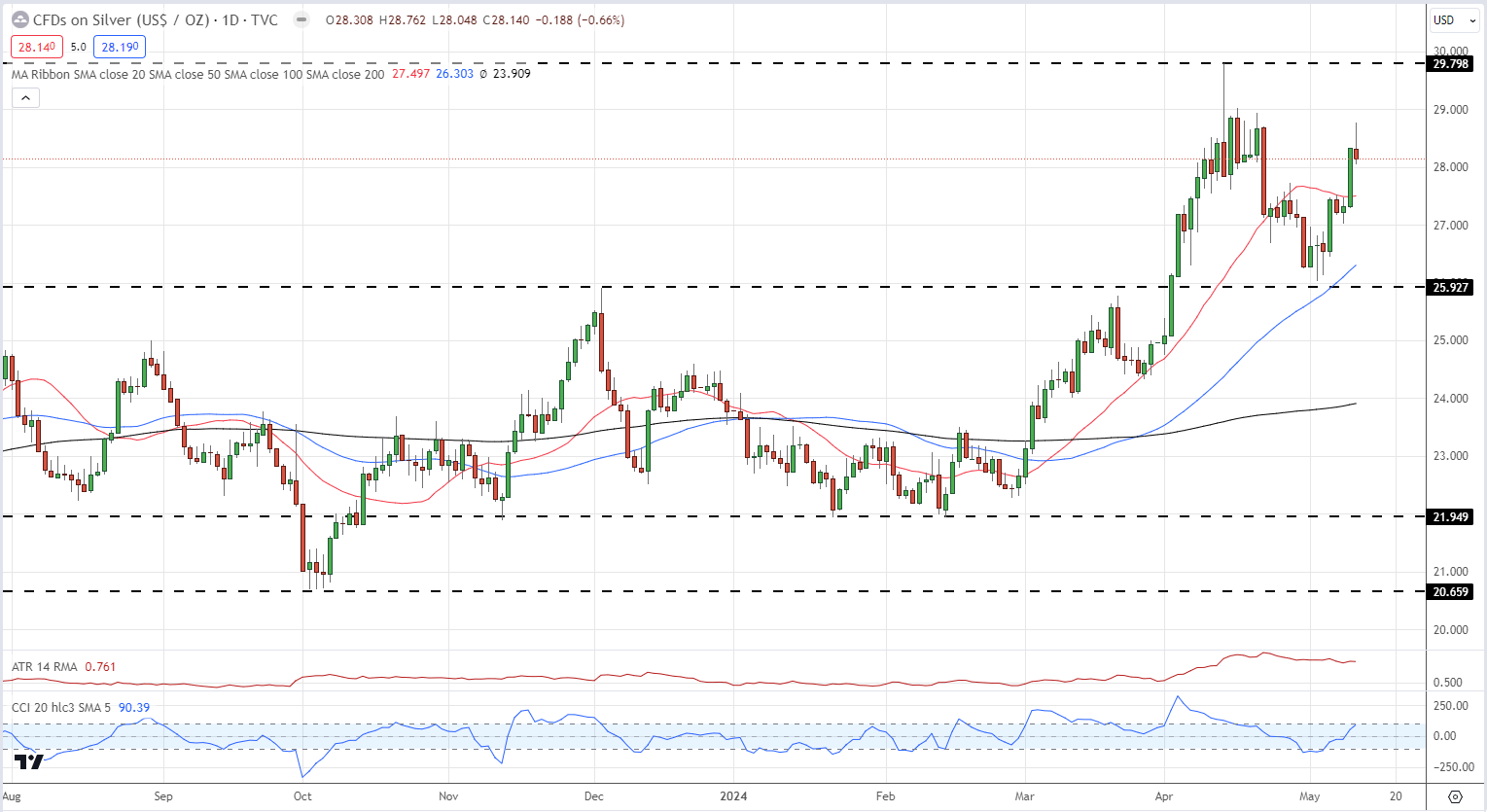

The Silver daily chart also shows a recent break and open above the 20-dsma, adding to its bullish outlook. The 50-/200-day sma golden cross made in late March has seen Silver push ever higher and suggests that a re-test of the recent $29.80 high is likely in the weeks ahead. As with gold, the US CPI number needs to be closely followed.

Silver Daily Price Chart

All Charts via TradingView

Recommended by Nick Cawley

Recommended by Nick Cawley

How To Trade Commodities

What is your view on Gold and Silver – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.