XAUUSD rose, boosted by the weakening of the USD and safe-haven demand due to concerns about persistent geopolitical tensions. Despite recovering in the final trading session of the week, gold still recorded its worst month of performance since September 2023.

The US Dollar Index fell to its lowest in more than two weeks, but was still up 2% in November as Republican Donald Trump’s victory earlier this month boosted expectations of big fiscal spending. , higher tariffs and tighter borders.

This month, gold prices have fallen more than 3%, the worst monthly decline since September last year. After Mr. Trump’s victory, the USD continuously increased in price and triggered a strong sell-off in the gold market.

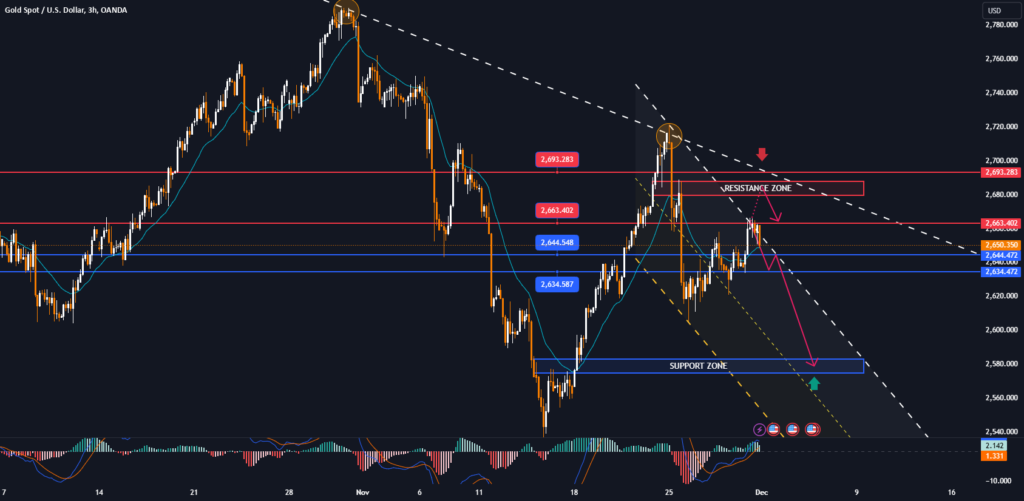

XAUUSD forecast

Geopolitical instability is still increasing, gold prices may still increase in the near future. Gold is often considered a safe investment in times of economic and geopolitical instability such as trade tensions or conflict.

The new administration’s policies in the US can impact economies, causing the central bank to increase gold reserves. This prompted a sharp increase in gold trading by central banks. This is the group that bought the most gold on the market recently.

BCA Research recommends buying gold when prices fall due to long-term prospects. Gold is a commodity that benefits from the policies of the new administration in the US. Increased global policy uncertainty will support gold buying demand.